Unpacking Bill Ackman’s 10 Best & Worst Trades | New Trade 2021 & Downloads |

Bill Ackman is a legendary activist investor & billionaire, he is known for making big bets against the consensus & being right (most of the time, data later on)

His strategy was originally influenced by Warren Buffett & he considers himself value investor at heart. However, it’s clear his strategy is much bolder & more fitting to an activist investor with a specialism in credit.

Bill Ackman is known for his dogged persistence, when he believes he is right which can result in major win’s, but also some very public losses. In this post i’m going to breakdown Bill Ackman’s greatest public trades & outline:

- Is Bill Ackman a Great Investor

- Has Bill Ackman Beat the Market

- Track Record of Public Trades (Performance)

- Best & Worst Trades (Bill Ackman) – Including PDF downloads

Is Bill Ackman a Great Investor?

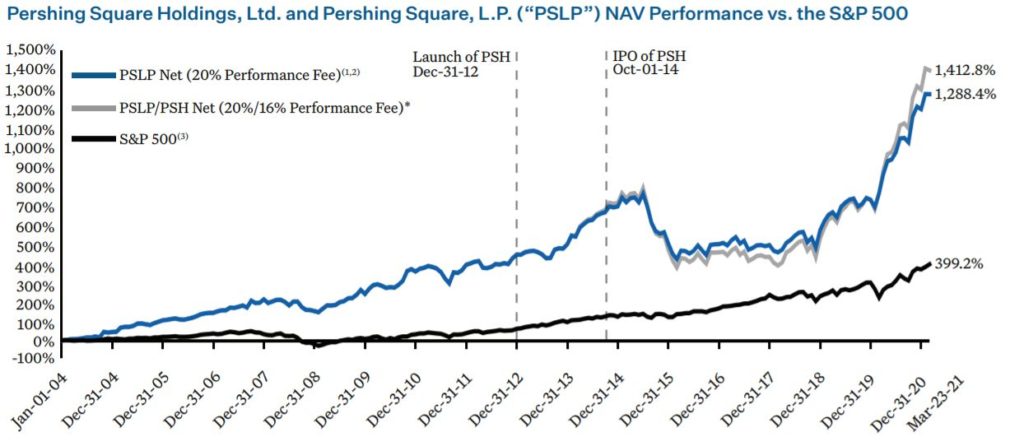

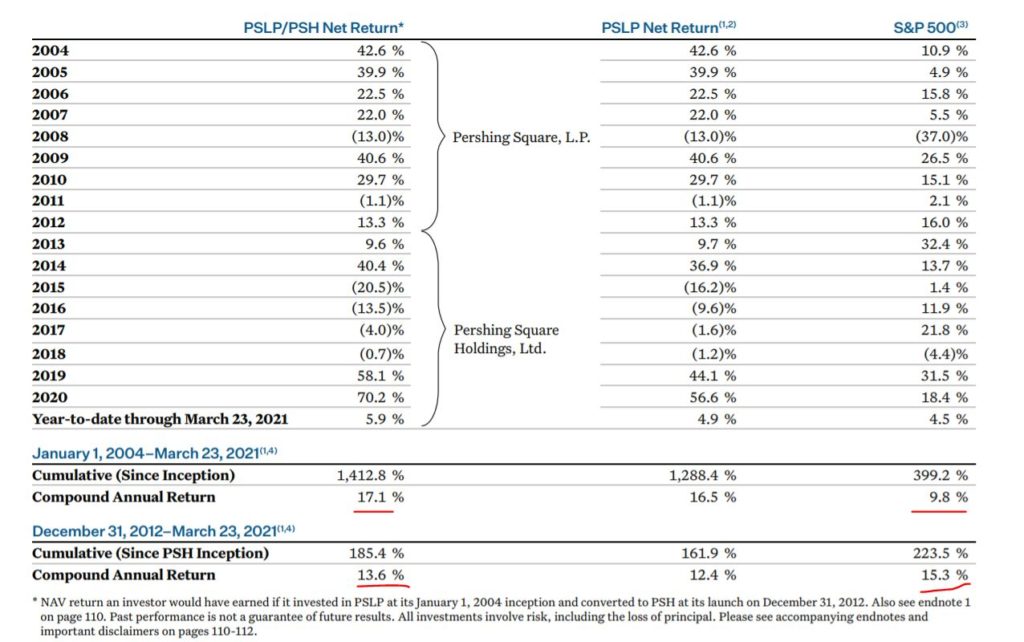

Yes, Bill Ackman is one of the greatest investors of all time despite his bold style. Pershing Square holdings (LSE:PSH) has achieved a 1,412.8% return between (2004 to 2021) vs the S&P 500 return of 399.2%. Figures are net of performance fee (20%). This is a compounded annual return of 17.1% vs the S&P 9.8% (2004 to 20201). Source. Pershing square holdings Annual Report.

Pershing Square Holdings Bill Ackman Portfolio Performance 2004 to 2021. Source: Pershing Square Holdings Annual Report

Has Bill Ackman beat the market?

Between 2004 and 2021, Bill Ackman beat the market with Pershing square producing an annual return of 17.1% vs the S&P 9.8% (2004 to 20201).

However, as noted on the below performance document between 2012 and 2021 the fund has slightly underperformed the S&P 500 Index producing a 13.6% compounded return vs 15.3% for the S&P 500.

Is it Harder to beat the market?

Many Value investors also noted from the period 2012 onwards, it has become harder to beat the market. This is for a few reasons, data is more abundant and markets have become more efficient. In addition, 2012 to 2021 was a fantastic period for the S&P 500.

The gains were driven by large tech stocks (FAANG) stocks, such as Facebook, Amazon, Apple, Netflix, Google which make up approximately 25% of the S&P 500.

BILL ACKMAN PERSHING SQUARE HOLDINGS PERFORMANCE (2004 to 2021). Source: Pershing Square Holdings Annual Report

Bill Ackman| Track Record of Trades

After an extensive amount of research & a trip back through history, I have managed to find out the approximate returns & losses for Bill Ackman’s most public trades.

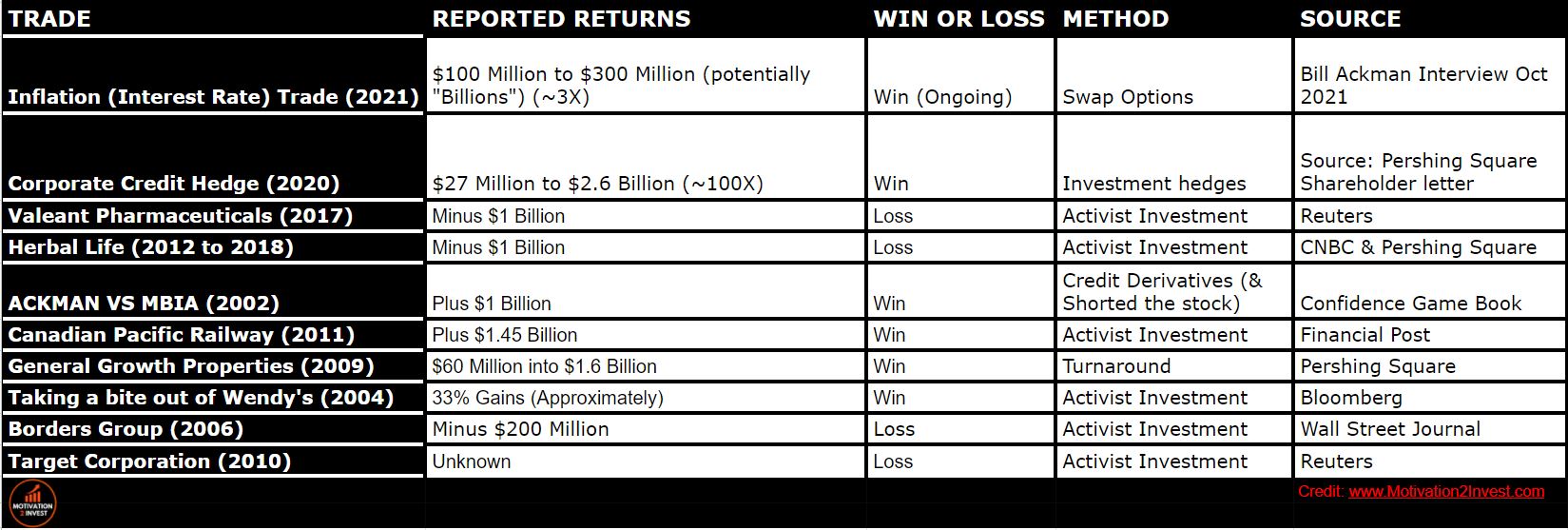

A few trends are notable from the below graph:

- More Win’s than losses (6 out of 10 public bets)

- Losses are Smaller than Wins

- Net Returns are positive +$4.75 Billion minusing losses from failed public trades.

BILL ACKMAN PUBLIC TRADE RETURNS BREAKDOWN, (Win/Losses). Credit: www.Motivation2invest.com/Bill-Ackman-Trades

More details can be found in the below table. Majority of return data has been sourced from Pershing Square shareholder letters and various high authority news providers, from the trade period such as Wall Street Journal and Bloomberg.

Bill Ackman Trade Returns Table Breakdown Good Investor or bad

Bill Ackman| Best & Worst Trades

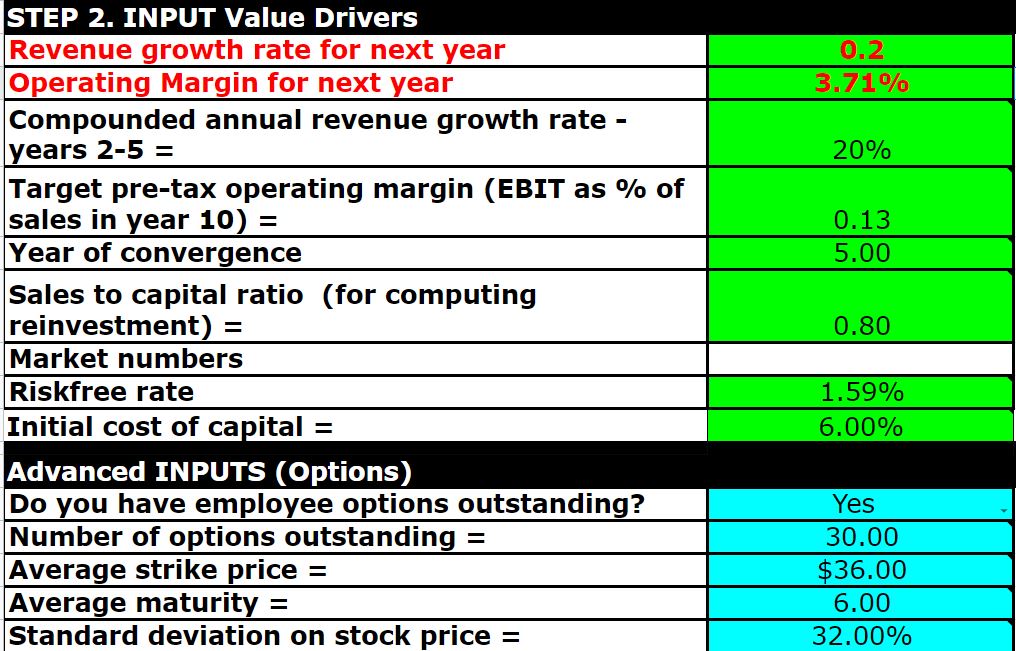

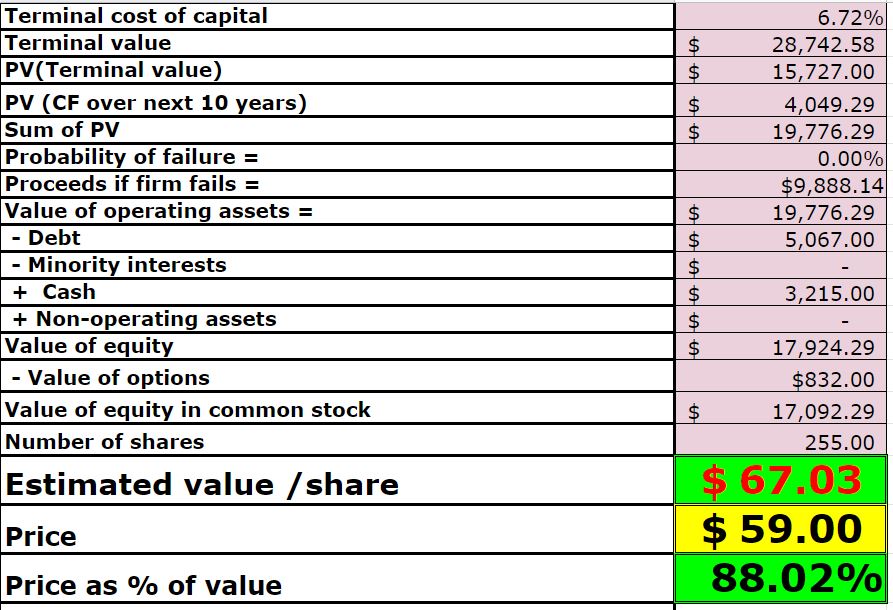

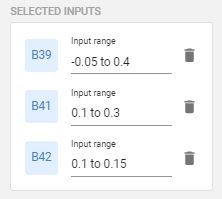

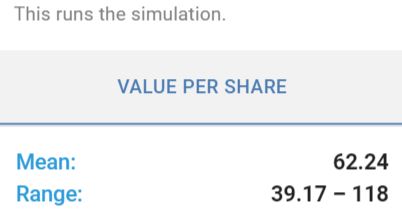

1. Inflation Trade (2021)

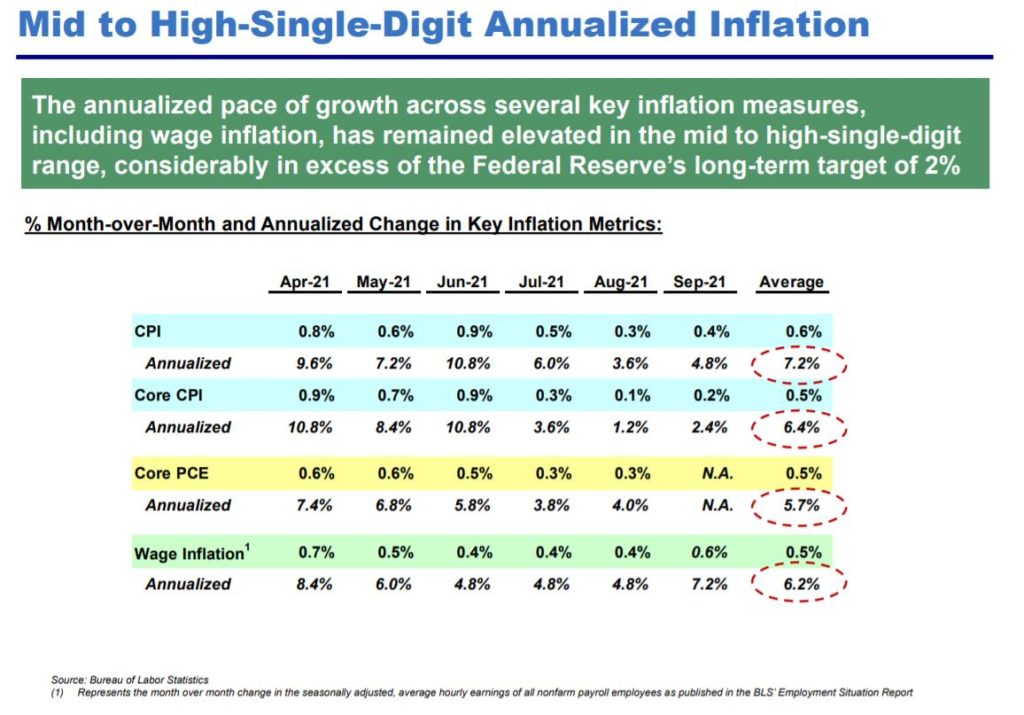

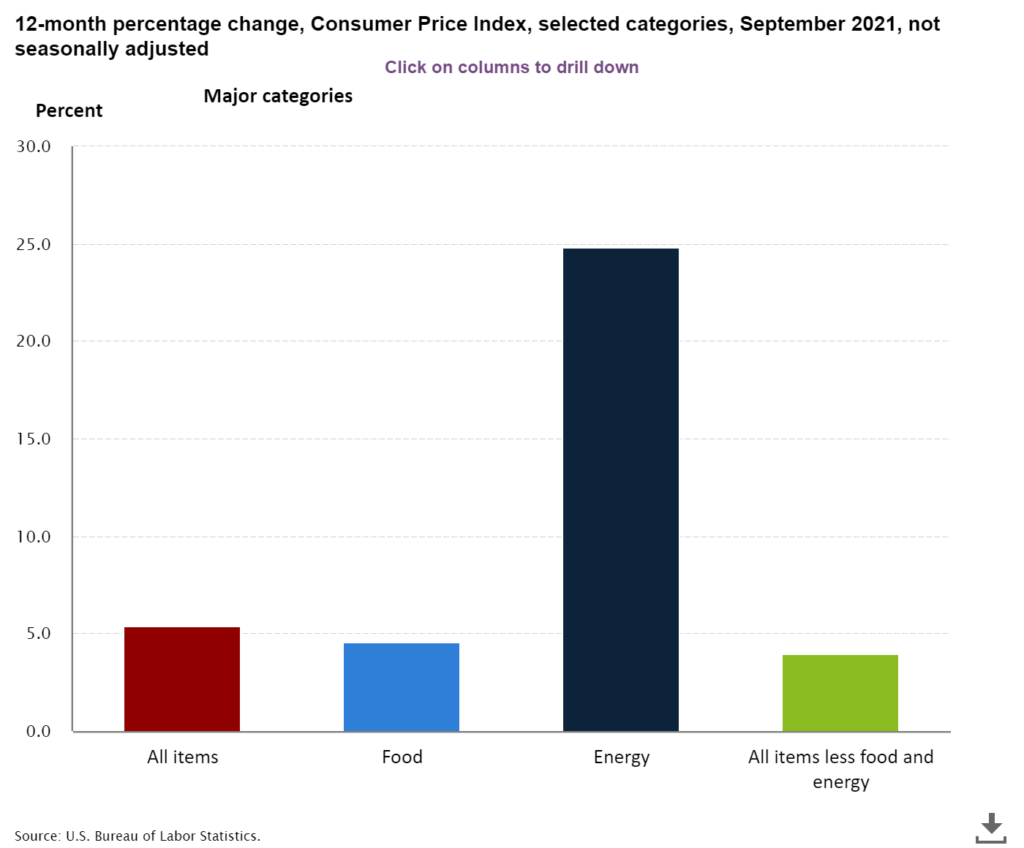

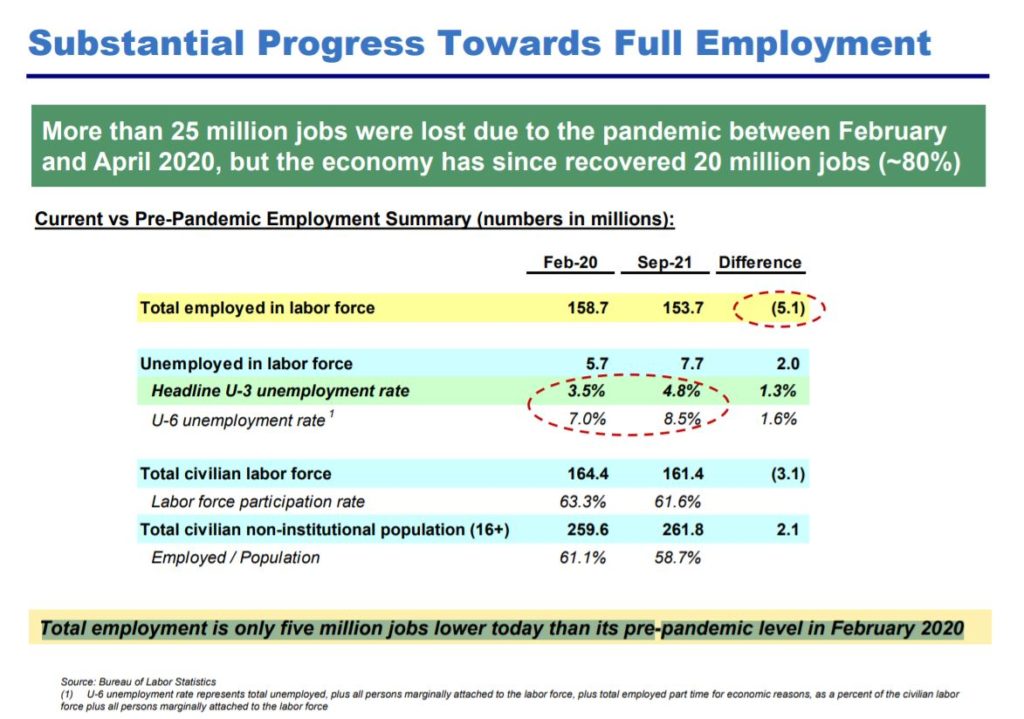

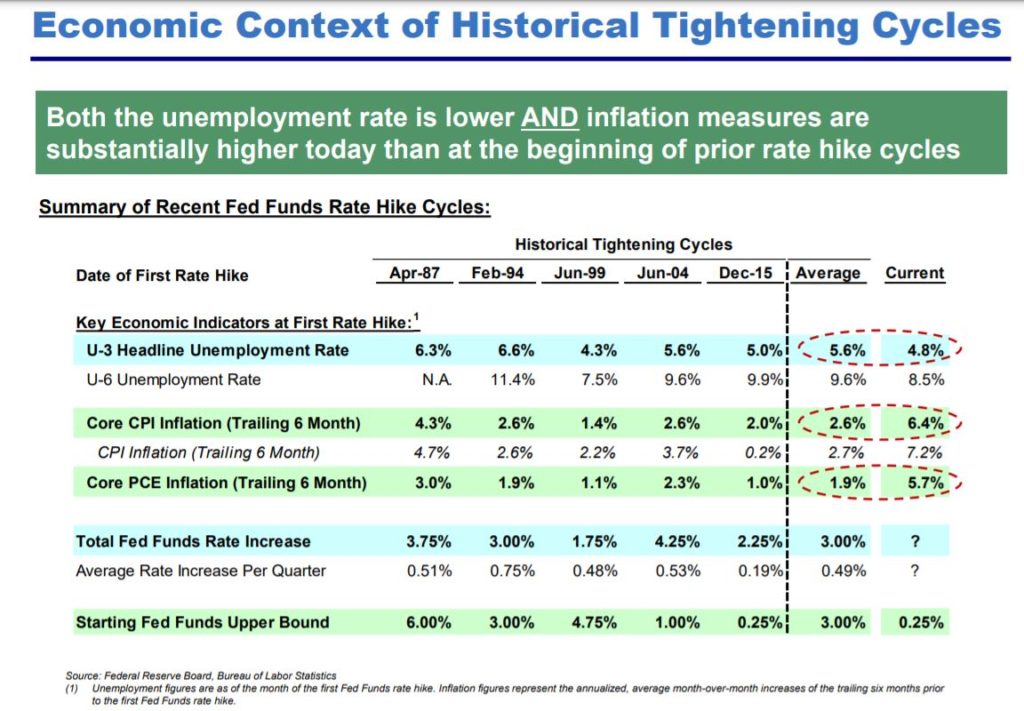

In October 2021 Ackman has spoken of Inflation fears and is urging the fed to raise interest rates “as soon as possible.” On Twitter Ackman stated

“as we have previously disclosed, we have put our money where our mouth is, in hedging our exposure to an upward move in rates, as we believe that a rise in rates could negatively impact our long-only equity portfolio.”

As we have previously disclosed, we have put our money where our mouth is in hedging our exposure to an upward move in rates, as we believe that a rise in rates could negatively impact our long-only equity portfolio.

— Bill Ackman (@BillAckman) October 29, 2021

Ackman even gave a presentation to the New York Fed, urging them to raise rates. Of course Ackman will benefit from the hedges he has in place.

I gave a presentation https://t.co/U9C5OoiDq3 to the Federal Reserve Bank of New York last week to share our views on inflation and Fed policy. The bottom line: we think the Fed should taper immediately and begin raising rates as soon as possible.

— Bill Ackman (@BillAckman) October 29, 2021

Bill Ackman recently revealed in an interview with interactive investor (Oct 25th 2021) he has purchased “Swaptions” worth $100 Million and has made a 3x return already! In addition, Ackman has the potential to turn the bet into “Billions” if interest rates rise substantially, he stated in the interview.

What is a Swap Option (Swaption)?

A swap option, is an option to enter into an interest rate swap (or other type of swap). In exchange for an options premium. The buyer gains the right, but not the obligation to enter into a specified swap agreement with the issuer on a specified future date.

Swaptions are usually used by large financial institutions such as banks, Hedge funds and some large companies to mitigate interest rate risk.

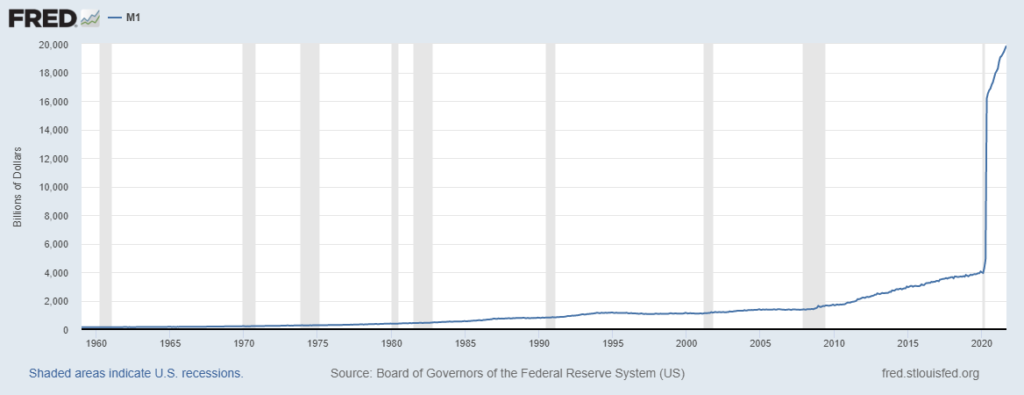

Reasons Ackman believes Interest rates will rise:

- Rising Inflation

- Increased Money Supply

- Close to Full Employment

- Historical Context

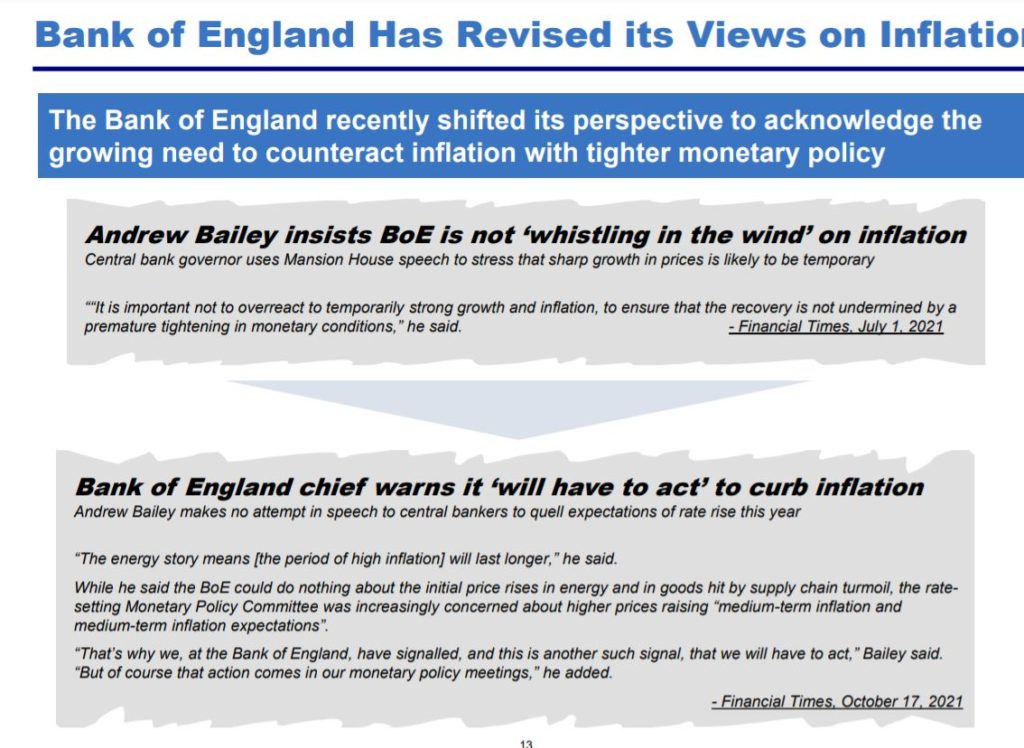

- Bank of England Revised it’s views

I outlined a summary of the presentation here: Bill Ackman Inflation Trade

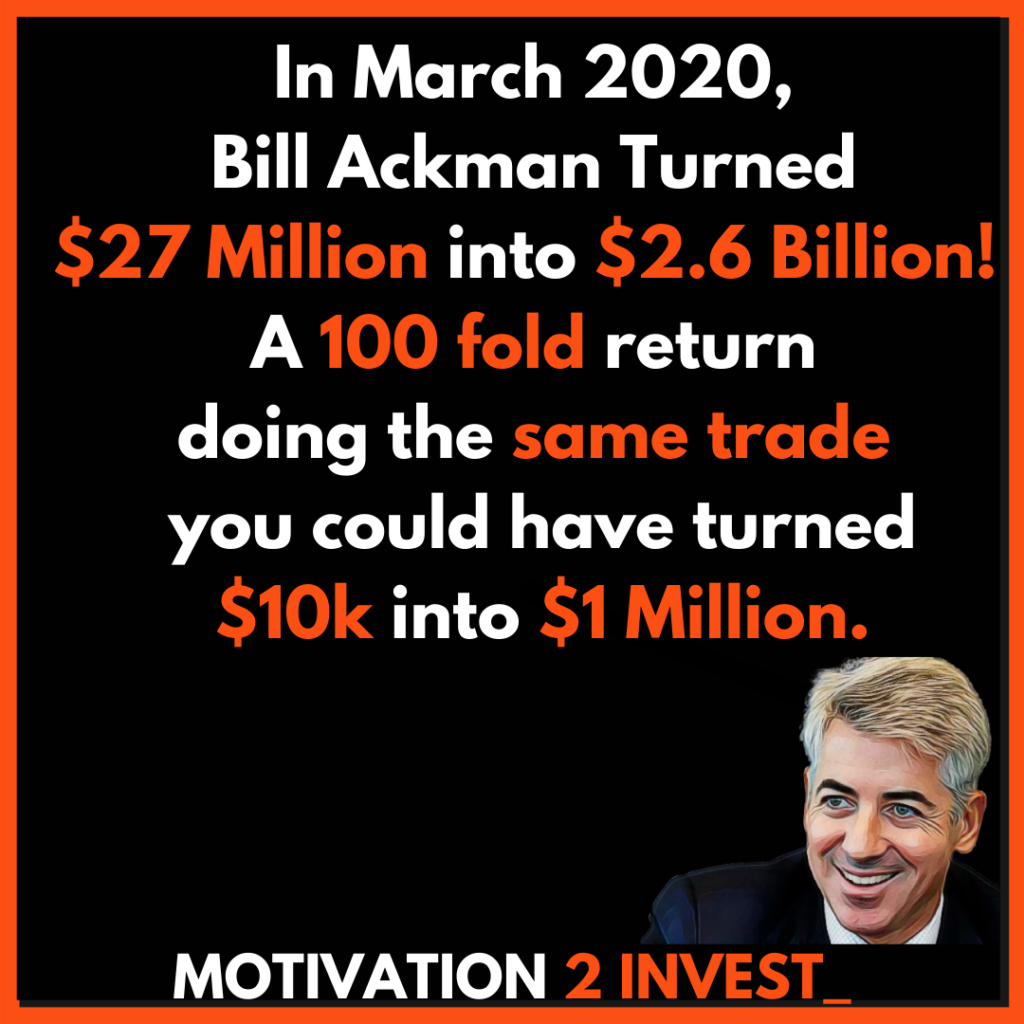

2. Greatest Trade of all Time (2020)

In 2020, Bill Ackman (CEO of Pershing Square Capital) made a major bet against corporate credit in early 2020. He bet that the health crisis in China, would crater the stock market & the economy in the USA.

This allowed him to turn $27 million into $2.6 billion for his investors! This is close to a 9500% return which is unbelievable! If you would have invested just $10k on the same trade, you could have turned that into $1 Million.

How did Bill Ackman do it?

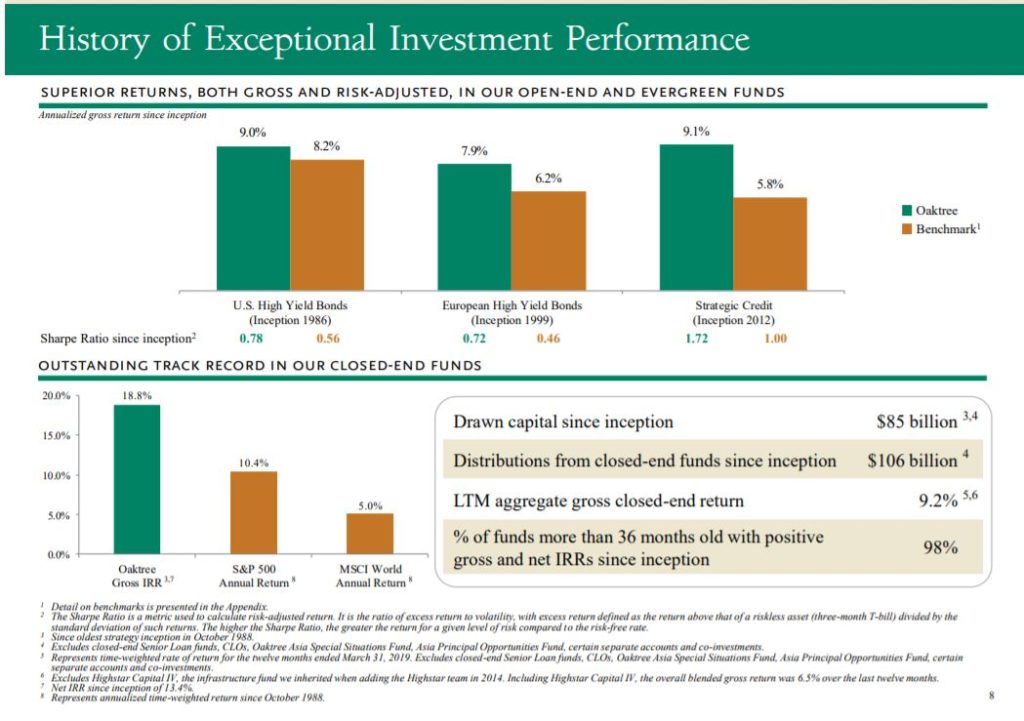

Bill Ackman used credit protection hedges on investment-grade and high-yield bond indexes, to score the incredible profits.

As the odd’s of corporate credit defaults increase, the Pershing Square purchased assets rise in value. As the global pandemic caused the economy to be put on hold, corporate bond ratings tanked.

Pershing Square purchased the investment hedges in February 2020. Ackman noted in his Trade shareholder letter, they purchased “at near-all-time tight levels of credit spreads” so the risk of loss was “minimal at the time of purchase” .

Ackman’s full trade outline is here:

“On March 23rd, we completed the exit of our hedges generating proceeds of $2.6 billion for the Pershing Square funds ($2.1 billion for PSH), compared with premiums paid and commissions totalling $27 million, which offset the mark-to-market losses in our equity portfolio.

Pershing Square was actually up 7.9% when the rest of the market crashed and the investment firm recorded a massive 70% return in 2020.

BEST BILL ACKMAN TRADES Credit: www.Motivation2invest.com/Bill-Ackman-Trades

It was clear Ackman saw slightly further than most during the time:

“we believe that the federal government will soon initiate a total-US shutdown with a defined reopening date about 30 days later. If the federal government does not impose such a lockdown

He goes onto to say additional delays by the government will cost many thousands of lives and cause much greater economic destruction.

Bill Ackman even publicly went onto CNBC and stated “HELL IS COMING”. He goes onto say:

“I haven’t felt like this since the financial Crisis, there is a Tsunami coming and you can feel it in the air”.

Ackman has a strategy of speaking publicly about his investing thesis (after he had his hedges in place for his shareholders of course).

Pershing Square Foundation also invested Capital to help scale testing kits produced by Covaxx.

Trader to Investor:

According to Bill Ackman’s shareholder letter at Pershing Square.

We became increasingly positive on equity and credit markets…and began the process of unwinding our hedges and redeploying our capital in companies we love at bargain prices that are built to withstand this crisis, and which we believe will flourish long term.

Ackman went onto to say that Perishing Square has added to investments in Agilent, Berkshire Hathaway, Hilton, Lowe’s, and Restaurant Brands. In addition to adding to “several new positions”, including Starbucks which they previously sold at high’s in early 2020.

This was truly the greatest trade of all time, minimal risk, maximal reward.

3. Ackman VS MBI | Trade (2002)

Outlined in the popular book “Confidence game”. Bill Ackman had his sights set on (MBI) Municipal Bond Insurance Association Inc.

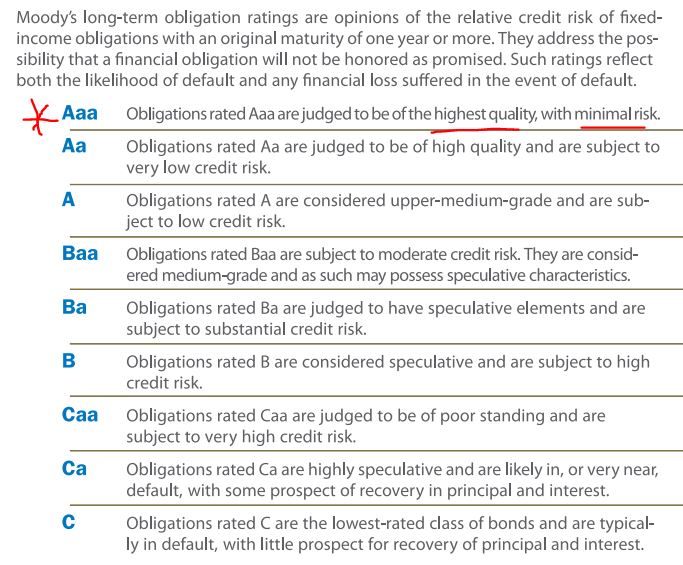

MBI was rated as AAA by Credit agencies, meaning they were the highest quality of credit and extremely unlikely to fail. Bill Ackman questioned this and believed differently. Download Moody’s credit rating chart here.

MOODYS CREDIT RATING SYSTEM. Source: Moody’s credit rating chart here.

Ackman discovered billions of dollars’ worth of credit default swaps (CDS) against mortgage-backed collateral debt obligations (CDOs), that MBIA was as part of.

The idea behind a CDO is that the number of loans bundled together diversifies the risk for investors.

However, this can be taken to extreme levels with various bad loans or “bad Ingredients” bundled together in an Investment grade (highest Rated) instrument.

The wide spread trading of these securities with major unknown default risk was one of the main causes of the sub prime mortgage crisis of 2007.

Download Ackman’s Trading thesis PDF (Free)

Ackman purchased his own credit default swaps against MBIA’s own debt in addition to shorting the company’s stock. He bet that the “safe” insurer would default due to the large exposure to CDO’s .

Bill Ackman Quotes Motivation 2 invest (4)

Ackman had a five year battle MBIA’s management, where they even banned Ackman from their earnings call’s! In addition to trying to intimate the “young guy”.

You’re a young guy, early in your career. You should think long and hard before issuing the report. We are the largest guarantor of New York state and New York City bonds.

In fact, we’re the largest guarantor of municipal debt in the country. Let’s put it this way: We have friends in high places.

– Confidence Game: How a Hedge Fund Manager Called Wall Street’s Bluff, Christine Richard, P. 6, (Wiley, 2010).

However, Ackman’s bold confidence & dogged persistence, paid off as the bond insurer’s shares and debt ratings crashed during the 2008 financial crisis. Ackman made $1.1 billion in gains for Pershing Square, which even offset the “paper losses” from stocks which crashed in 2008.

financial crisis 2008. Collapse of Lehman Brothers

Michael Burry Big Short

Legendary Investor Michael Burry also made a similar bet against these Mortgage backed Securities which was popularised in the movie, the big short. Below Margot Robbie explain’s these mortgage backed securities, a movie clip from the big short.

Are all Mortgage Backed Securities Collateralized Debt Obligations?

Mortgage-backed securities (MBS) and collateralized debt obligations (CDOs) two very similar but technically different financial instruments.

The key difference between the two lies in what these assets are. MBS, as their name implies, are made up of mortgages home loans bought from the banks that issued them.

However, CDOs are much broader: They may contain corporate loans, auto loans, leases, credit card debt and of course mortgages.

4. Bill Ackman VS Carl Ichan | Herbal Life | 2012

How much did Ackman lose on Herbalife?

Bill Ackman Quotes Motivation 2 invest (6)

5. Valeant Pharmaceuticals (2017)

On March 13, 2017, Pershing Square finally threw in the towel and sold its entire position, taking a loss of more than $3 billion!

Ackman stated

“We elected to sell our investment and realize a large tax loss which will enable us to dedicate more time to our other portfolio companies and new investment opportunities,”

Download the Valeant’s Investing Thesis from 2015 here.

Bill Ackman Quotes Motivation 2 invest (5)

6. Taking a Bite of Wendy’s (2004)

Wendy’s (WEN) was one of the first success stories for Ackman, as an Activist investor at Pershing Square.

In 2004, he invested into a large portion of the company (5.4%)(6.2 Million shares) then using his Activist techniques of persuasion he encouraged/pressured management to spin off it’s Tim Hortons business. Shortly after Ackman then later exited at a substantial profit.

However, surprisingly Wendy’s stock did not perform better after the spinoff. Many spoke critically of the move stating that Wendy’s was now in a weaker market . Ackman blamed the poor performance on their new CEO.

Download the Wendy’s Valuation here.

7. Canadian Pacific Railway (2011)

In 2011, Pershing Square took a 14.2% stake in Canadian Pacific Railway. This was a bold activist move by Bill Ackman who battled with the board of directors at Canadian Pacific. In the end Pershing won the battle and forced the change of the CEO & business strategy.

This resulted in a large increase in Canadian Pacific’s stock from just $49 per share to over $220 per share between September 2011 and December 2014, the Financial Post reported.

In 2016, Pershing sold its 6.7% stake which was valued at approximately $1.45 billion. This was a Big Win for Ackman.

Bill Ackman Quotes Motivation2invest.com/Bill-Ackman-Trades

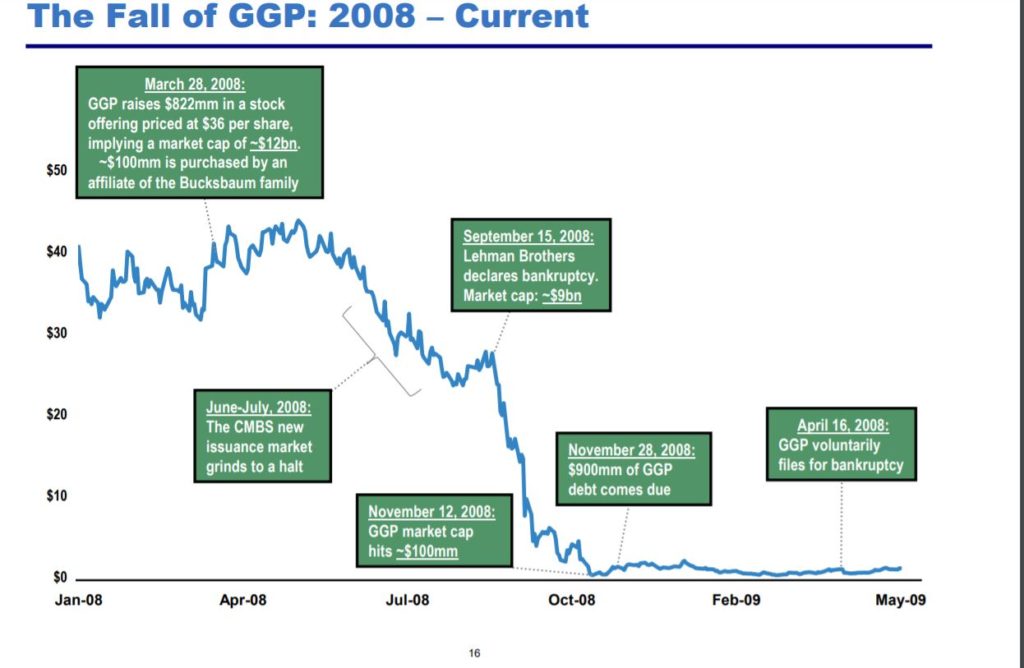

8. General Growth Properties (2009)

Pershing Square bold yet fantastic turnaround of the troubled mall operator General Growth Properties. Ackman took the company from close to bankruptcy to success which netted the hedge fund a incredible $1.6 billion return on a small $60 million investment.

General Growth Value Investing Thesis (1) .

General Growth Properties From Pershing Square Presentation

General Growth Properties Pershing Square GGP stock chart 1. 2009.

9. Borders Group (2006)

Ackman’s Activist Career is fraught with high’s and low’s, here is one of the low point. Pershing Square invested into Borders Group (Bookseller) in 2006 and increased their position in 2008 to (10.5 million shares). Borders had a failed take over attempt of Barnes & Noble Inc.

After which Borders declared Bankruptcy in 2011 and Pershing Square $200 million according to the Wall Street Journal. Ackman reportedly called borders the worst investment he’s ever made.

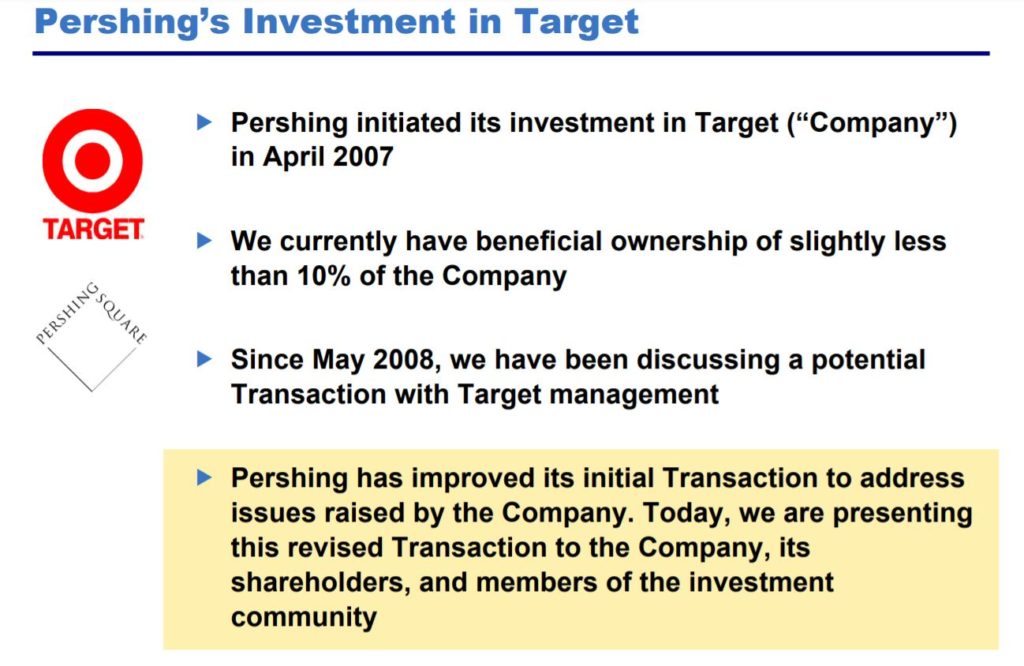

10. Target Corporation (2010)

Activist Ackman attempted to take over five board seats of Target the second-largest discount retailer in the USA. At the end of 2010, Pershing Square had 7.39 million shares of Target but still failed the takeover attempt. Ackman struggled to convince other shareholders which were mostly his Intuitional investment peer’s that he and his selected people were right for the board seats.

Extract from Pershing Square Target investment presentation in 2008.

Final Thoughts

Bill Ackman is a legendary activist investor & billionaire, he is known for making big bets against the consensus & being right (most of the time as data shows).

It is clear from the data of his fund performance (shown earlier) he has beat the market successfully over a number of years. Looking at the performance of his bold public trades it is clear that despite the very public losses (herbal life etc). Ackman has overall achieved much more win’s with net returns of $4.75 Billion for the shareholders of Pershing Square.

From 2020, Ackman made 100x returns on Hedges and announced with many new deals from a public SPAC (Pershing Square Tontine Holdings) to taking a large stake in Universal Music in 2021.

On a personal note, Ackman seems to still have plenty of drive, confidence and just seems to getting into his stride.