Activist investors are the boldest & most influential investors. They target companies which can increase their shareholder through a change of management, strategy, company structure etc.

To accomplish this change Activist investors generally can “force” their way onto the board of directors by purchasing a large enough number of shares in a public company.

Such “takeover” attempts are often fought by existing management/CEO who fears they may be fired, many CEO’s even cement in a “Golden parachute Clause” to ensure if they did leave they would have a substantial pay check to compensate.

Some Shareholders welcome the presence of an activist investor, as they will hold the management of the company accountable and force changes as necessary.

Greenmail

“Greenmail” is frowned upon corporate business tactic which occurs when a corporate raider or activist investor buys a large block of a companies stock & then threatens to take over the company, unless they are paid a premium over the purchase price. Here are the top 10 most famous Activist Investors, with many Quotes included.

Activist Investor Quotes Gallery

1. CARL ICHAN

Carl Icahn is a legendary activist investor who’s brash & outspoken Strategy of investing has made him a billionaire, with an estimated net worth of $16.7 Billion. Carl Icahn was a feared & famous corporate raider during the 1980’s.

He generally focuses on companies which are hording cash on the balance sheet, have limited growth opportunities and poor corporate governance.

Carl Ichan Quotes motivation 2 invest. Credit: www.Motivation2invest.com/Carl-Ichan-Quotes

“I enjoy the hunt more than the good life after the victory”. This is another way of saying the thrill is in the chase. It is clear Carl Ichan and many legendary investors such as Warren Buffett love the game. As it is obvious they are extremely wealthy but still love the game

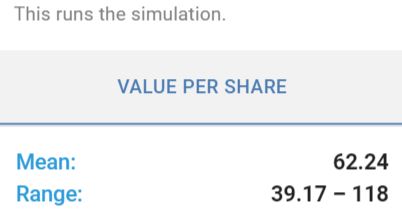

Notable Activist Raids by Carl Ichan:

Carl Ichan Activist Investments Corporate Raids. Credit. Created by www.Motivation2invest.com/Carl-ichan

Carl Ichan Quotes motivation 2 invest. Credit: www.Motivation2invest.com/Carl-Ichan-Quotes

“Bill Ackman is a cry baby in the school yard”. This is an extract from the “battle of the billionaires” a public argument on CNBC.

Carl Ichan and Ackman had a major battle over the company Herbal Life. Billionaire Bill Ackman had shorted the stock as he believed it was a “pyramid scheme” and Carl Ichan took the opposing side. In the end, Ichan came out on top with a reportedly $1 Billion in profits.

Carl Ichan Quotes Gallery

2. Bill Ackman

Bill Ackman is a legendary activist investor & billionaire, he is known for making big bets against the consensus & being right!

His strategy was originally influenced by Warren Buffett & he considers himself value investor at heart, but it’s clear his strategy is much bolder & more fitting to an activist investor.

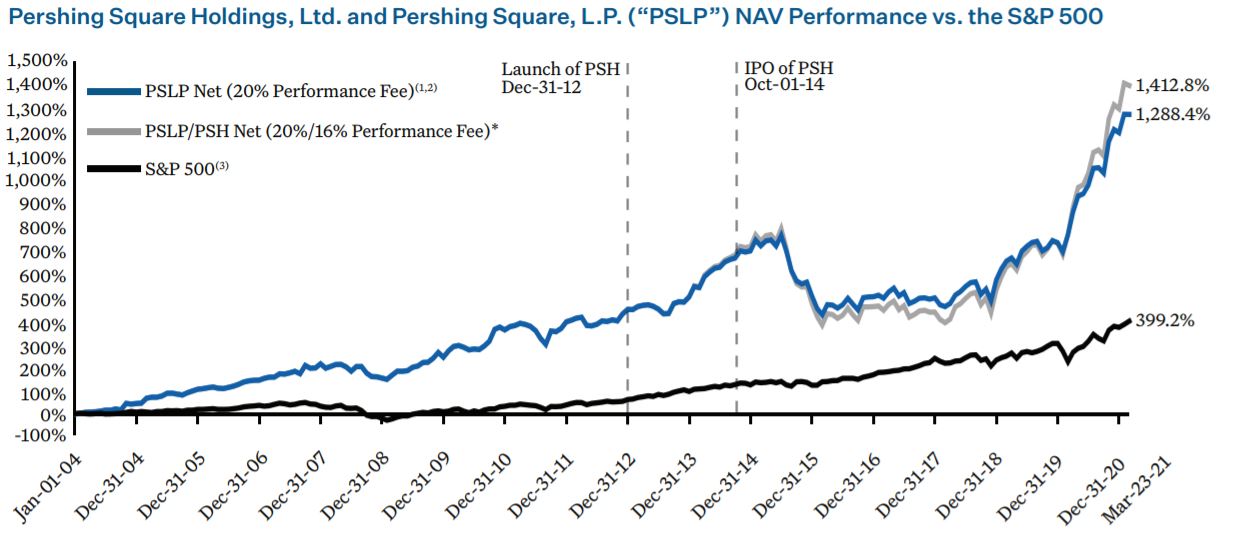

Bill Ackman is one of the greatest investors of all time despite his bold style. Pershing Square holdings (LSE:PSH) has achieved a 1,412.8% return between (2004 to 2021) vs the S&P 500 return of 399.2%.

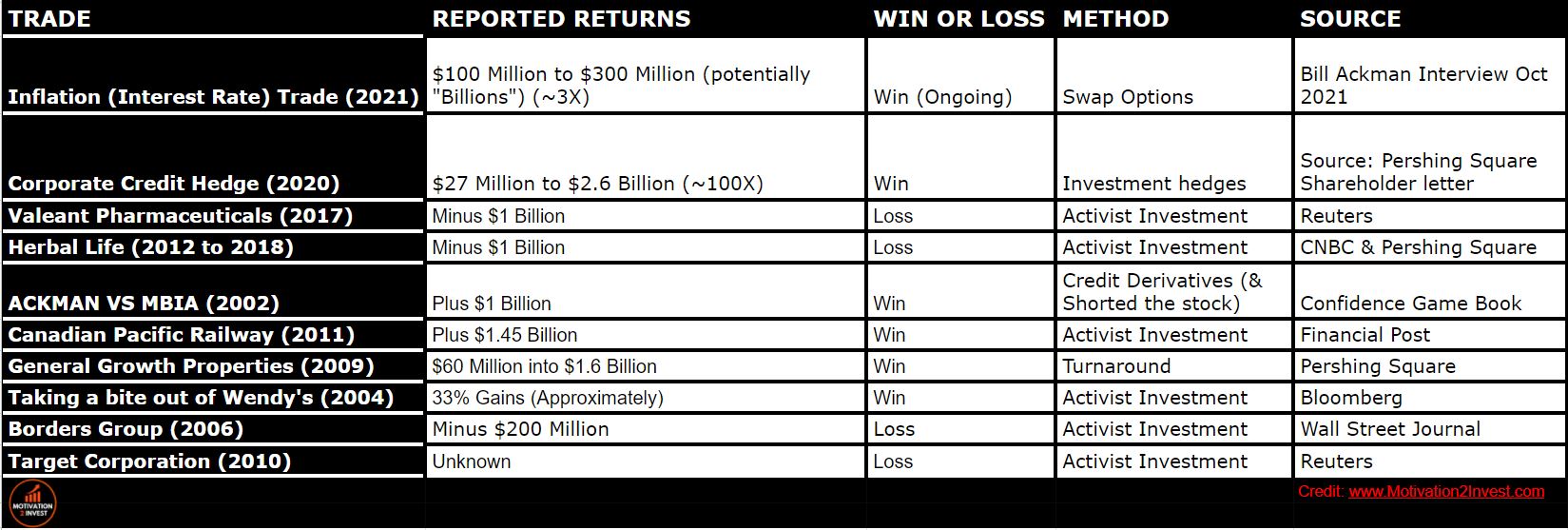

BEST BILL ACKMAN TRADES Credit: www.Motivation2invest.com/Bill-Ackman-Trades

Bill Ackman has had some exceptional investments over the years. In 2020, Ackman turned $27 Million into $2.7 Billion with his bet against corporate credit.

Persistent Activist Investor

Bill Ackman is extremely persistent & outspoken, when he believes he is right. This can work positively when it pay’s off (MBI Case) but can also work negatively when thinks don’t work out (Herbal Life).

After an extensive amount of research & a trip back through history, I have managed to find out the approximate returns & losses for Bill Ackman’s most public trades.

A few trends are notable from the below graph:

- More Win’s than losses (6 out of 10 public bets)

- Losses are Smaller than Wins

- Net Returns are positive +$4.75 Billion minusing losses from failed public trades.

BILL ACKMAN PUBLIC TRADE RETURNS BREAKDOWN, (Win/Losses). Credit: www.Motivation2invest.com/Bill-Ackman-Trades

See Unpacking Bill Ackman’s 10 Best & Worst Trades for more.

Bill Ackman Quotes Gallery

3. Jeff Ubben

Jeff Ubben is an activist investor & hedge fund veteran.

Previously he ran ValueAct Capital before launching his new fund Inclusive Capital Partners in 2020.

One of Jeff Ubben’s major activist wins was his investment into Adobe in 2011. ValueAct got board seats in 2012 and then sold shares for over $1 Billion 5 years later, as the stock rose by over 200%.

A major loss by Ubben was his investment into Valeant, the company had board since 2006 and was doing well until the stock crashed.

Ubben is now seeking to raise $8 billion for his new socially and environmentally conscious fund.

He recently joined the board of Exxon Mobil to help bolster their environmental credentials.

Jeff Ubben Quotes Gallery

4. Chris Hohn

Sir Chris Hohn is a Billionaire, know as “The UK’s most powerful Hedge Fund Manager”

Hohn is an activist investor with a focus on Value Investing. Hevhas made headlines recently for earning a stratospheric £1 Million per day in 2020.

Fun Fact: Hohn has pledged over $2 Billion to charity, which earned himself a knighthood in 2014.

Chris Hohn Quotes Gallery

5. Dan Loeb

Dan Loeb is the Billionaire hedge fund manager of an event driven, value investing fund.

Loeb’s Strategy is that of an Activist investor as he likes to buy troubled companies, replace inefficient & bad managers and thus increase value for shareholders, he describes this as his “Key to success”.

Loeb founded Third Point Partners targets have includes Sony, Yahoo, and recently the Japanese retail group (Seven & i Holdings Co).

Fun Fact: In a recent interview Loeb stated the name “Third Point Partners” comes from a beach area in California where he had many good times surfing and socialising with friends.

Dan Loeb Quotes Gallery

6. Christer Gardell (Cevian Capital)

Christer Gardell is a management consultant-turned-hedge fund manager who was dubbed a capitalist “butcher,” . He founded Cevian Capital in 2002 with an ex-investment banker Lars Förberg from Zurich and this became the Largest Activist investor in Europe.

Fun Fact: The firm was originally backed by the king of Activist investors Carl Ichan

A successful example of Cevian’s activist skills is where they urged British engineering firm Cookson to spin off its performance materials unit at the end of 2012.

This move drove up investment value for the company’s shareholders by over than 25%, according to Bloomberg.

However, it hasn’t all been rosy the firm has had two losses since inception. The first was a 20% loss when turning around a Norwegian Firm called CTG and a “small loss” with the insurance firm Munich Re

7. Clifton Robbins (Blue Harbour Group)

Clifton Robbins heads the Blue Harbour Group ($3.8 Billion AUM) which calls itself a “friendly activist Investor.”

They prefer to talk to management and bring about corporate changes, instead of using hostile tactics like proxy fights and leveraged buy outs which are popular with Carl Ichan.

A notable success by Blue Harbour was there stake taken in Jack in the box back n 2010. The company acquired a 5.2% stake in the company and urged the burger chain to do share buy backs and franchise more stores. Three years later the stock was up 75% according to the Wall Street Journal.

A notable Loss was Blue Harbours investment into CSK Auto Corp (an auto parts retailer) , the company reportedly lost 23% according to the Wall Street Journal in 2013.

8. Starboard Value

Starboard Value is an Activist Hedge Found founded in 2002 by Jeffrey Smith and Mark Mitchell, with Peter Feld.

The firm has battled with Macys, Yahoo and Brink’s Home Security. They are best known for tearing apart Darden Restaurants’ management in a 300-page presentation, that also included a blistering attack on the lack salting of Olive Garden’s pasta! According to Business insider.

In 2014, Smith took over as chairman of Darden Restaurants which runs Olive Garden and Longhorn Steakhouse, after which the stock shot up nearly 60%.

In a failed activist move, Starboard urged Office Depot and Staples to merge. This was stopped after a federal judge sided with the Federal Trade Commission to block the deal because of anti-trust issues.

9. Trian Fund

Trian Fund Management was founded by Wharton dropout Nelson Peltz, former President and COO of Triarc Companies (now known as The Wendy’s Company) and an ex-investment banker Ed Garden in 2005.

Trian earned a $830 million in profit following the merger of Triangle Industries and National Can Company in 1985.

In a notable win, the firm purchased Snapple from Quaker Oats for $300 million in 1997 and sold it just 3 years later for a whopping $1.5 billion!

In a notable loss, Trian lost a multimillion-dollar fight to win seats on DuPont’s board. Bill Ackman had said that Peltz’s biggest mistake in that battle was that he waited “too long,” according to Reuters .

10. Kyle Bass

Kyle Bass is a Legendary Hedge Fund Manager with a net worth of approximately $3 Billion. Bass got rich by predicting the subprime mortgage crisis in 2008 and betting against the U.S Housing market.

Along with other legendary investors such as Michael Burry (Big Short.) His investment style is that of a “top down” approach to investing looking at Economics, Politics and currency trades.

Kyle Bass Vs China

Although not classed as a traditional “Activist investor” I have included Kyle Bass on this list as he seems to be a “Political Activist” mainly against China.

Bass believes that China is a “paper dragon” and the influence central China is having in Hong Kong is causing many issues.

Kyle Bass Hayman Capital Quotes. www.motivation2invest.com/Kyle-Bass

He has also spoken publicly about the human rights violations in China and is very against their practices, in this sense you could also call Kyle Bass an Ethical Investor. Hayman Capital’s Hong Kong Dollar short so far has not paid off, but if it does we could see another Asian financial crisis!

Due to the unlikelihood of this occurring, Kyle Bass could generate exponential returns.

This strategy is very similar to the contrarian bet the Legendary George Soros made against the British Pound, in which he reportedly made over $1 Billion in a single day. In recent times, Bass has reiterated his predicted a collapse of the Hong Kong Dollar and has urged investors to move their assets to USD

Kyle Bass Quotes Gallery

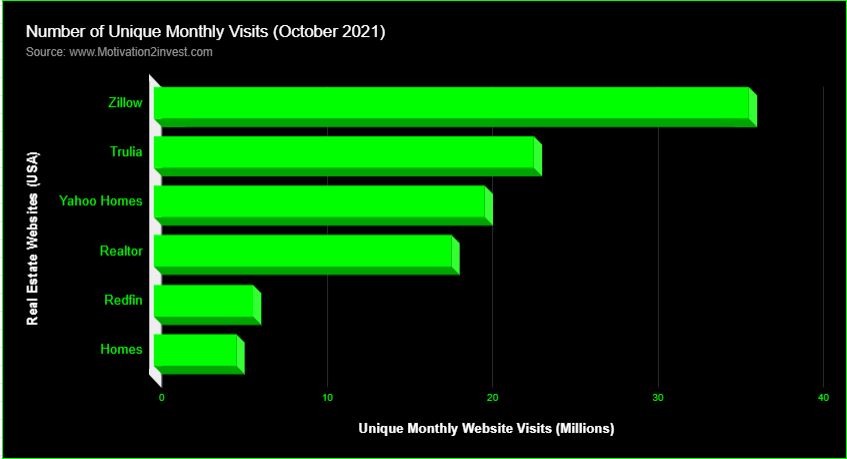

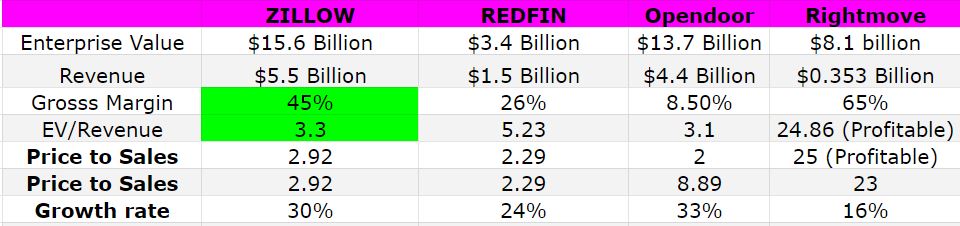

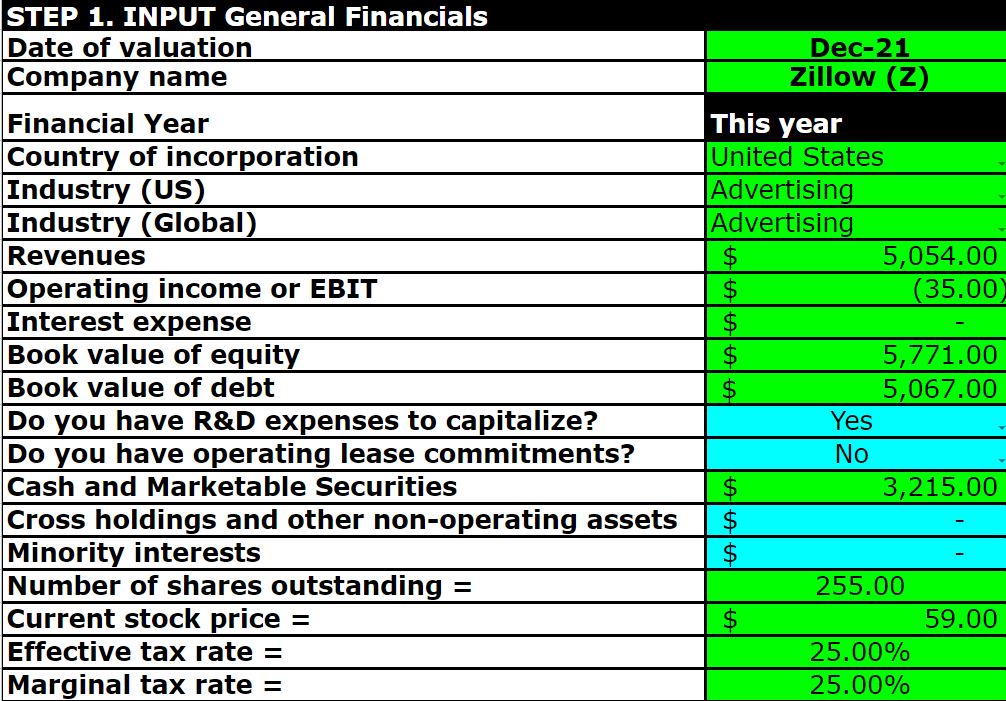

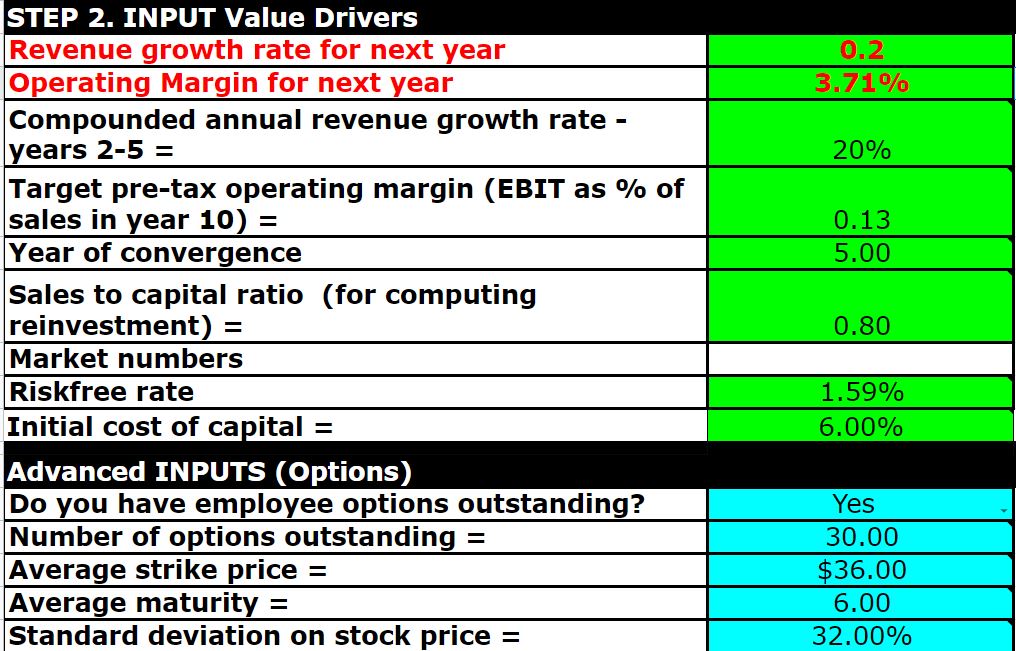

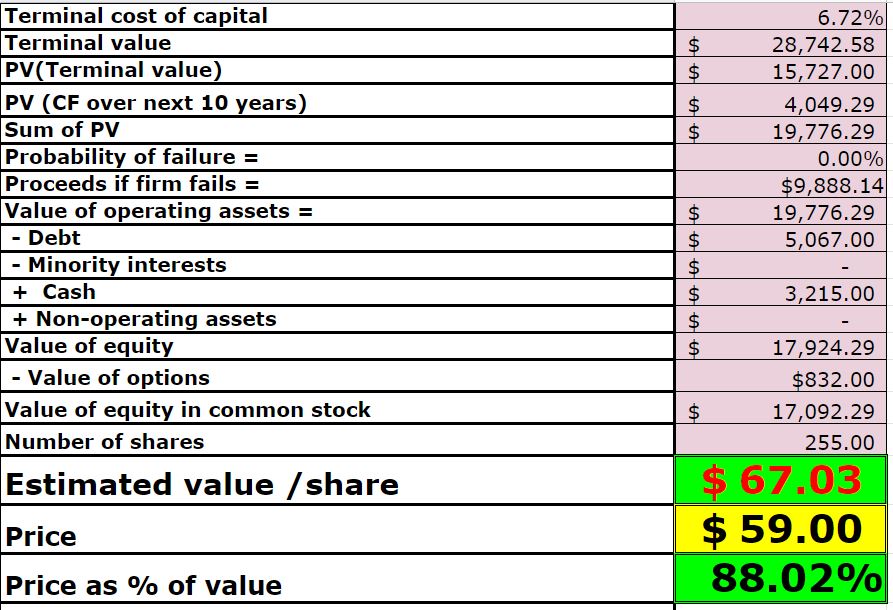

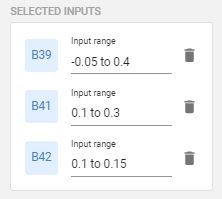

Zillow Stock Valuation Gallery

Zillow Stock is Primed for Activist Investors after a recent decline, review our gallery below to find out whether the stock is undervalued, from our advanced valuation model.