20 Greatest Investors of all time | Famous & Historical Legends

Investing into the stock market has attracted the greatest minds in History! Many with their own unique investing style, so in this post we’re going to take a trip back through time and reveal some of the most famous & Historical investors.

Many are still active today, some are no longer with us, but in either case their immense timeless wisdom lives on & is still extremely relevant today!

After all despite the increase in technology & computer trading there is one common factor which has been present in making decisions in the stock market throughout the ages, PEOPLE.

Where there are people there is volatility & psychological biases all which create opportunities for profit.

Greatest Investors of all time Quotes Gallery

Who is the Greatest Investor of All Time?

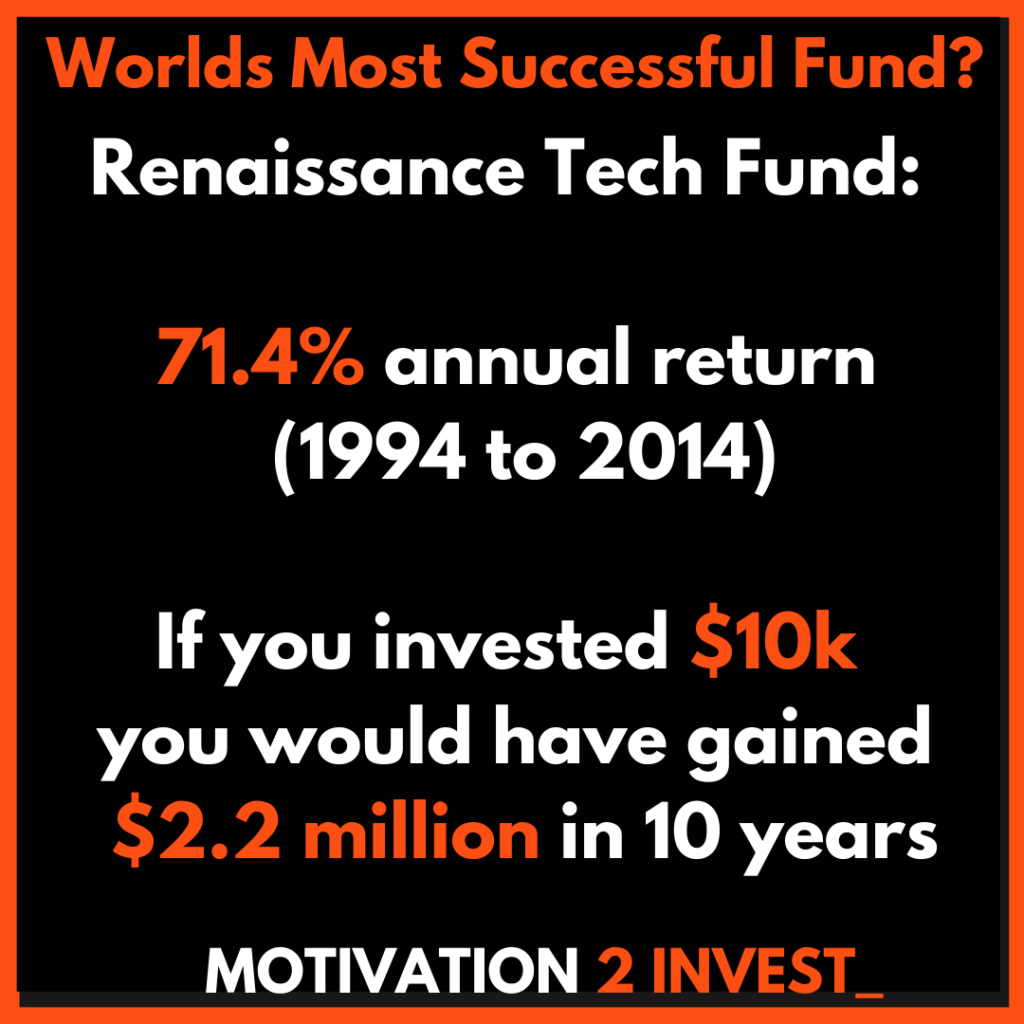

1. Jim Simons

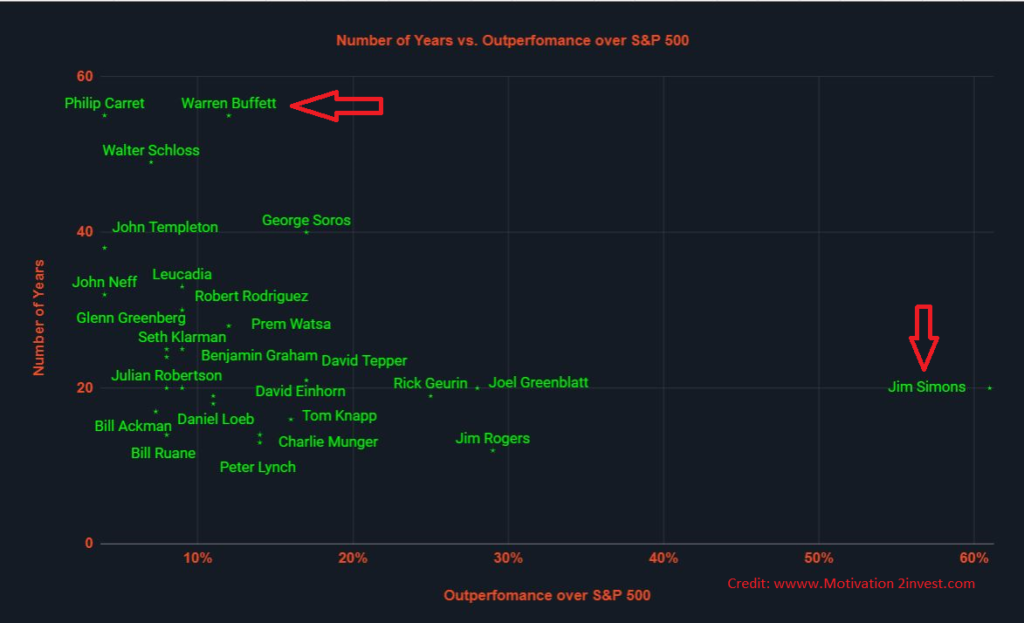

In terms of pure investment returns, Jim Simons is the greatest investor of all time. Simons Medallion Fund averaged an incredible 71.4% compounded return annually between (1994 and 2014). This puts him ahead of Warren Buffett’s investment conglomerate Berkshire Hathaway which earned “only” 20% compounded returns annually.

Both are incredible returns massively outperforming the S&P 500 index which averaged a 10.2% annual return.

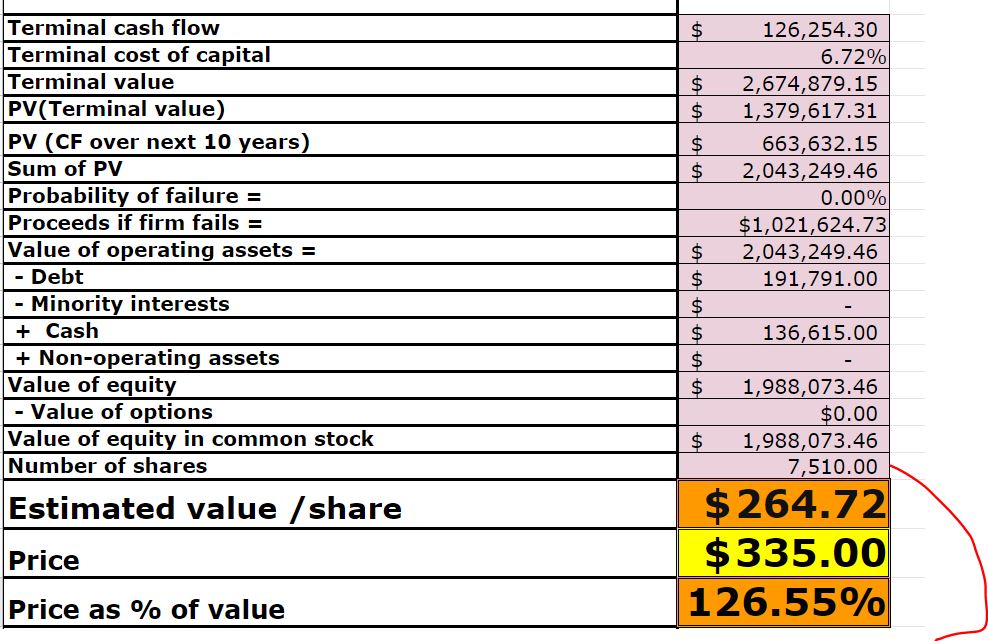

INVESTING LEGENDS GREATEST INVESTORS RETURNS STOCK MARKET JIM SIMONS OUTLIER. Jim Simons (renaissance technologies) Vs Warren Buffett (Berkshire Hathaway) Credit: www.motivation2invest.com/Jim-Simons

The Scatter plot i’ve created above plots outperformance over the S&P 500 (X Axis) vs Number of Years. It is clear to see that Jim Simons is a true outlier in terms of returns.

However, Warren Buffett has an incredible return over such a long period of time nearly 60 years!

Why this is not a fair fight?

Jim Simons is a “Quant Investor” and advanced Mathematician who has created a computer model & algorithm for trading at Renaissance technologies. So although his firm has generated better returns than any other investor, the computer algorithm is the real success story.

Jim Simons Quotes Gallery

2. Warren Buffett

Warren Buffett…the man, the myth, the legend is one of the best investors of all time & a wealthy billionaire. He is the epitome of a classic Value investor.

Valuing Companies not stocks, with an extremely disciplined approach to his trades. His strategy focuses on risk minimisation & long term investing gains.

Investment Returns:

This has paid of substantially with an annualised compounded portfolio return of approximately 20% since 1964, for his investing conglomerate Berkshire Hathaway. Overall returns from 1964 to 2021 = 2,855% (approximately).

If you invested $1000 in 1964 into Berkshire, that would be worth an incredible $28,855. Close to a 29X Return!

Warren Buffett Quotes (8). You can use this image if credit with clickable link: www.Motivation2invest.com/Warren-Buffett-Quotes

Warren Buffett is not just a great investor but also an incredible teacher, his wisdom, Witt and life Lessons are Legendary. Many of the greatest investors we see today stood on the shoulders of Buffett and credit him for their success.

Warren Buffett Quotes Gallery

3. Ray Dalio

Ray Dalio is the Billionaire founder of the worlds largest hedge fund, Bridgewater associates.

Dalio got his first taste of investing during the “nifty fifties” this was a major bull market and everyone was talking about stocks.

He overhead many conversations while caddying at a golf club & thus saved up his wages before investing.

He bought his first stock, North East Airlines which immediately increased in price. After which Dalio was hooked on investing & fell in love with the opportunities.

Fun Fact: The 1950’s was a strong bull market, as it followed World War II thus pent up consumer demand was released.

Ray Dalio Quotes MOTIVATION 2 INVEST (6)Credit: www.Motivation2invest.com/Ray-Dalio

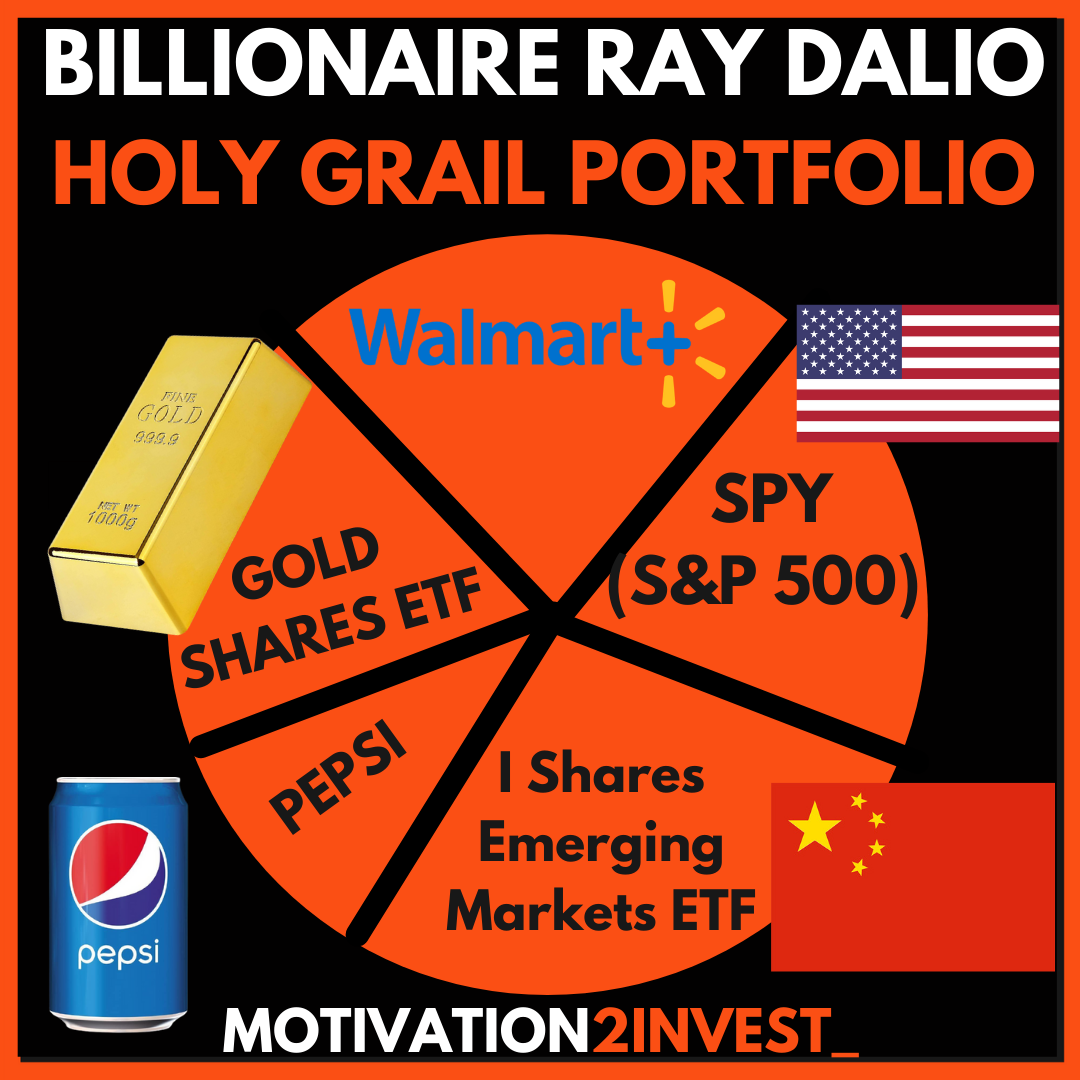

Ray Dalio’s investing Strategy has a big focus on Investing internationally and diversification across stocks, industries, asset classes etc.

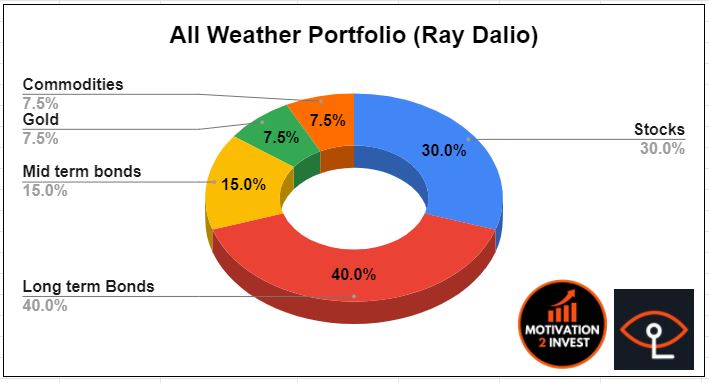

all weather portfolio ray dalio 3D. Credit: www.motivation2invest.com/Ray-Dalio

Dalio is a major bull on investing into Gold, he states “If you don’t own gold, you know neither history or economics”.

This is contrary to Warren Buffett who doesn’t invest into gold as it “doesn’t produce anything”, Buffett prefers farmland.

Ray Dalio Quotes Gallery

4. Benjamin Graham (1894 to 1976)

Benjamin Graham (1894- 1976) is known as the “Father of Value Investing”, a pioneer of Deep Value investing & the incredible Warren Buffett’s mentor!

Graham wrote the book the intelligent investor of which his prodigy the Legendary Warren Buffett widely cites as the “best investing book ever written”. Graham also wrote the bible of value investing “Security Analysis”.

Warren Buffett studied under Benjamin Graham at Columbia University and was his top student (no surprise).

Fun Fact: A series of unfortunate events led to Buffett’s encounter with Graham. As one of the richest people on this planet was TURNED DOWN by Harvard Business school in 1950.

Buffett stated: “I spent 10 minutes with the Harvard alumnus who was doing the interview, and he assessed my capabilities & turned me down,” Then Buffett Realised Graham was at Columbia and having read his books multiple times cover to cover he rang him up

“I thought you were dead! If not it would be great to study with you” , Buffett even offered to work for free for Benjamin Graham in his original investing partnership.

Benjamin Graham Quotes The Intelligent Investor You can use this image if credit with clickable link (do follow) www.Motivation2invest.com/benjamin-graham-quotes

Investment Returns:

Benjamin Graham averaged a compounded return of approximately 20% annually between 1936 to 1956. During the same period the general market returned just 12.2% annually on average.

Investment Strategy:

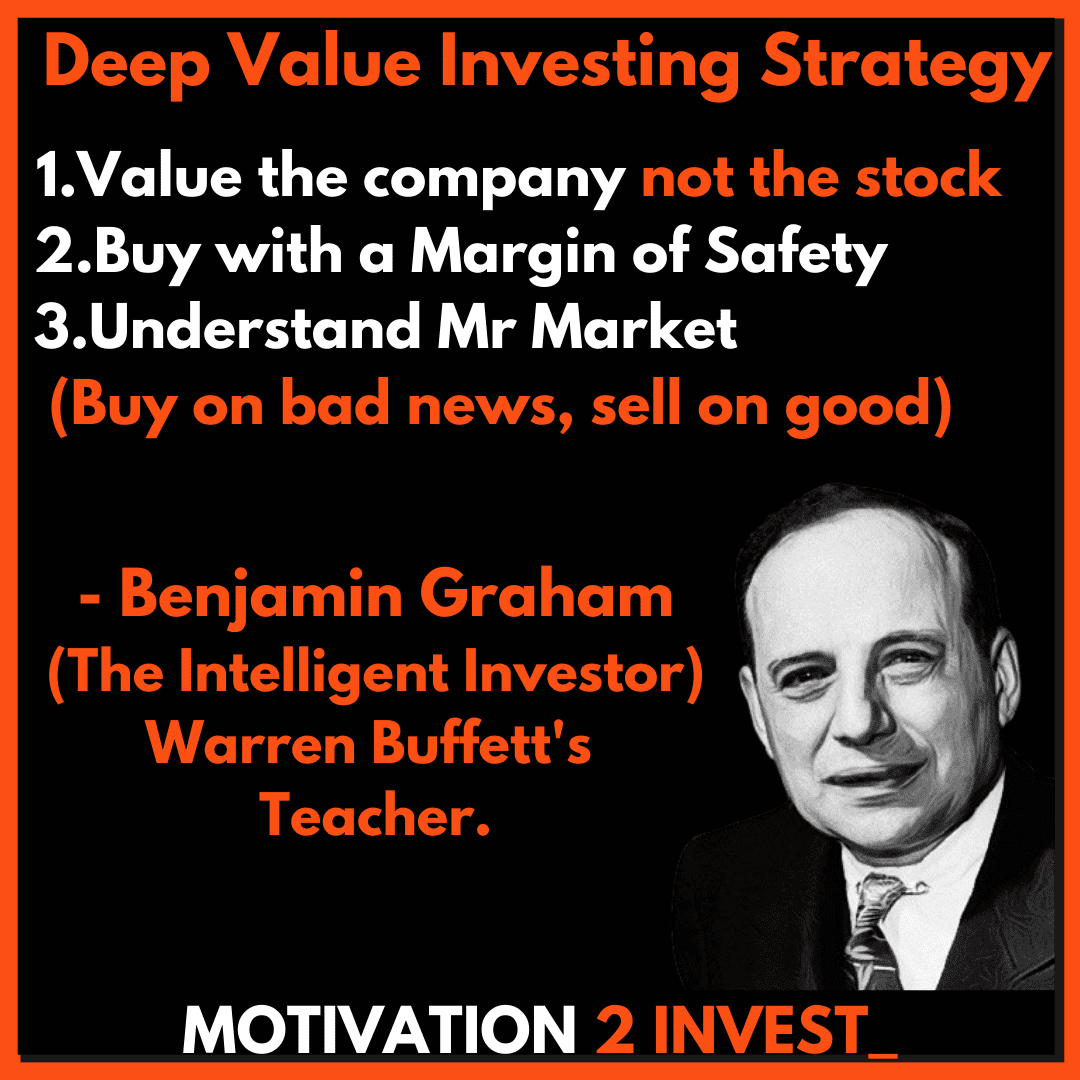

Benjamin Graham’s deep value investment strategies although simple were game-changing for those who adopted them, concepts include:

- Recognising a Stock is a portion of a Business

- Margin of Safety (Valuing a company then buying below than fair value)

- Mr Market (The concept that the Market is governed by a bipolar person which fluctuates from Fear to Greed)

- Deep Value Investing.

Is Benjamin Graham still relevant today?

Yes! The principles outlined in books such as the Intelligent investor are still very relevant today for both business and investing, although the book is not so easy to read.

The strategy of deep value investing has become more difficult, this is due to a few factors, from the increasing availability of strategy information, to network connection of the stock market, algorithmic trading and more.

Many Stock Market inefficiencies tend to be plugged extremely fast these days which makes it harder to find opportunities.

Even Warren Buffett evolved Benjamin Graham’s traditional deep value investing style to pay more for “wonderful companies at fair prices” .

This was partly thanks to the influence of another legendary Investor, who will discuss next Charlie Munger.

Benjamin Graham Quotes Gallery

5. Charlie Munger

Charlie Munger is a famous historical investor with a net worth of $2.2 Billion. Munger is an exceptional value investor with great Witt, Wisdom & no filter when it comes to saying what he thinks!

Munger is also a great friend & Business partner of Warren Buffett. Buffett often jokes about himself & Munger knowing “what each other are thinking” like former Siamese Twins & they used speak on the phone almost daily.

Munger is credited to have helped Warren Buffett invest into “Wonderful companies at fair prices”, rather than just deep value investments, using the Benjamin Graham method.

Buffett had traditionally done cigar butt strategy investing, where he looked to buy companies trading below net asset value, with “one last puff” in them.

Charlie Munger Quote 8 MOTIVATION 2 INVEST (1)

How did Charlie Munger Meet Warren Buffett?

Warren Buffett and Charlie Munger first met in 1959.

The famous investors were introduced to each other at a dinner, with the referral coming from a popular family doctor of in Omaha.

The story is Legendary, In 1957 Doctor Edwin Davis had a meeting with Buffett and agreed to allow him to manage his money…because he reminded him of someone named “Charlie Munger.”

In a CNBC Interview, Buffett stated:

“Well, I don’t know who Charlie Munger is, but I like him”

The Doctors wife, Dorothy made it her mission to connect Buffett and Munger. Two years she managed to connect the two at a dinner in 1959.

Charlie Munger, who was then a lawyer in Los Angeles, was visiting Omaha after his father, Alfred had passed away.

The two immediately made a connection and the rest of the room melted away as Buffett & Munger talked for hours.

Charlie Munger Quotes Gallery

6. Philip Fisher

Phil Fisher is a great Historical Investor who pioneered the strategies of growth stock investing & a more qualitative approach to investing.

Fisher Pioneered the “Scuttlebutt” investing strategy which involves speaking to Management, Customers & even competitor companies in order to gain a special insight into a businesses quality.

Fisher looked to buy great businesses, with high returns on capital and to hold them long term, as opposed to repeatedly buying low & selling high.

Phil Fisher also focuses on Customer insight, Marketing & sales processes in his book he states:

In the business world customers simply do not beat a path to the door of the man with the better mousetrap.

In the competitive world of commerce it is vital to make the potential customer aware of the advantages of a product or service.

This awareness can be created only by understanding what the potential buyer really wants (sometimes when the customer himself doesn’t clearly recognize why these advantages appeal to him)

and explaining it to him not in the seller’s terms but in his terms.” – Common Stocks & uncommon profits.

Phil Fisher has a very similar approach to a modern day Legendary Investor Nick Sleep whose investment partnership produced compounded returns of 20.8% with over 40% of the fund in just one stock, Amazon!

This is the power of investing into long term compounders with great Managers.

Nick Sleep Nomad Investment Partners Letters Quotes. Returns if invested into Tesla Stock or Amazon. Source: Motivation2invest.com

Warren Buffett is often considered to be part Ben Graham and part Phil Fisher.

Buffett stated in a 1995 Berkshire Hathaway shareholder meeting

“I was very influenced by Phil Fisher when I read his books in the 1960’s, they are terrific books”

“I think of myself as 100% Ben graham and a 100% Phil Fisher [at the same time]

It takes more business experience to apply Fishers approach compared to Ben Graham

Ben was more of a teacher as he had no urge to make alot of money”

Charlie Munger is also quoted to share fond thoughts on Phil Fisher at the same annual meeting in 1995.

Phil Fisher Quotes Gallery

7. Sir John Templeton

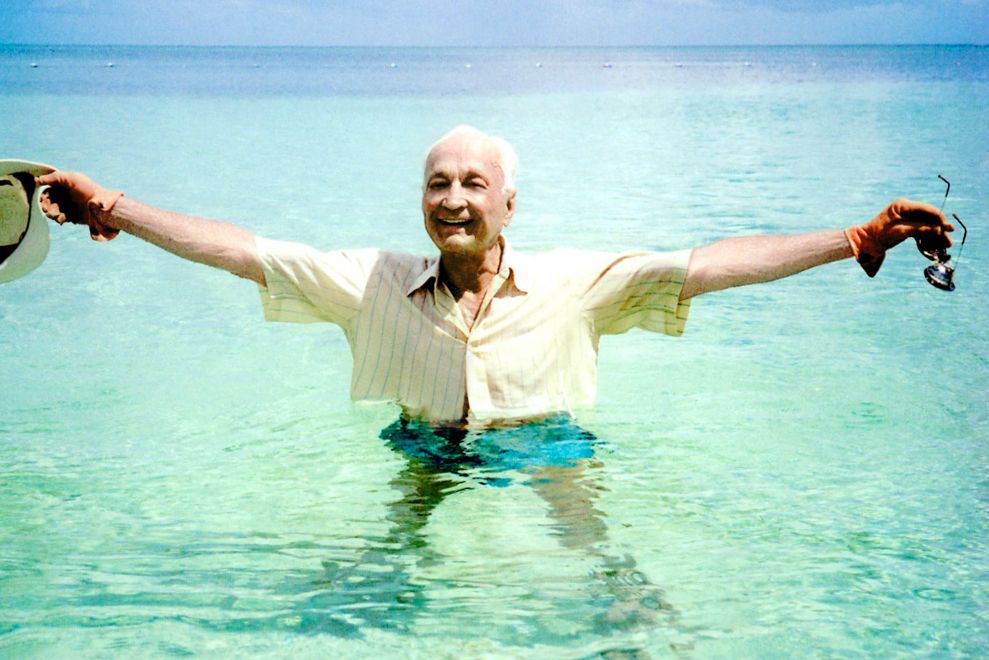

Sir John Templeton (1912-2008) is one of the greatest contrarian investors in history. Templeton is most famous for making bold bets against the consensus and being right!

The Ultimate Contrarian (World War 2) Investment:

An extreme example of this includes a bold investment during World War 2!

In 1939, WW2 was just beginning and the stock market crashed as most people were in fear (understandably).

However, Templeton saw this volatility as an opportunity.

John Templeton MOTIVATION 2 INVEST Quotes (1)Credit: www.Motivation2invest.com/John-Templeton-Quotes

Templeton borrowed thousands to buy 100 shares of EVERY STOCK selling for less than one dollar, during Stock Market Crash.

At that point one third of the companies faced bankruptcy, but he held his shares firm. After which all but four stocks rebounded, which made him an incredible 400% return in just 4 years!

John Templeton MOTIVATION 2 INVEST Quotes (1) Credit: www.Motivation2invest.com/John-Templeton-Quotes

The Time of Maximum PESSIMISM is the Best time to BUY, the time of maximum OPTIMISM is the best time to SELL.

When stocks crash and fear grips the stock market, people perceive a greater risk. However, stocks are actually LESS RISKY as they are cheaper to buy…effectively stocks are on sale.

The same is true when stocks go up and euphoria is prominent, the perception from the media is now you should buy, when actually that is the most dangerous time to buy and the best time to sell.

This is very similar to Legendary Investor Warren Buffett’s quote: “Be fearful when others are greedy and greedy when others are fearful”.

This sounds easy on paper but during the heat of a stock market crash it requires immense courage and independent thinking to buy when others are selling in fear.

John Templeton Quotes Gallery

8. Peter Lynch

Peter Lynch is one of the greatest investors in History who has also inspired a generation (including myself!).

As the manager of the Magellan Fund at Fidelity Investments, Lynch averaged an incredible 29.2% annual return! Between 1977 and 1990.

This was consistently more than double the S&P 500 stock market index and thus this was the best-performing mutual fund in the world.

Lynch believes the average retail investor can get “one up on Wall street” which was the name of his famous book.

Peter Lynch Investing Quotes Wall Street Legend (5). Credit: www.Motivation2invest.com/Peter-Lynch-Quotes

Peter Lynch is also a great teacher similar to Warren Buffett . Lynch has the incredible skill of being able to simplify an investment strategy enough for anyone to understand.

Famous Value Investor Mohnish Pabrai, tells a story of how reading Peter Lynch’s books got him into investing.

Mohnish was running an IT services company and decided to pick up one of Lynch’s books to read on a flight. He loved the book and saw many synergies which would help him to run his own business better.

Then decided to read another one of Lynches books, Mohnish stated:

I was then out of Peter Lynch Books, but Lynch talked about this guy named Buffett in the book, so then I started reading his books

Peter Lynch Quotes Gallery

9. George Soros

George Soros is a legendary Investor who is most famous for his bold Macro economic predictions & currency trades. Soros is most famous for making $1 Billion in a single day when his bet against the British pound paid off!

This was called the “greatest Trade of all time” and he executed this with his former business partner & Trading Legend Stanley Druckenmiller.

Investing Strategy: Contrarian, Economics, Trader, Top Down

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

George Soros Quotes Gallery

10. Stanley Druckenmiller

Stanley Druckenmiller is a Famous Investing great with an estimated net worth of $6.6 billion.

Druckenmiller is most famous for executing what has been called the “greatest trade of all time” in which he made up $1 Billion in a single day!

This was accomplished by a bold bet against the British pound during the early 90’s when Stanley Druckenmiller was at the Quantum Fund with another Legendary investor George Soros.

Stan Druckenmiller and George Soros (Quantum Fund)

Stan Druckenmiller Quotes Gallery

11. Sam Zell

Sam Zell is one of the greatest Real Estate investors of all time! Known as the “King of Real Estate” he has an net worth of $6 Billion according to Forbes.

Zell is also nicknamed the “Grave Dancer” as he buys when everybody in the real estate world is getting killed!

How to build a Real Estate Empire from Scratch?

Zell has humble beginning as the son of Polish Emigrants which fled Nazi Germany in 1939. From young it was clear Zell had a strong entrepreneurial tendency.

As a boy he started buying Playboy Magazines in the city and selling them to friends for a massive 600% mark-up!

Sam Zell Quotes Investing Real (18).Credit: www.Motivation2invest.com

In college, he asked the landlord of a 15 unit student housing building if he could manage the property in exchange for a free room & board.

Zell learnt a lot from the experience about refurbishing properties and he began buying distressed properties, renovating them and then renting to students.

Afterwards Zell branched out from student rentals to commercial properties to

other residential units, resorts, even manufactured homes. Zell began

incorporating his different types of holdings into real estate investment

trusts.

He organized his different real estate investments into various trusts which allowed him to sell them off as he wished. A notable example is the whopping $36 billion sale to investment giant Blackstone.

Sam Zell Quotes Investing Real (11). Credit: www.Motivation2invest.com

Sam Zell Quotes Gallery

12. Carl Ichan

Carl Icahn is a legendary activist investor who’s brash & outspoken Strategy of investing has made him a billionaire, with an estimated net worth of $16.7 Billion.

As an activist investor Ichan analyses poorly run companies where he believes a change in management strategy will improve the company & increase shareholder value.

To accomplish this Carl Icahn buys up a vast amount of shares in a company at opportune moments in order to gain voting rights for shareholders.

This can even result in a hostile takeover if not approved by the board of directors or stubborn management who may fear for their jobs.

Carl Ichan Quotes motivation 2 invest. Credit: www.Motivation2invest.com/Carl-Ichan-Quotes

Ironically many shareholders welcome Carl Ichan’s presence as an investor as they know he will hold management accountable for their decisions.

Fun Fact: Carl Icahn is known for his public fights with another Legendary Activist Investor Bill Ackman. This occurred during the Herbal Life investment, where both activists took opposing positions & argued very personally on public TV!

Investing Strategy: Activist Investor, Contrarian, Value Investor

Carl Ichan Quotes Gallery

13. Walter Schloss

Walter Schloss (1916 to 2012) is was of the greatest value investors in History. As a known disciple of Benjamin Graham, Schloss focused on deep value investing.

Schloss took Ben Graham’s investment courses before going to work for him at the Graham-Newman Partnership, there he met Warren Buffett.

Walter Schloss Quotes (1 (7). Credit; www.motivation2invest.com

Investing Returns

In 1955, Walter Schloss started his own fund and for over 45 years he delivered his investors incredible annual returns of 15.3% versus 10% for the S&P 500.

In 1984, Warren Buffett named him as one of the Superinvestors of Graham-and-Doddsville.

Warren Buffett stated about Walters Schloss:

“He knows how to identify securities that sell at considerably less than their value to a private owner; And that’s all he does …

He owns many more stocks than I do and is far less interested in the underlying nature of the business; I don’t seem to have very much influence on Walter.

That is one of his strengths; No one has much influence on him.”

Walter Schloss closed his fund in the year 2000 and passed away at the age of 95 in February 2012.

Walter Schloss Quotes Gallery

14 Bill Ruane

Bill Ruane (1925 to 2005) is a famous & historical Value investor who was one of Warren Buffett’s Superinvestors of Graham-and-Doddsville.

When Buffett closed his original fund in 1969 he even referred his investors to Bill Ruane’s Sequoia Fund, this is the ultimate referral!

Bill Ruane’s fund had a Value based strategy of buying “Wonderful Businesses at fair prices” , rather than the strict Ben Graham approach of “Cigar Butt” style, deep value investing.

Bill Ruane investing Quotes (5). Credit: www.motivation2invest.com

Investing record

Since Sequoia funds inception in 1970 they have massively outperformed the S&P 500. If you invested just $10,000 into the fund this would have grown to over $4.2 Million today! Compared with “just” $1.3 Million from the S&P 500.

Bill Ruane Quotes Gallery

15. Jack Bogle

Jack Bogle (1929-2019) was the “Father of Index Fund Investing” as the Billionaire Founder of Vanguard. One of the large Passive investment fund providers in the world.

How Jack Bogle Founded Vanguard?

Jack Bogle started in the mutual fund business in 1951 when his senior thesis caught the eye of Walter L. Morgan, founder of the Wellington Fund.

Bogle started working at the Wellington fund and rose to become Executive Vice President in 1965 & was named one of “The Whiz Kids” by Intuitional Investor Magazine.

However, the good times didn’t last…as the bear market of 1973 led to poor performance by the Wellington Fund & caused a dispute amongst partners. This resulted in Bogles firing in 1974!

Not one to take things lying down, Bogle proposed a new company which would provide admin to the Mutual fund provider at a cost basis. This would be called the Vanguard Group and was also named “The Vanguard Experiment”.

After reading a study on efficient markets & past fund manager performance, Bogle realised that rather than trying to “beat the market” better performance could be achieved by buying the Market.

“Rather than trying to look for a needle in a haystack, just buy the whole haystack”

Jack Bogle Investing Quotes (13). Credit: www.motivation2invest.com

In 1976, Bogle introduced the first index investment trust which allowed people to buy the market. This was ridiculed in the press as a “sure path to mediocrity” and “un-American”, the firm only managed to collect $11 Million during the release.

However, today index funds are a huge part of Vanguards approximately $5 TRILLION in assets under management!

Passive investing has even become more popular than active investing & this has really changed the entire investment industry.

Jack Bogle Quotes Gallery

16. Ron Baron

Ron Baron is a legendary growth stock investor, who makes big bets on high tech stocks.

He is most famous for being an early Bull on Tesla stock and publicly placing an astronomical price target of $4,000 per share back in early 2020. This was before Tesla stock rose by over 800% that same year!

In a 2021 interview with Bloomberg, Baron stated that He thinks Tesla CEO Elon Musk will become a “Trillion Dollar Man”.

Ron Baron Growth Stock Investing Strategy & Quotes

Credit: www.Motivation2invest.com/Ron-Baron-Strategy

Ron Baron invests into growth stocks with high revenue growth and a long term vision. He tends to hold these stocks for a very long term if the fundamentals don’t change.

Baron Looks for unique companies which are “changing or disrupting” an industry. For Example, Tesla is disrupting the auto industry and SpaceX is disrupting the rocket Industry with it’s reusable rockets.

Ron Baron Quotes Gallery

17. David Dodd

David Dodd (1895 to 1988) is a legendary Value investor, who was one of Warren Buffett’s Super Investors of Graham & Doddsville!

Dodd was a colleague of Benjamin Graham at Columbia Business School and together they wrote the bible of deep value investing “Security Analysis” in 1934.

David Dodd focuses on Deep Value Investing which involves buying assets below their intrinsic value with a Margin of Safety. The strategy also involves looking for “Net-Nets” these are stocks trading below their net asset value.

David Dodd Value Investing Quotes. Credit. www.Motivation2invest.com

How Buffett Met Graham & Dodd?

In 1950, Warren Buffett was turned down from Harvard Business School (the Irony)

Buffett quoted:

“I spent 10 minutes with the Harvard alumnus who was doing the interview, he assessed my capabilities and turned me down.”

Luckily for Buffett he discovered that Benjamin Graham & David Dodd were teaching at Columbia Business School. Having read their books “Security Analysis” & “The Intelligent Investor” cover to cover multiple times.

Buffett called them up “I thought you guys were dead, but if not I would love to come and study at Columbia” . Buffett was their greatest student & top of the class (no surprise)

David Dodd Quotes Gallery

18. Howard Marks

Howard Marks is a legendary Value investor with a specialism in deep value investing & special situations, such as credit & distressed debt investing. Marks is the founder of Oak Tree Capital .

Howard Marks believes everything is governed by cycles, from investor moods to stock market crashes.

Mastering the Market Cycle Howard Marks

Howard Marks even wrote a best selling book on the subject called “Mastering the Market Cycle” & “the most important thing”. The later book lists “the most important things” to do when investing.

Investing Record

Howard Marks Oaktree capital has a history of exceptional performance. 18.8% IRR (Internal Rate of Return) vs the S&P 500 Annual Return of 10.4%. This is the annualised time weighted return since October 1988.

Investing Strategy: Value Investor, Contrarian, Small Cap, Large Cap

Howard Marks Quotes Gallery

19. Julian Robertson

Julian Robertson is the billionaire former hedge fund manager of Tiger Management.

Now 89 years old, Robertson likes to invest into many so called “Tiger cubs” these are former Tiger Management employees who have since founded their own Hedge Funds

Julian Robertson Hedge Fund Investor Quotes (3). Credit: www.Motivation2invest.com

Tiger Global

Tiger Global is one of the so called “Tiger Cubs” related to the investment management firm Tiger Management (Julian Robertson).

Tiger Global was founded by Coleman in 2001 with an initial check of $25 million from the great & famous investor Julian Robertson of Tiger Management.

Tiger Global is a leading hedge fund and private investment firm focused on companies in the Technology industry.

Tiger has been nicknamed the “As The World’s Biggest Unicorn Hunter”

Fun Fact: A “Unicorn” is a privately held startup company with a value of over $1 billion.

Julian Robertson Quotes Gallery

20. Bill Ackman

Bill Ackman is a legendary activist investor & billionaire, he is known for making big bets against the consensus & being right (most of the time, data later on)

His strategy was originally influenced by Warren Buffett & he considers himself value investor at heart. However, it’s clear his strategy is much bolder & more fitting to an activist investor with a specialism in credit.

Bill Ackman is known for his dogged persistence, when he believes he is right which can result in major win’s, but also some very public losses.

BEST BILL ACKMAN TRADES Credit: www.Motivation2invest.com/Bill-Ackman-Trades

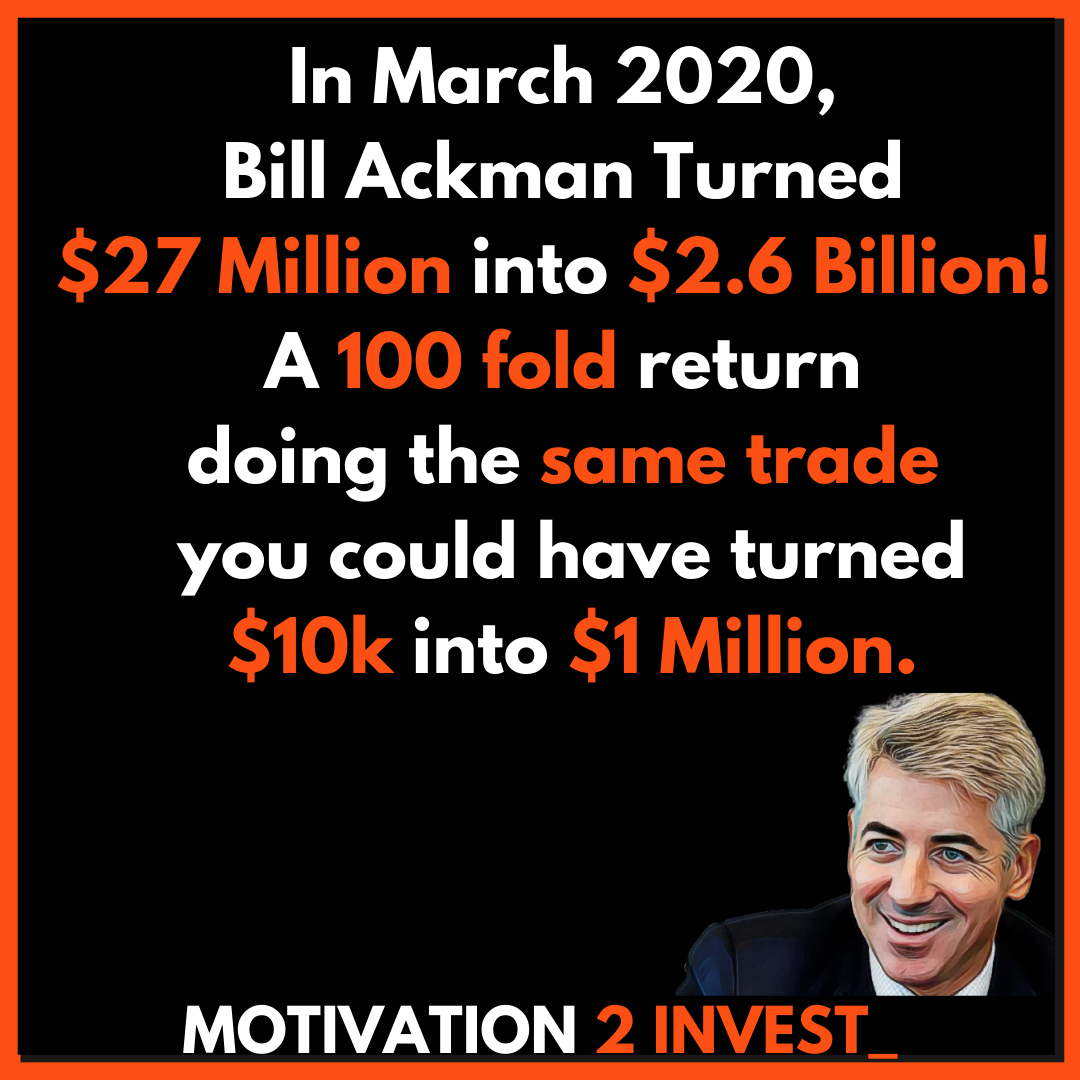

Investing Returns

Bill Ackman is one of the greatest investors of all time despite his bold style. Pershing Square holdings (LSE:PSH) has achieved a 1,412.8% return between (2004 to 2021) vs the S&P 500 return of 399.2%. Figures are net of performance fee (20%).

This is a compounded annual return of 17.1% vs the S&P 9.8% (2004 to 20201). Source. Pershing square holdings Annual Report.

Latest Trades

Bill Ackman is betting big on rising interest rates due to inflation. Unpacking Bill Ackman’s 10 Best & Worst Trades | New Trade 2021 & Downloads |

Want to Learn how to be great investor?

We have compiled together the strategies from the greatest investors of all time with our own real world investing experience to create the ultimate investing strategy course for the fundamental investor.

We open the course & our stock research platform each month for a limited time, so be sure to click through to reserve your spot.