Tom Gayner is a legendary Value investor who is the CEO of Markel Corp, an investment firm with $8.61 Billion of assets under management. He has a net worth of at least $16 million.

Investment Strategy of Tom Gayner

Tom Gayner has an investment strategy of which core philosophy focuses upon Value investing & Special Situations.

A Value Investing strategy involves valuing companies & then buying stocks below their fair value with a Margin of Safety.

In a recent interview, Tom Gayner highlighted four parts of high investment strategy:

- Profitability & Good ROC

- Talent & Integrity in Management

- Great Reinvestment Dynamics

- Buy Price less than value

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

The principles of Value Investing were popularised by Benjamin Graham & carried further by Warren Buffett.

Markel Corp, also has reinsurance business which follows a similar model to Berkshire Hathaway (BRK).

Insurance is a great business for an investor as the outstanding payments or “float” can be invested until payouts are required. This has been one of the major growth engines of Warren Buffett’s Berkshire Hathaway.

Investing Strategy: Value Investor, Special Situations.

Investment Performance

Markel Corp is up 34% over the past year & 86% over the past three years.

Fun Fact: Tom Gayner was a DJ in his youth & loves music and stated it is a “backdrop” for his life.

In a recent interview when asked how to describe the next 10 years of his investment fund in terms of a song. He stated: “The Best is yet to come” Frank Sinatra.

1. Choose your Bets

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

“If there were 50 hands of poker played in an evening maybe i’d only play 5 of them” – Tom Gayner (Legendary Investor)

Warren Buffett often talks about “waiting for the right pitch” when investing and he uses the baseball analogy that there are “no called strikes”.

Thus you can see and watch opportunity after opportunity go by until one is in your “sweet spot”.

Choosing not to invest into a certain opportunity is still a decision.

2. Know the Power of Compounding

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

“If you stumble on something that really compounds value for decades, it can make all the difference” – Tom Gayner (Value Investor)

Look for businesses which have the potential to be Long term compounders.

These are businesses with high returns on capital & can compound over time.

Growth Stock Investor Nick Sleep invested into stocks like Amazon very early and held it through the volatility to produce returns of over 20.8% annually for investors.

3. Try not to be the dumb guy

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

“My Thinking says look i’m not a smart guy But I try really really hard not to be the dumb guy” – Tom Gayner (Legendary Investor)

Warren Buffett often talks about looking for “One foot hurdles” to step over as opposed to trying to jump over 6 foot ones. Buffett is referring to easy “no brainer” opportunities and a simple investment approach.

4. Life is volatile

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

“Things are always getting better or worse and it’s no different this time” – Tom Gayner (Value Investor)

This is very true for both the stock market & life. There is never this theoretical constant state, the only constant is change.

5. Be a Contrarian

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

“Part of being a value investor is being able to lean against the wind & do things that are unpopular” – Tom Gayner (Value Investor).

A common trait of value investors is to have a contrarian streak, this is the ability to bet against the consensus and also be right.

Many legendary investors have this trait from Warren Buffett (Buying banks during the financial crisis) to Sir John Templeton (Investing during WW2!).

6. Be a Long Term Investor

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

“If you limit your buying to things you will be able to own for a long time, you will put more thought into whether to buy them or not” – Tom Gayner (Legendary Investor)

Warren Buffett often talks about having a “Punch card” with just 5 holes, thus imagine you could only make 5 investments or buy 5 stocks in your life.

Most people would think about each decision more deeply. Thus the liquidity of the stock market (how easy it is to buy and sell) encourages negative charged impulse trades.

7. Cash is Trash

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

“Cash is a Pathetic investment & it’s subject to depreciation every day [However] I’m willing to give up return in order to have options cash carriers” – Tom Gayner (Legendary Investor)

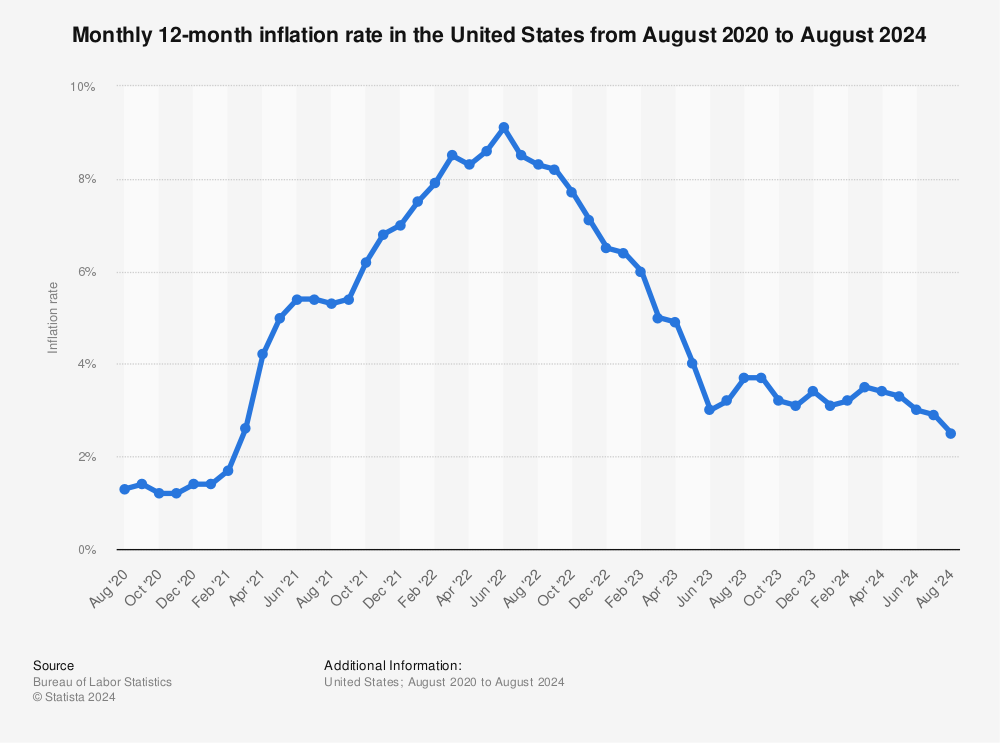

Many investors such as Warren Buffett have been criticised for holding “too much cash” at Berkshire Hathaway which currently has a whopping $139 Billion!

Now although Buffett is aware the value of this cash is depreciating every day due to inflation (which is higher than normal)…Buffett still chooses to keep cash.

This is thought to be as “dry powder” for future buying opportunities should the stock market crash.

8. Practice Empathy

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

“The Idea of Empathy trying to keep the human dimension first, try to think from your customers or colleagues point of view” – Tom Gayner (Value Investor)

Empathy is one of the most powerful tools for connecting with customers, in addition to building & maintaining relationships.

9. Stay Curious

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

“Ask the “And then what” questions have a natural curiosity trying to figure out the next thing and the thing after that” – Tom Gayner (Legendary Investor)

Curiosity is a powerful trait we seem to lose as we get older but this is a shame. Curiosity breeds great questions, which in turn leads to new insights and better investment opportunities.

10. Have an Investing Strategy

Tom Gayner Legendary Investor quotes (8). www.motivation2invest.com/Tom-Gayner-Quotes

I still see so many people investing into the Stock Market without any strategy of what they are doing, this is a shame.

If you want to learn a great fundamental investing method check out our:

Investing strategy Course

We also have our Stock Research Platform for those who want to know which stocks we are buying & our valuations.

Our platform is open for a limited time each month so be sure to click the links above to find out more.

Tom Gayner Quotes Gallery