Best Investors Quotes Gallery

Investing into the stock market attracts the greatest minds, legendary characters and those hoping to strike it rich! The goal of investing, in words of Warren Buffett is “To lay out cash now with plan to get more back in the future” but this is no easy task.

There are many styles of investing from Value Investing to Growth stock investing & even Macro Economic trading. All methods are utilised with the goal of “beating the market”…which is not easy.

The Stock Market is an auction based system similar to Horse racing a “Pari-mutuel” system. Basically this means you can’t just invest into the “best horse (best company)” because as this information becomes known by the public, the odd’s change.

Thus generally the majority of famous investors look for a “mispricing” in the Stock Market. This is where the Stock Market has got it wrong or potentially overreacted, the volatility can equal an opportunity.

Thus in this post i’m going to reveal the 10 Best Investors to follow, who have BEAT the MARKET!

Which Investors are the best?

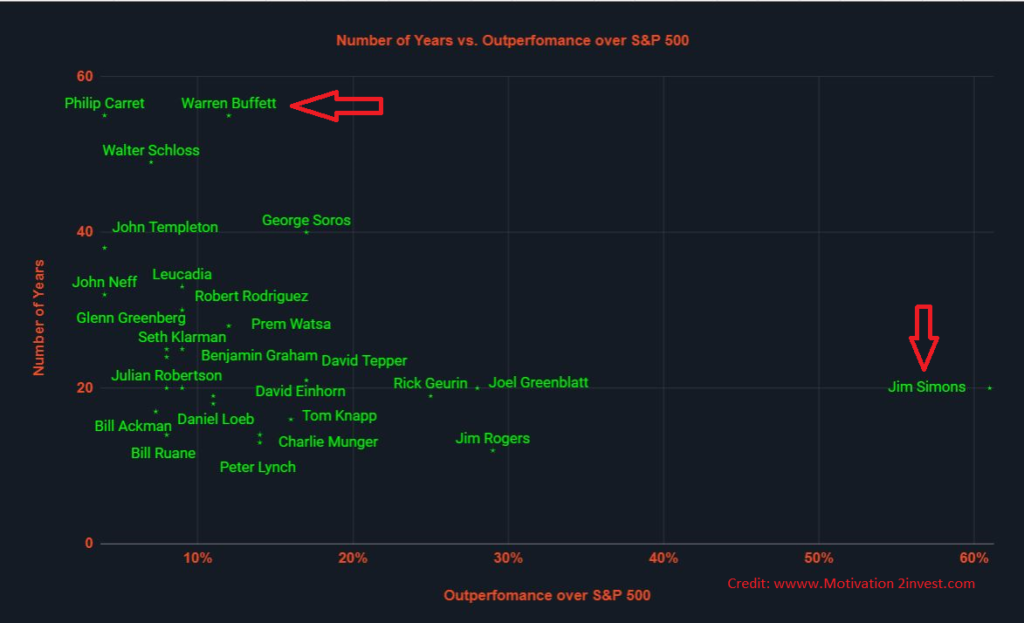

INVESTING LEGENDS GREATEST INVESTORS RETURNS STOCK MARKET JIM SIMONS OUTLIER. Jim Simons (renaissance technologies) Vs Warren Buffett (Berkshire Hathaway) Credit: www.motivation2invest.com/Jim-Simons

Which Investors are the best? From the scatterplot above which plots Outperformance over the market index (S&P 500) on the X Axis and Number Years on the Y Axis.

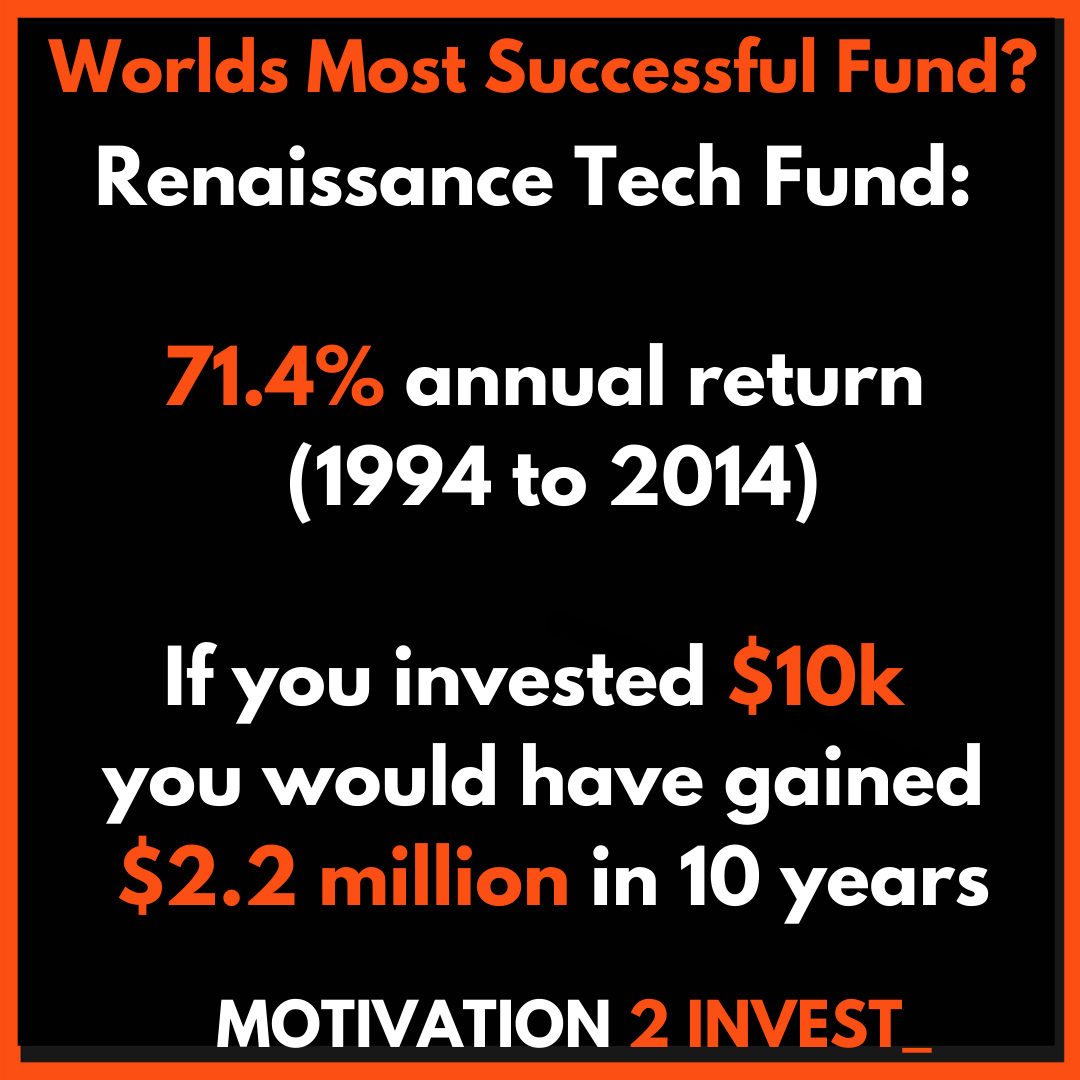

We can see clearly that Jim Simons of Renaissance Technologies is the greatest investor of all time and a true outlier. His Fund has averaged over 60% annual returns (above the Index) for over 20 years!

Warren Buffett is also one of the best investors to follow due to the amount of time he has sustained great investment returns. Buffett has achieved great returns for nearly 60 years which are approximately 12% above the market index.

1. Warren Buffett

Warren Buffett…the man, the myth, the legend is one of the best investors of all time & a wealthy billionaire.

He is the epitome of a classic Value investor. Valuing Companies not stocks, with an extremely disciplined approach to his trades. His strategy focuses on risk minimisation & long term investing gains.

Track Record:

This has paid of substantially with an annualised compounded portfolio return of approximately 20% since 1964, for his investing conglomerate Berkshire Hathaway.

Overall returns from 1964 to 2021 = 2,855% (approximately).

Fun Fact: If you invested $1000 in 1964 into Berkshire, that would be worth an incredible $28,855. Close to a 29X Return!

The Great thing about following Warren Buffett is he tends to do a few focused, low risk and long term investments as opposed to trading daily.

Warren Buffett Quotes Gallery

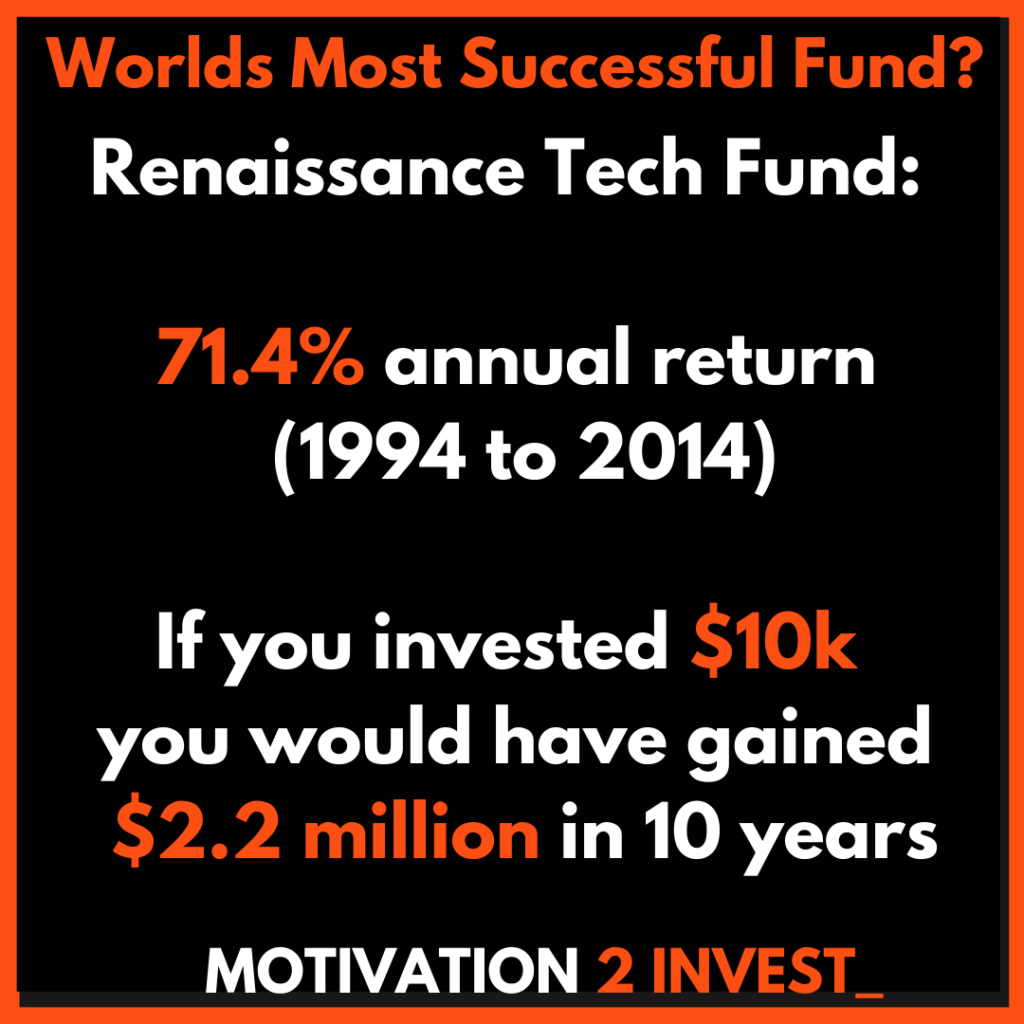

2. Jim Simons

Jim Simons is a Billionaire Hedge Fund Manager & Legendary Mathematician. Simons is the greatest “Quant investor” in the world. He uses quantitative analysis & computer models with complex algorithms to spot inefficiencies in the stock market & trade daily.

Jim Simons is the MOST SUCCESSFUL INVESTOR of all time, with an average annual return of 71.4% before fee’s. This is an incredible return.

Renaissance Technologies winning strategies have been notoriously secret which has led to the nickname “the worlds most secretive hedge fund”, this truly is the smartest money in the market.

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

Can I invest into Renaissance Technologies?

Not exactly, Jim Simons secretive hedge fund is NOT ACCEPTING any new money and is mostly owned by employees such as leading Nobel prize winning scientists.

However, by being a Member of a platform like Invest with Legends you can view the past investments of Renaissance technologies, to access Simons full portfolio & quarterly trades.

Jim Simons Quotes Gallery

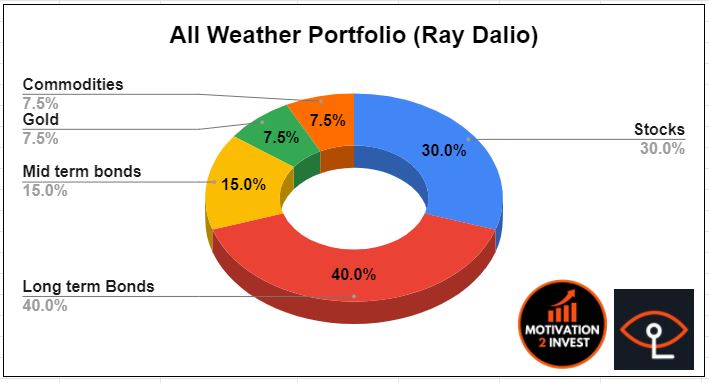

3. Ray Dalio

Ray Dalio is the Billionaire founder of the worlds largest hedge fund, Bridgewater associates.

Dalio got his first taste of investing during the “nifty fifties” this was a major bull market and everyone was talking about stocks.

He overhead many conversations while caddying at a golf club & thus saved up his wages before investing.

He bought his first stock, North East Airlines which immediately increased in price. After which Dalio was hooked on investing & fell in love with the opportunities.

all weather portfolio ray dalio 3D. Credit: www.motivation2invest.com/Ray-Dalio

Ray Dalio’s investing Strategy has a big focus on Investing internationally and diversification across stocks, industries, asset classes etc.

Investing Strategy: Diversified, Value Investor, Emerging Markets, alternative assets, Long Term, International, Economics.

Ray Dalio Quotes Gallery

4. George Soros

George Soros is one of the Best Investors & traders in the world. He has a strategy of making bold Macro economic predictions & currency trades. Soros is most famous for making $1 Billion in a single day when his bet against the British pound paid off!

George Soros Quotes Motivation 2 invest (3). Credit: www.Motivation2invest.com/George-Soros-Quotes

This was nicknamed the “greatest Trade of all time” and he executed this with his former business partner & Trading Legend Stanley Druckenmiller.

Investing Strategy: Forex, Contrarian, Economics, Trader, Top Down

George Soros Quotes Gallery

5. Carl Ichan

Carl Icahn is a legendary activist investor who’s brash & outspoken Strategy of investing has made him a billionaire, with an estimated net worth of $16.7 Billion.

As an activist investor Ichan analyses poorly run companies where he believes a change in management strategy will improve the company & increase shareholder value.

To accomplish this Carl Icahn buys up a vast amount of shares in a company at opportune moments in order to gain voting rights for shareholders. This can even result in a hostile takeover if not approved by the board of directors or stubborn management who may fear for their jobs.

Carl Ichan Quotes motivation 2 invest. Credit: www.Motivation2invest.com/Carl-Ichan-Quotes

Ironically many shareholders welcome Carl Ichan’s presence as an investor as they know he will hold management accountable for their decisions.

Fun Fact: Carl Icahn is known for his public fights with another Legendary Activist Investor Bill Ackman. This occurred during the Herbal Life investment, where both activists took opposing positions & argued very personally on public TV!

Investing Strategy: Activist Investor, Contrarian, Value Investor

Carl Ichan Quotes Gallery

6. Charlie Munger

Charlie Munger is the Billionaire Investing legend and great friend of Warren Buffett, Buffett openly admits to learning a lot from Charlie Munger. Munger has great witt, humour but is also an exceptional value investor.

Munger is credited to have helped Warren Buffett invest into “Wonderful companies at fair prices”, rather than just deep value investments.

Buffett had traditionally done cigar butt strategy investing, where he looked to buy companies trading below net asset value, with “one last puff” in them.

Charlie-Munger-Quote-4-MOTIVATION-2-INVEST-1.png. Credit: www.motivation2invest.com

Charlie Munger Quotes Gallery

7. Cathie Wood

Cathie Wood is the founder & chief investment officer at Ark invest. This is an investment firm which specialises in investing into disruptive innovation.

With a series of active ETF’s focusing on Genomics, Robotics and even space exploration.

She is widely regarded as the biggest Tesla bull and was known for publicly stating what seemed to be outlandish price targets for Tesla of $4000+ , back when Tesla stock was trading at just a couple of hundred dollars.

Cathie Wood Quotes Ark Invest Tesla Credit: www.Motivation2invest.com/Cathie-Wood

Cathie Wood of Ark Invest is a Growth stock investor who invests into companies which offer elements of disruptive innovation. She is not afraid of making bold bet’s against the consensus (Tesla 2019) and thus can be called a contrarian.

Cathie Wood believes Wrights Law (cost declines as a function of production) is a major predictor of future technology success from decreasing costs for EV Batteries to gene sequencing becoming more affordable.

Investing Strategy: Growth Stocks , Technology, Medium Term, Daily Trades, Small Cap, Medium Cap.

Cathie Wood Quotes Gallery

8. Michael “Big Short” Burry

Michael Burry “Big Short” is a legendary contrarian investor, he is most famous for predicting the housing bubble of 2007 and subsequent financial crisis of 2008.

Burry’s Hedge Fund opened a “Big Short” position against the US Housing market, betting that it would fall. This contrarian bet paid off for his investors & was popularised in the Oscar winning movie “the Big Short” where Michael Burry was played by Christian Bale.

More recently Burry has opened major short positions against stocks like Tesla and Cathie Woods Ark Invest. See Michael Burry | What stocks has he been shorting?

Fun Fact: Michael Burry is a qualified medical doctor and also has a glass eye! For more see: 8 Unbelievable Facts about Big Short Michael Burry?

Investing Strategy: Contrarian, Short Seller, Value Investor , Medium Risk.

Michael Burry Quotes Gallery

9. Mohnish Pabrai

Mohnish Pabrai is a legendary deep value investor. His strategy focuses on medium risk , high return bets.

Pabrai is one of the few Legendary investors who invests into volatile small cap stocks which offer greater potential for returns.

These include “10 Bagger stocks” , these are stocks which can earn 10 times your money!

Pabrai is also a contrarian investor who likes to “fish where others aren’t fishing” and bet against the crowd.

He does this by investing into emerging markets and areas which seem to be of higher risk such as India and Turkey.

Mohnish Pabrai Quotes Motivation 2 invest . Credit: www.Motivation2invest.com/Mohnish-Pabrai

In his book, Pabrai calls his investing Strategy the “dhandho” which is derived from Sanskrit word Dhana which means “endeavors that create wealth”.

In Mohnish Pabrai’s own words he looks for “no brainer opportunities for high investment returns.”

Fun Fact: Mohnish is widely influenced by the investment strategy of Warren Buffett and Charlie Munger, whom he is now good friends with after winning an auction for charity meal with Buffett many years ago.

Investing Strategy: Value Investor, Contrarian, Small Cap, Large Cap, Emerging Markets, International.

Mohnish Pabrai Quotes Gallery

10. Bill Ackman

Bill Ackman is a legendary activist investor & billionaire, he is known for making big bets against the consensus & being right (most of the time, data later on)

His strategy was originally influenced by Warren Buffett & he considers himself value investor at heart. However, it’s clear his strategy is much bolder & more fitting to an activist investor with a specialism in credit.

Bill Ackman is known for his dogged persistence, when he believes he is right which can result in major win’s, but also some very public losses.

BEST BILL ACKMAN TRADES Credit: www.Motivation2invest.com/Bill-Ackman-Trades

Between 2004 and 2021, Bill Ackman beat the market with Pershing square producing an annual return of 17.1% vs the S&P 9.8% (2004 to 20201).

However, as noted on the below performance document between 2012 and 2021 the fund has slightly underperformed the S&P 500 Index producing a 13.6% compounded return vs 15.3% for the S&P 500.

BILL ACKMAN PUBLIC TRADE RETURNS BREAKDOWN, (Win/Losses). Credit: www.Motivation2invest.com/Bill-Ackman-Trades

Bill Ackmans Public Trade Returns on above chart:

- More Win’s than losses (6 out of 10 public bets)

- Losses are Smaller than Wins

- Net Returns are positive +$4.75 Billion minusing losses from failed public trades.

Bill Ackman has recently announced a new inflation trade, as he thinks interest rates will rise.