What is Bill Ackman’s Investing Strategy?

Bill Ackman is a legendary activist investor & billionaire, he is known for making big bets against the consensus & being right!

His strategy was originally influenced by Warren Buffett & he considers himself value investor at heart, but it’s clear his strategy is much bolder & more fitting to an activist investor.

Investing Strategy: Activist Investor, Short Seller, Contrarian, Value Investor

What is Bill Ackman doing now?

Inflation Trade:

In October 2021 Ackman has spoken of Inflation fears and is urging the fed to raise interest rates “as soon as possible.” On Twitter Ackman stated

“as we have previously disclosed, we have put our money where our mouth is, in hedging our exposure to an upward move in rates, as we believe that a rise in rates could negatively impact our long-only equity portfolio.”

As we have previously disclosed, we have put our money where our mouth is in hedging our exposure to an upward move in rates, as we believe that a rise in rates could negatively impact our long-only equity portfolio.

— Bill Ackman (@BillAckman) October 29, 2021

Ackman even gave a presentation to the New York Fed, urging them to raise rates. Of course Ackman will Benefit from the hedges he has in place. Most likely shorting Bonds and buying assets such as Gold and Gold Futures.

I gave a presentation https://t.co/U9C5OoiDq3 to the Federal Reserve Bank of New York last week to share our views on inflation and Fed policy. The bottom line: we think the Fed should taper immediately and begin raising rates as soon as possible.

— Bill Ackman (@BillAckman) October 29, 2021

Bill Ackman recently revealed in an interview with interactive investor (Oct 25th 2021) he has purchased “Swaptions” worth $100 Million and has made a 3x return already! In addition, Ackman has the potential to turn the bet into “Billions” if interest rates rise substantially, he stated in the interview.

Below we have unpacked Bill Ackmans presentation and given a brief overview of the main points.

5 Reasons Bill Ackman Thinks Interest Rates will Rise:

1. Rising Inflation

Latest Inflation Numbers are approximately 5% , which is above the Federal reserves target of 2%. The Fed states this is “Transitory” as the economy restarts, many investors are sceptical.

source: tradingeconomics.com

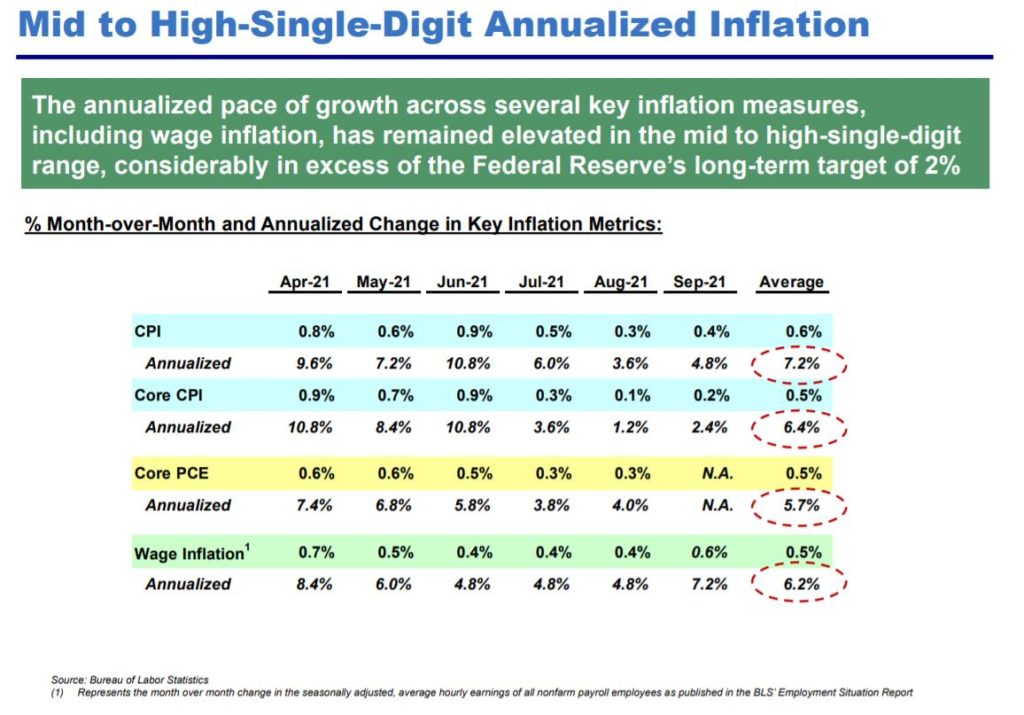

An extract from Ackman’s presentation shows mid to high single digit inflation. From 7.2% for the CPI (Consumer price index) ,which is basically a basket of common goods purchased by people (food, groceries etc) to 6.2% for Wage inflation. Fed Target is 2% overall.

Inflation High. Source: Bureau of Labor Statistics

(1) Represents the month over month change in the seasonally adjusted, average hourly earnings of all nonfarm payroll employees as published in the BLS’ Employment Situation Report

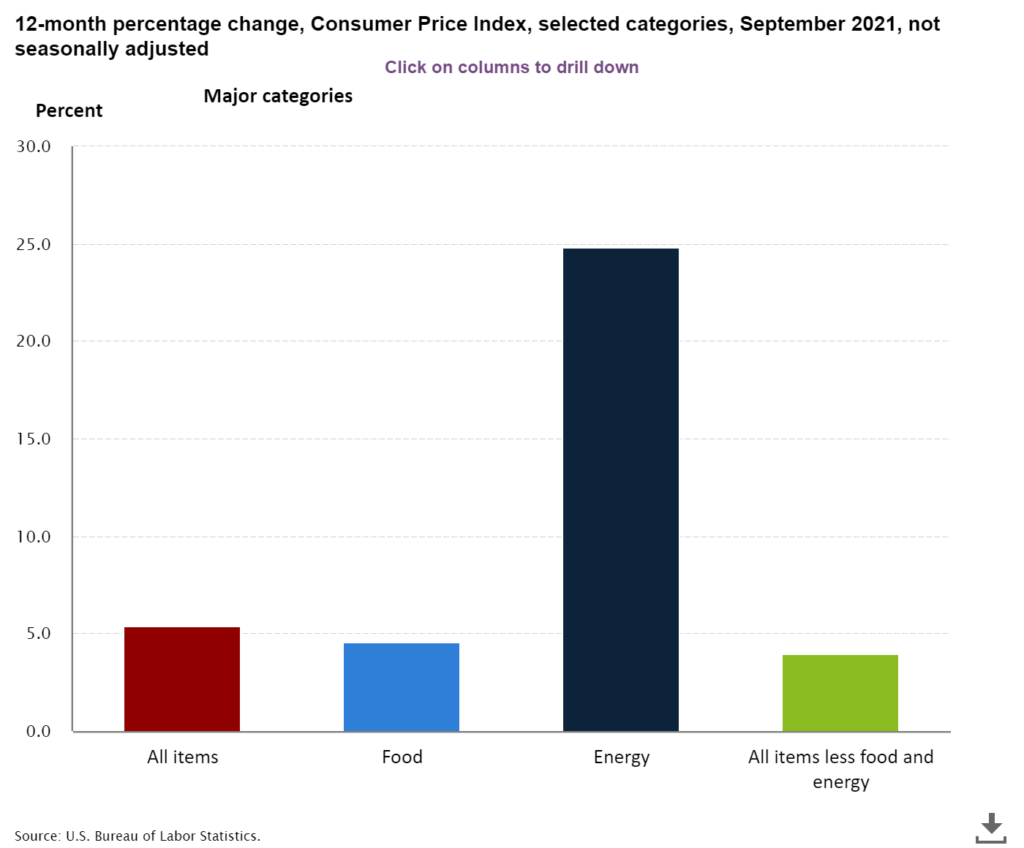

12-month-percentage-chan. Source: US Bureau of Labor Statistics.

Energy prices seem to have spiked the highest, with a 25% percentage change over the past 12 months.

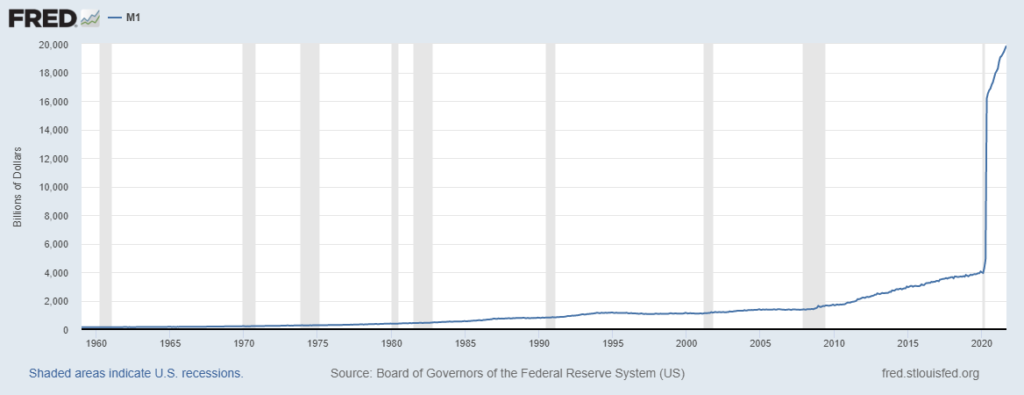

2. Money Supply Increased

1 in 5 dollars were printed in 2020, from the unprecedented amount of stimulus. The spike in supply can be seen clearly on the graph below.

fredgraph m1 Money supply Increase. 1 in 5 Dollars were printed in 2020. Source: https://fred.stlouisfed.org/series/M1NS

3. Close to Full Employment

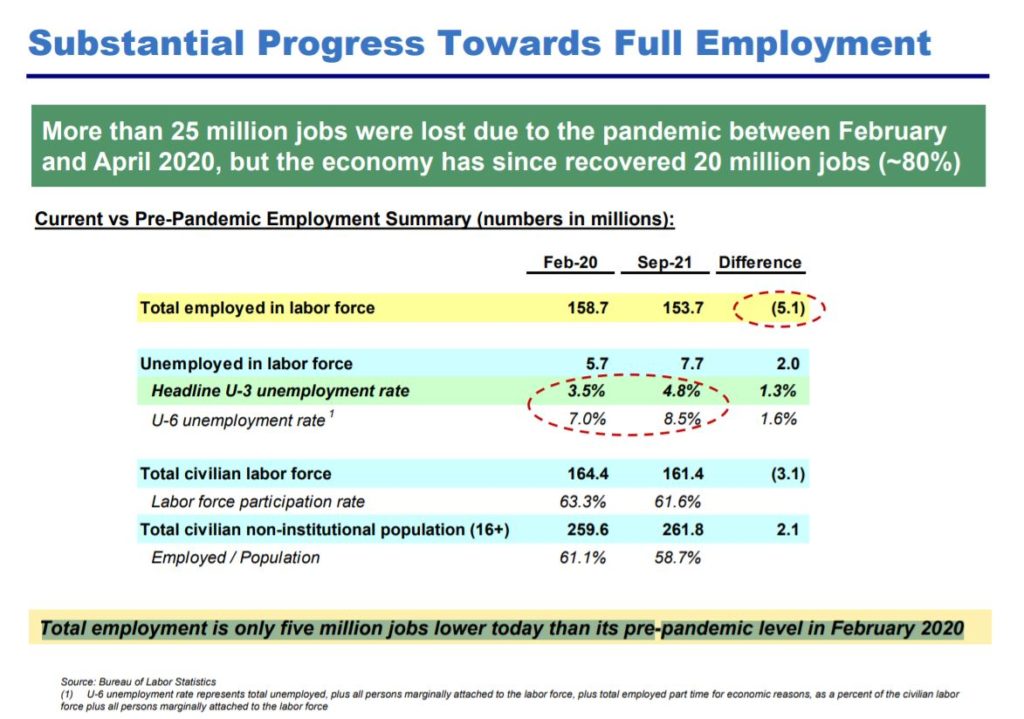

Ackman pointed out that total employment is only five million jobs lower today than its pre-pandemic level in February 2020.

Total employment is only five million jobs lower today than its pre-pandemic level in February 2020. Source: Bureau of Labor Statistics

(1) U-6 unemployment rate represents total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all persons marginally attached to the labor force

4. Historic Context

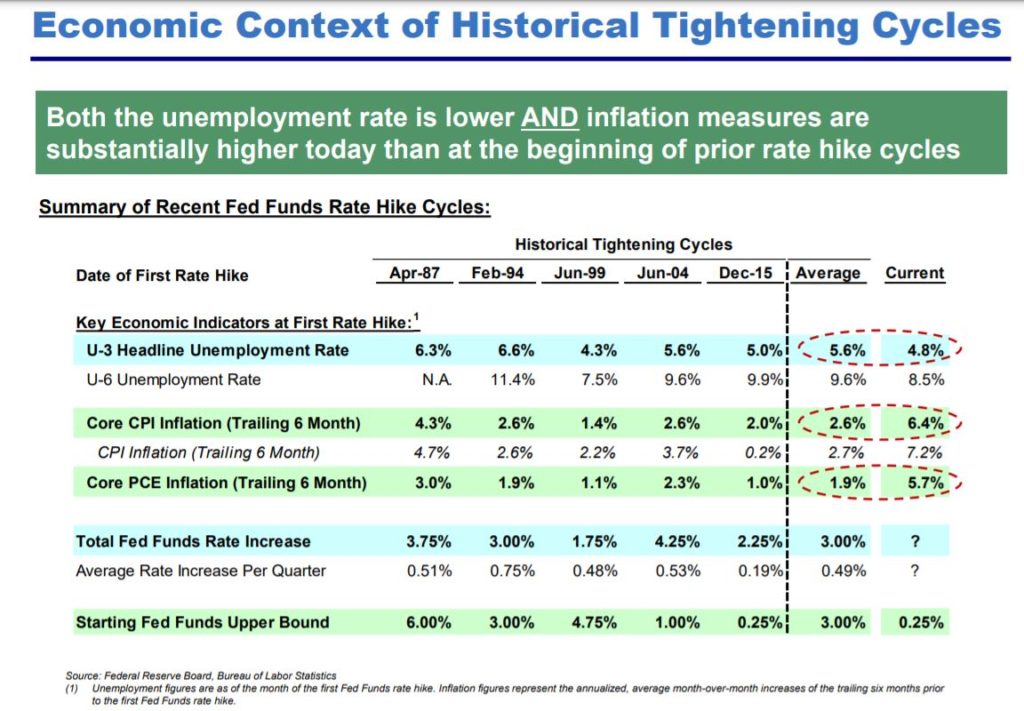

Historically, when unemployment is low and inflation is high, the Fed has increased it’s Fed Funds Rate.

This is the amount of interest the federal reserve charges to banks for overnight borrowing. This often acts as a signal to the market and overall interest rates.

Bill Ackman noted in his presentation, that we now have low unemployment and higher inflation yet the federal reserve has still not increased interest rates. They are keeping them artificially low as they believe inflation is “Transitory” which means temporary.

Historic Interest Rate Rises relative to Inflation and Unemployment department of labor statistics. Bill Ackmans Presentation to New York Fed Pershing Square October 2021

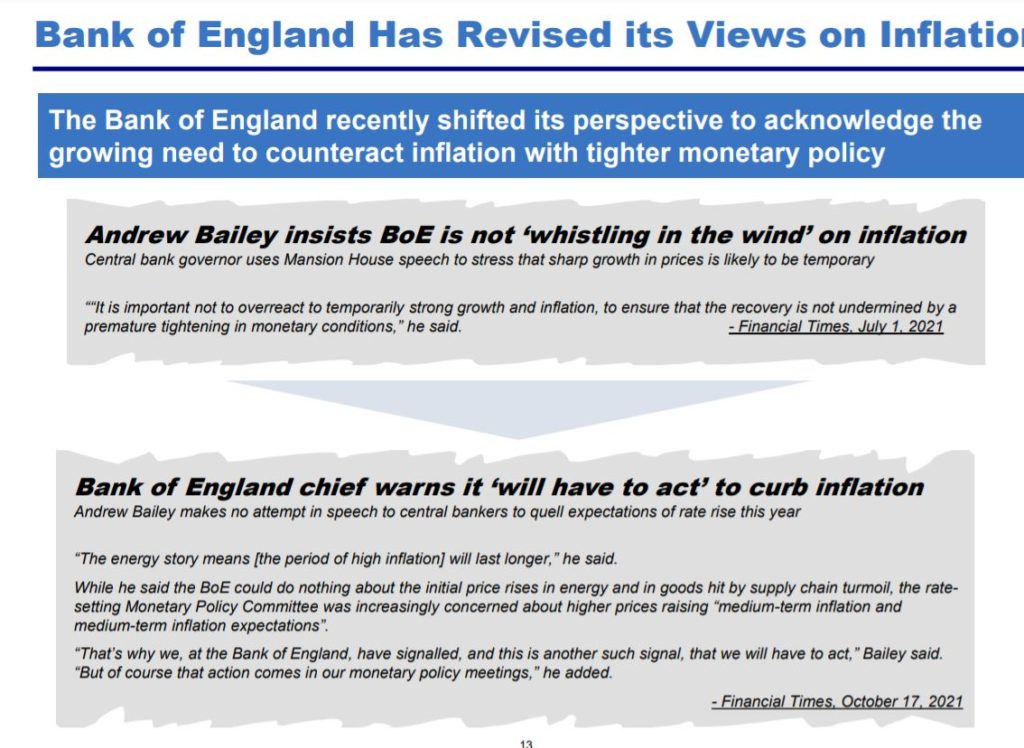

5. Bank of England Revised it’s views on Inflation

Bank of England Revises views on Inflation.Source. Bill Ackmans Presentation to New York Fed Pershing Square October 2021

The Bank of England has recently changed it’s story between July 2021 to October 2021. In July 2021 They stated “It is important to not to overreact to temporarily strong growth and inflation”. However, in October 17th 2021 they stated “The Energy story means [the period of high inflation] will last longer”.

How to play this Inflation Trade?

Bill Ackman recently revealed in an interview with interactive investor (Oct 25th 2021) he has purchased “Swaptions” worth $100 Million and has made a 3x return already! In addition, Ackman has the potential to turn the bet into “Billions” if interest rates rise substantially, he stated in the interview.

Historically during times of inflation, investors have invested into assets such as Gold, Gold Futures and Real Estate. Rising inflation will also impact the value of Treasury bills and bonds. As if as if a 10 year Treasury Bill is paying 1.5% interest and inflation is at 5%. The Investor is actually losing money by investing into these bonds!

Thus short selling fixed income such as government and corporate bonds could also produce high returns. Of course this is not financial advice and the risk is inflation doesn’t continue to rise and is “transitory” as the fed believed.