Next stock which could 10x your money like tesla?

Well in this video/blog post you guys are gonna find out i’m ben and welcome to motivation to invest.

- Share Price action

- Affirm Stock Business model

- Affirm founder Max Levchin ( paypal mafia )

- Deep dive stock analysis of Affirm (Financials)

- Affirm Stock valuation and buy points.

- Investing Risks

1. AFFIRM SHARE PRICE ACTION:

Affirm ipo’d in january 2021 the stock actually had a lot of exuberance behind it it shot up by around 50% and then actually declined also by around 60% with the whole tech stock correction and rotation out of tech stocks.

affirm-rings-nasdaq-opening-bell_1024xx3692-2077-0-174

2. AFFIRM STOCK BUSINESS MODEL

What does a Affirm actually do what’s this company’s business model.

Affirm is involved in what’s called the buy now pay later space, if you go onto many websites and you’re purchasing especially high ticket item you’ll often see a little button and it says you can buy now and pay later so you can pay an instalments for a product now a firm has a variety of major partnerships with big companies such as walmart.com peloton adidas expedia and many more.

Affirm stock is up massive (42%) after amazon partnership was announced.

This will let consumers buy expensive things in instalments , so the partnership will allow customers to break up purchases of $50 or more into smaller instalment. Amazon is the leader in e-commerce it’s a trillion dollar company i believe over 50% of the u.s population are now amazon prime members so this is a major major partnership for a firm.

3. AFFIRM Founder Max Levchin

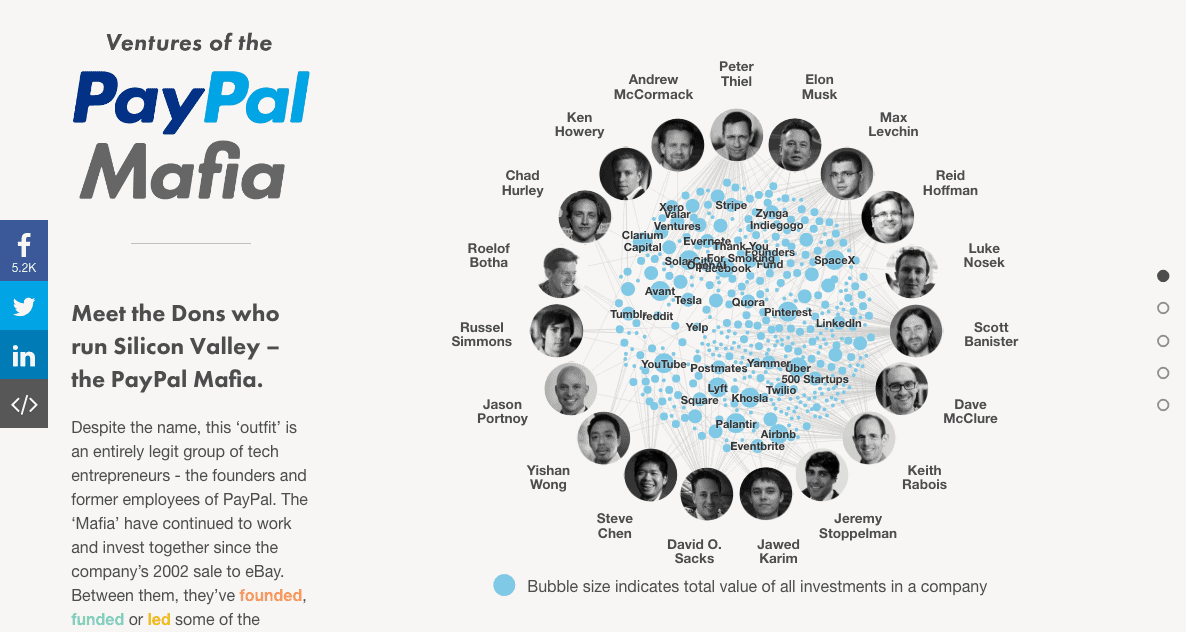

The founder is Max levchin , He’s part of what’s called the Paypal mafia . The Paypal mafia is a group of technology entrepreneurs which have changed the world.

Many technological companies with billion dollar valuations most of them were founded by members of the paypal mafia, which were the original paypal founders.

Max Levchin Affirm CEO. Source: Business insider

Paypal Mafia:

Paypal Mafia, Source: https://www.informationisbeautifulawards.com/showcase/1273-the-paypal-mafia

We’ve got peter thiel here who is a co-founder of Palantir, we’ve got all the founders of youtube which of course is owned by google now we’ve got Elon Musk , obviously founder of tesla & spacex and of course we have max levchin who used to work on a product called slide but his heart wasn’t really in that product and he was more interested in the fintech arena,.

INVEST WITH GREAT FOUNDERS?

so my personal investing philosophy after reading over 600 books on investing and studying the greatest hedge funds of all time is to invest with great founders. Those with skin in the game and a large portion of their net worth in the stock of the company.

Max Levchin has 6.36% ownership of a firm.

He’s only paying himself ten thousand dollars per year salary! so he’s paying himself a very low salary this guy’s heart and soul is in the company.

Shopify owns 7.66% of the firm. so to me that’s a real deep embedded strategic partnership which is great news for a firm.

4. AFFIRM FINANCIALS (Stock Analysis):

Affirm is burning a lot of cash at the moment, so they’re burning around 300 million dollars every single year. Revenues also forecasted to increase to 1.1 billion dollars by 2022. Sales growth over the past period has been 66%.

Price of sales of 48. so you’re paying 48 times the company sales looking backwards!

5. Affirm Stock valuation and buy points.

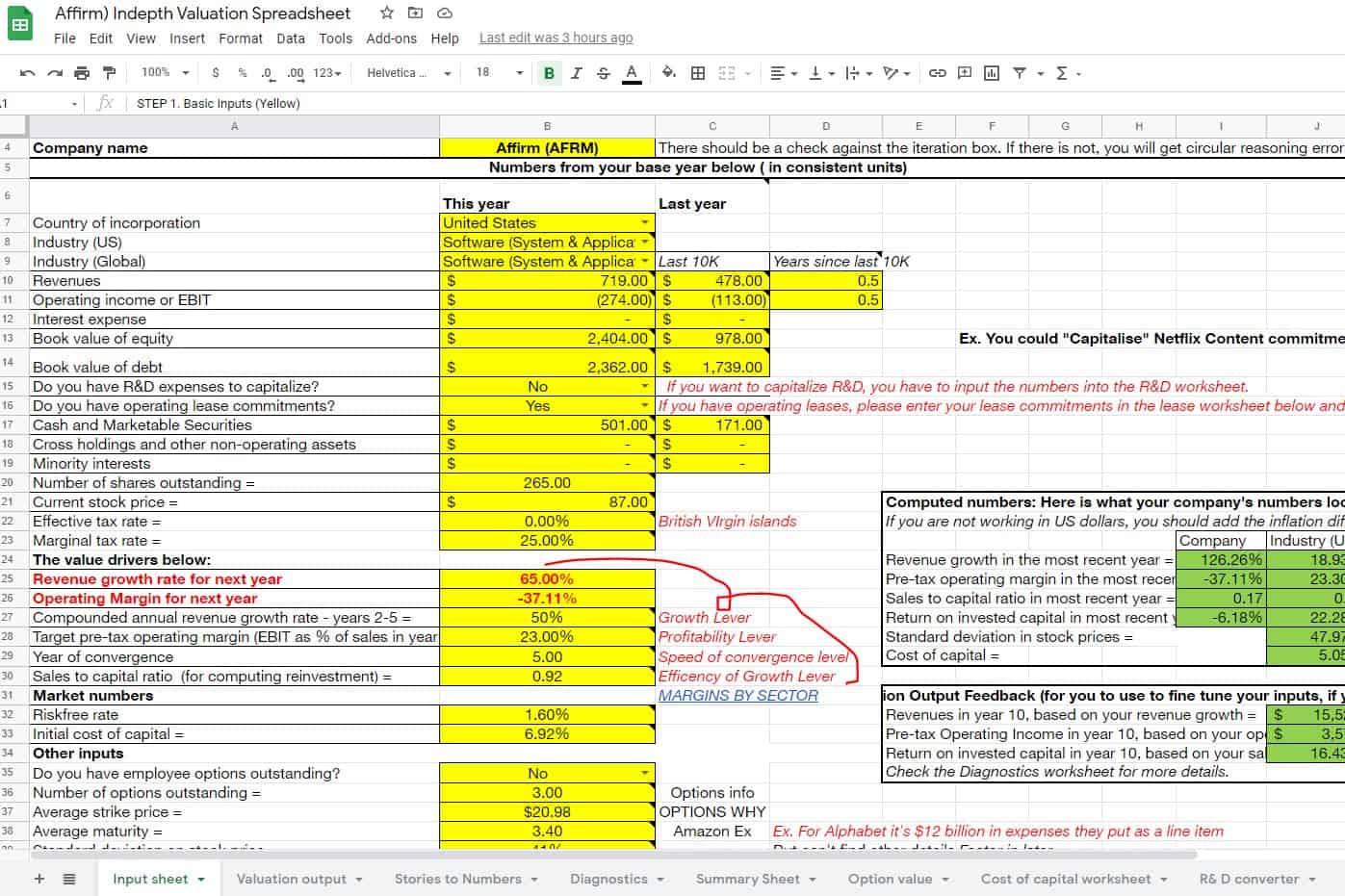

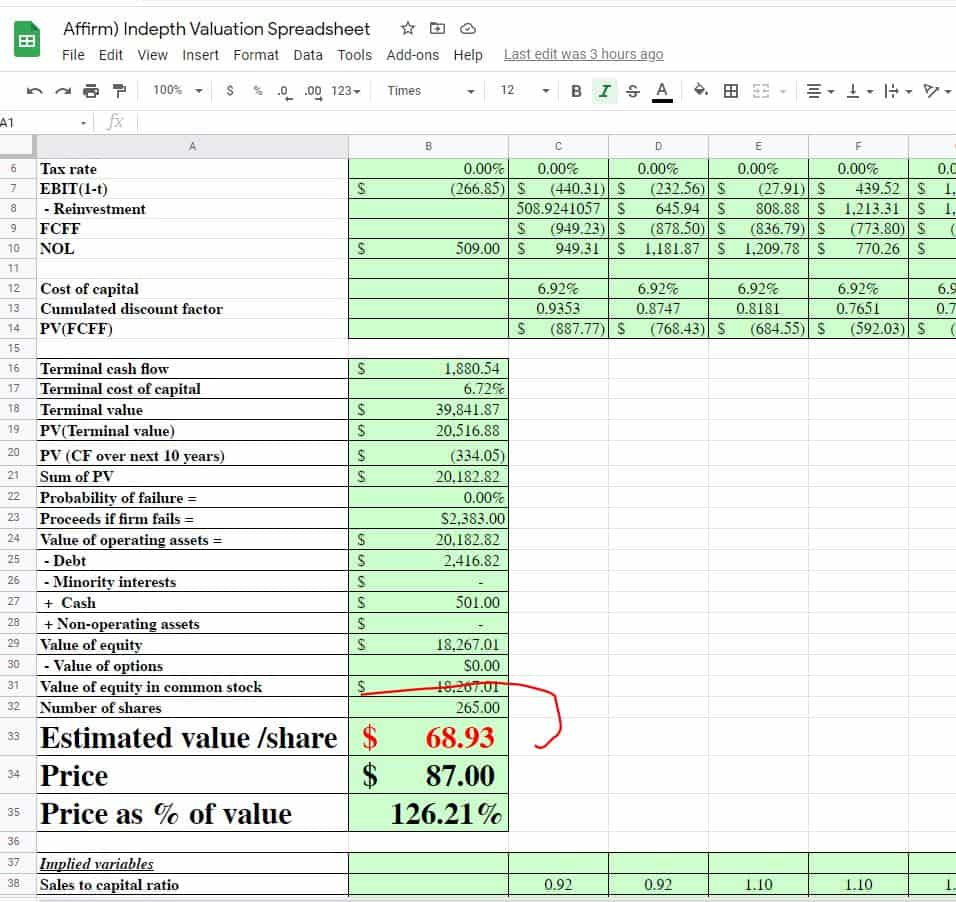

Plugging in my projections, 65% growth rate next year, 50% for the next two to five years. Predicting Affirm can grow its margins in the next five years to 23% which is the average for a software company.

FAIR VALUE FOR THE STOCK: $68 per share (From Discounted Cash Flow Model)

Affirm Stock valuation model Motivation 2 invest. Join Our Investing Course & VIP Community to Access all VALUATION MODELS for over 55 Stocks! Click here to find out more https://www.motivation2invest.com/product/stock-investing-course/

Before this big pop after the Amazon partnership, the stock was trading close to its fair value.

affirm Stock valuation model Motivation 2 invest.

Affirm Stock valuation model Motivation 2 invest.

Join Our Investing Course & VIP Community to Access all VALUATION MODELS for over 55 Stocks! Click here to find out more https://www.motivation2invest.com/product/stock-investing-course/

6. INVESTING RISKS?

LOTS OF COMPETITION (BUY NOW PAY LATER SPACE)

We’ve got apple who’ve launched apple pay later this was launched in july 2021.

we’ve got Klarna, paypal’s launch buy now pay later.

Paypal Buy Now Pay Later

Apple Buy now pay laterr

Klarna Buy now pay later