12 Brilliant Quotes by George Soros | Investing Legend

George Soros is a legendary Investor who is most famous for his bold Macro economic predictions & currency trades. Soros is most famous for making $1 Billion in a single day when his bet against the British pound paid off!

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

This was nicknamed the “greatest Trade of all time” and he executed this with his former business partner & Trading Legend Stanley Druckenmiller.

Investing Strategy: Forex, Contrarian, Economics, Trader, Top Down

1. Recognize Mistakes

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“I’m only rich because I know when i’m wrong” – George Soros takes great pride in recognising his own mistakes. This extreme self awareness and reflection is vital to investing success.

2. Know the Best Case & Worst Case

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“It’s not whether your right or wrong, but how much money you win or lose either way” Many Legendary investors from Ray Dalio to Mohnish Pabrai, believe in identifying a low risk, high reward bets ( asymmetric risk reward ratio). If the worst case is your will go bankrupt then you shouldn’t be taking that bet.

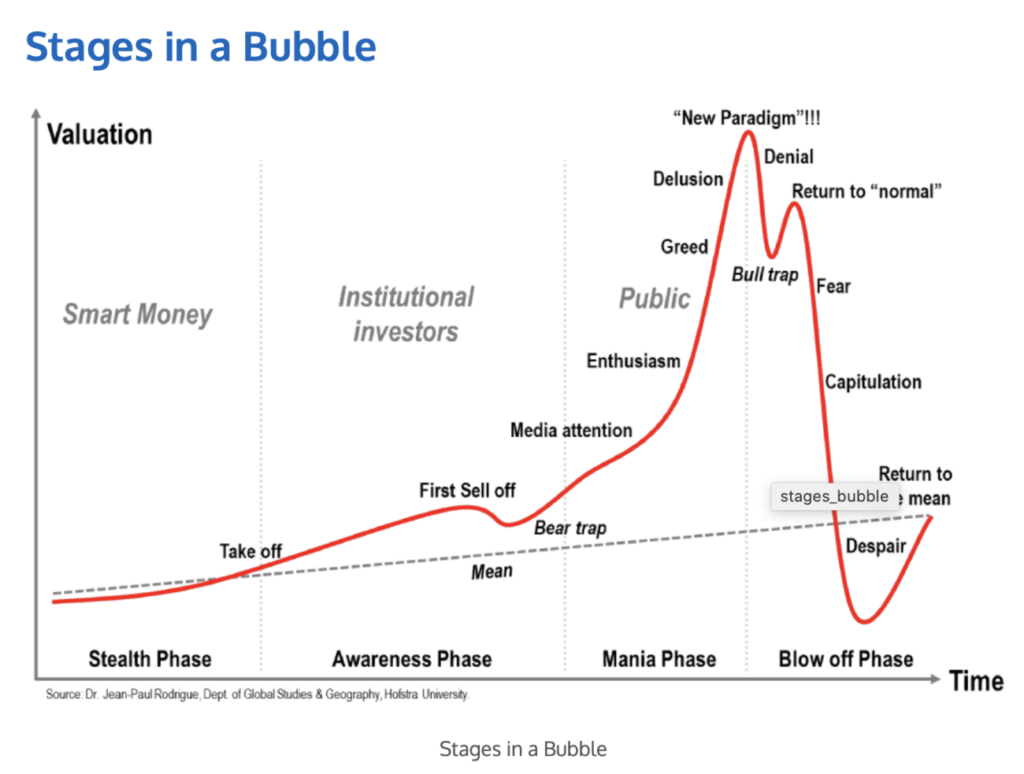

3. Identify Stock Market Bubbles

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“Every bubble consists of a real trend and a misconception relating to it”. Every asset bubble starts with a “nugget of truth” . For example back in the late 90’s the internet was great technology. However that didn’t mean any price could be paid for internet stocks!

When the Bubble popped, the music stopped and the Market crashed from the 10th March year 2000 the Nasdaq (tech index) crashed by over 71%.

Stocks like Pets.com went bankrupt and even stocks like Amazon lost a vast amount of value. The same is true for the housing bubble in 2008, and could even be true for many cryptocurrency tokens.

Stock Market Bubble chart.

4. Stock Prices are always wrong

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“I believe market prices are always wrong in a sense they present a biased view of the future”. This is an interesting concept as many people question the “efficient market hypothesis” which states all available information is currently reflected in the market and thus no mispricing’s can be found.

However, Soros speaks of a market which is always has a “biased view of the future” which is true.

5. Uncertainty = Opportunity

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“Markets are always in a state of uncertainty, money is made by discounting the obvious and betting on the unexpected”.

The “obvious” Soros refers to is often the “Nosie” of mainstream media and the “bad news” about the company. This is stuff everyone knows, the trick is to extract the “signal from the noise” and look for the true fundamentals of a business.

6. Learn from Mistakes

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“There is no shame in being wrong, only failing to correct our mistakes”. Learning from mistakes is the key to self improvement.

Ideally it would be nice to learn from others mistakes but when you make a mistake yourself the mistake “sears itself into you” as that is how our bodies are designed.

We are not robots, our emotions are designed to “sear in” what we should and shouldn’t do. This is why relationship love is often pleasurable but so is hurt from experiences.

7. Stock Market Beauty Contest

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“The Stock Market is like a beauty contest where the winner is the person OTHER PEOPLE think is most beautiful”. George Soros is referring to what is called a Keynesian beauty contest. This phrase was coined by legendary economist John Maynard Keynes.

This is a beauty contest where judges job to not say who they think is the most beautiful objectively but to vote on who they think OTHER PEOPLE will think is the most attractive overall.

With regards, to the stock market this means stocks which are “popular” tend to go up in the short term, this is the basis for a momentum investing strategy. The Legendary Value investor Benjamin Graham states “In the short term the stock market is a voting machine, in the long term it’s a weighing machine”.

8. Expectations = Reality

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“The relationship between what we think we are and what we are in reality is the key to happiness” . Our expectations of our self and others dictate our happiness. If we expect alot from ourselves or others we may be left unhappy.

This is why the legendary investor Charlie Munger once stated “Lowering your expectations is the key to happiness” , he even made a joke about how he met his wife. “Lowering expectations is how i met my wife…[crowd gasps]…she lowered hers” [crowd laughs haha]

9. Adapt to succeed

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

” I don’t have a particular style of investing, I change my style to suit the conditions”. Adapting to your environment is the key to success in many walks of life, including evolution.

Bruce Lee once said “Be like water, formless, shapeless…if you pour water into a cup, it becomes the cup…if you pour water into a bottle it becomes the bottle”….”Water can flow but also crash” .

The reason this is interesting is most legendary investors believe in sticking to their investing style for many year’s even though it may not be working.

10. Money is not the only Motivator

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“I’m primarily interested in ideas, and don’t have much personal use for money” , Most really successful people and legendary investors are intrinsically motivated by the process, as opposed to being externally motivated purely by money.

11. Be a Continuous Learning Machine

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“Recognizing my mistakes is a source of pride”. Reflecting & Learning from your mistakes is the key to success. Billionaire Ray Dalio has cited meditation as one of his key’s to success, by helping him to become more self Aware. Charlie Munger often talks about being a “Continuous learning machine”.

12. Good investing is boring

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

“If investing is entertaining your probably not making money, good investing is boring”.

Good Investing generally involves patience, discipline and making a few good decisions. Warren Buffett is known to have spend many hours each day reading and even manually screening stocks by going through a “Moodys manual” of stocks “starting with the A’s” As the Legendary Investor Peter Lynch once said “The person who turns over the most rocks wins”.

Want to Learn how to invest?

Many members of the Motivation 2 Invest community also have this passion and this drive to learn more each day. If you want to learn how to become a great fundamental investor or just join our thriving VIP Group. Check out the link here: https://www.motivation2invest.com/product/stock-investing-course/ We open the course to a limited number of members each month so be sure to reserve your spot now. Good Luck!