Cathie Wood is the founder & chief investment officer at Ark invest. This is an investment firm which specialises in investing into disruptive innovation.

With a series of active ETF’s focusing on Genomics, Robotics and even space exploration.

She is widely regarded as the biggest Tesla bull and was known for publicly stating what seemed to be outlandish price targets for Tesla of $4000+ , back when Tesla stock was trading at just a couple of hundred dollars.

Cathie Wood Quotes Ark Invest Tesla

Credit: www.Motivation2invest.com/Cathie-Wood

In one CNBC interview in Early 2020 before Tesla stocks monstrous bull run of over 800%, Cathie wood stated many times “Tesla is ready for prime time” much to the look of amusement from CNBC’s commentators.

Cathie Wood had the last laugh with her active ETF’s returning over 100% in 2020.

Cathie Wood Quotes Ark Invest Credit: www.Motivation2invest.com/Cathie-Wood

In 2021 her ETF’s have had a rocky start thanks to rising interest rates which have impacted growth stocks more than others in the industry. Only time will tell if Cathie Wood can regain her crown as the queen of investing.

What is Cathie Wood’s Investing Strategy?

Cathie Wood of Ark Invest is a Growth stock investor who invests into companies which offer elements of disruptive innovation. She is not afraid of making bold bet’s against the consensus (Tesla 2019) and thus can be called a contrarian.

Cathie Wood believes Wrights Law (cost declines as a function of production) is a major predictor of future technology success from decreasing costs for EV Batteries to gene sequencing becoming more affordable.

Fun Fact: Some people refer to Cathie Wood as “Katie Wood” assuming Katie is short for Catherine. But Cathie tends to not use that name.

Investing Strategy: Growth Stocks , Technology, Medium Term, Daily Trades, Small Cap, Medium Cap.

1. My Highest Conviction stocks are…

Cathie Wood Quotes Ark Invest Tesla

Credit: www.Motivation2invest.com/Cathie-Wood

“My Highest conviction stocks are Tesla, Square & Palantir”. Tesla is no surprise, but Square & Palantir are also great growth stocks with lots of potential. I previously covered stocks such as Square & Palantir on my channel Motivation2invest, full valuation models with buy points can be found here.

2. Tesla Price Target for 2025 is $4000

Cathie Wood Quotes Ark Invest Tesla

Credit: www.Motivation2invest.com/Cathie-Wood

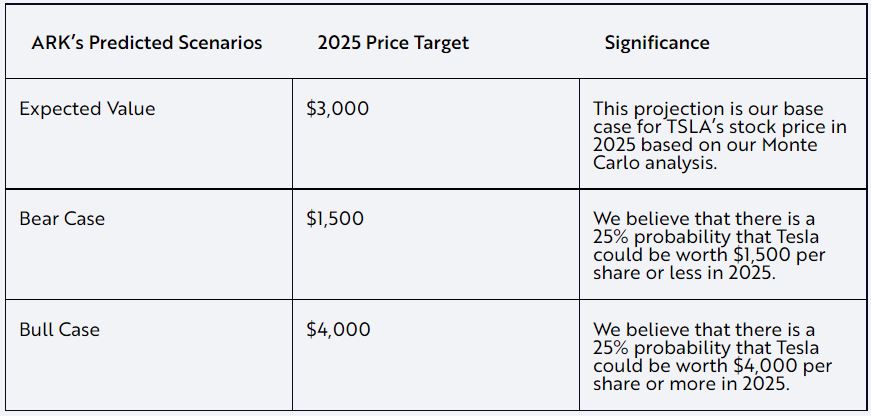

Cathie Wood Stated her bullish price target for Tesla stock is $4000 by 2025.

Ark invest Tesla Price target. Source: https://ark-invest.com/articles/analyst-research/tesla-price-target-2/

3. Wrights Law

Cathie Wood Quotes Ark Invest Motivation 2 invest (11)Credit: www.Motivation2invest.com/Cathie-Wood

“Wrights Law forecasts cost declines in EV’s, Robotics and genomics.”

What is Wrights Law?

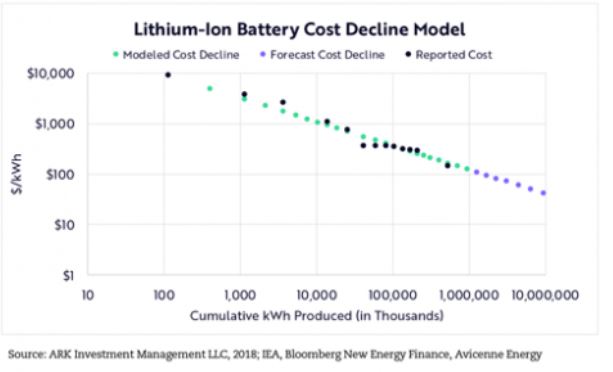

Developed by Theodore Wright in 1936, Wright’s Law is a framework for forecasting cost declines as a function of cumulative production.

It states that “for every cumulative doubling of units produced, costs will fall by a constant percentage.”

This is a very similar concept the economics of scale and that mass production & technology innovation results in cost declines. This has been true for Batteries, Solar Panels, Genomic sequencing and more.

Ark Invest even found “A price forecast based on Wright’s Law was 40% more accurate than one based on Moore’s Law.” (From the decade to 2015.

Battery cost decline wrights law. Credit: https://ark-invest.com/wrights-law/

4. “Robot Grocery Delivery could cost just 40 cent per trip”

Cathie Wood Quotes Ark Invest Tesla

Credit: www.Motivation2invest.com/Cathie-Wood

Following on from the previously mentioned Wrights Law, “cost declines as production increases”. Cathie Wood has also forecasted similar cost declines with robot grocery delivery.

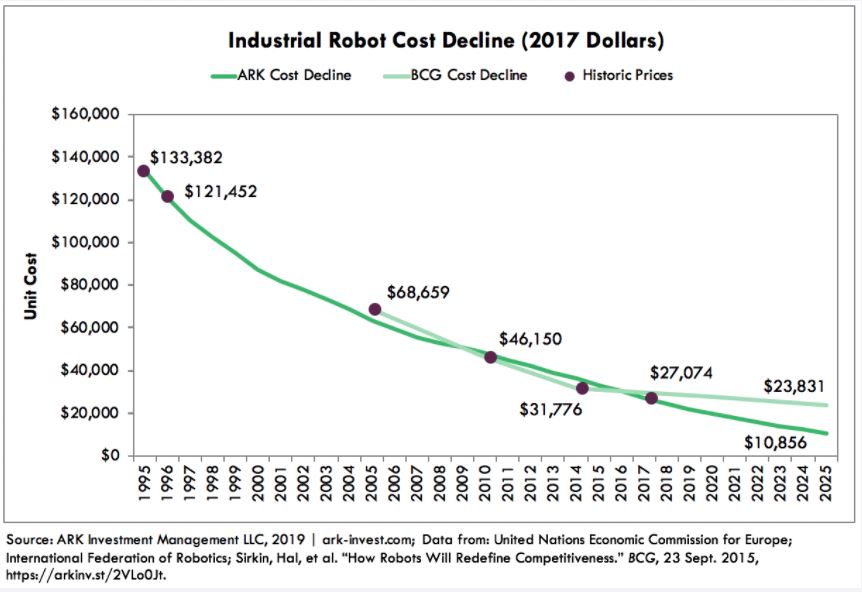

Ark Invest also wrote a report on Industrial robot cost declines which they state will create a tipping point in demand.

Industrial Robot Cost Decline Ark Invest. Source: https://ark-invest.com/articles/analyst-research/industrial-robot-cost-declines/

ARK Invest expects industrial robots will cost less than $11,000 per unit, this is less than Boston Consulting Group’s (BCG’s) expectation of roughly $24,000, by 2025

5. “Genomic Sequencing costs are dropping 40% per year”

Cathie Wood Quotes Ark Invest Motivation 2 invest (9)

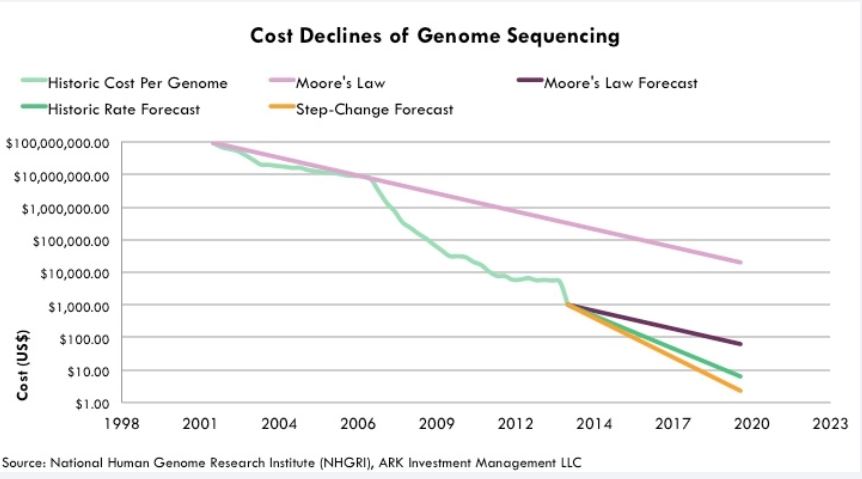

Following on from the previously mentioned Wrights Law, “cost declines as production increases”. Cathie Wood has also forecasted similar cost declines with Genome Sequencing following on from previous declines.

Ark Invest stated:

“DNA sequencing is following a cost curve decline that is steeper than microprocessors enjoyed during the past 40 to 50 years”.

“Since 2001 the cost to sequence one whole human genome has dropped from $100 million to $1,000, or more than 50% per year, an decline unrivalled by any other general purpose technology platform in history.”

cost declines of DNA Sequencing. Ark Invest. Source: https://ark-invest.com/articles/analyst-research/illumina/

Although inspiring, Ironically Ark invest sold of it’s very bullish Illumina stock (a leading company in the genomics industry) as they weren’t keeping up with the cost declines necessary. However, there are many other players in this arena.

6. “Tesla is a leader in Batteries, Robotics…”

Cathie Wood Quotes Ark Invest Motivation 2 invest (14)

“Tesla is a leader in Batteries, Robotics, Solar & Autonomous vehicles”. Tesla is not only an Electric Vehicle company but a technology company which has entered many industries aggressively.

Wall Street Analysts tore down 7 competing Batteries and they found Tesla’s to the be the lowest cost with highest energy density.

According to UBS:

“Tesla will likely remain the cost and technology benchmark for several more years, and Volkswagen is the fastest follower on a global scale. Its €33bn committed EV investments of over a 5-year period are still unmatched.”

In terms of Robotics, Tesla shocked the world when they announced to be working on a Humanoid style Robot. A figure came out which many thought was a prototype…before the dancing started. Watch the supercut of the video below.

Tesla Robot Revealed | TESLA AI DAY 2021 | 6 Minute Supercut Analysis

7. Autonomous Taxi’s will revolutionise the auto industry

Cathie Wood Quotes Ark Invest Tesla

Credit: www.Motivation2invest.com/Cathie-Wood

“Autonomous Taxi’s will revolutionise the auto industry” this area could really be a game changer and although Tesla hasn’t fully mastered the technology yet the potential is huge.

Tesla vehicles are capturing a vast amount of data daily, all this feeds into their Artificial intelligence & neural net’s system.

Thus once the accuracy of their system is close to perfect they can do an over the air software update to vehicles which will make their entire fleet self driving at scale. No other company has this ability to scale right now.

However, in terms of pure technology googles Waymo technology is actually fully functional as a self driving vehicle in Arizona right now! They use LIDAR which Elon Musk rejected as “too expensive” will he regret this.

More details on this video below, Top 3 Self Driving Car Stocks:

8. Bitcoin is the reserve currency of the digital ecosystem

Cathie Wood Quotes Ark Invest Motivation 2 invest (1) Credit:

Cathie Wood called Bitcoin the Reserve currency of the digital ecosystem and said investors see it as a “flight to safety” . Similar to the way the US dollar is the reserve currency of the world and gold can often be considered a hedge.

9. “Bitcoin Will reach $500k in 10 years”

Cathie Wood Quotes Ark Invest Motivation 2 invest (1) Credit: www.Motivation2invest.com/Cathie-Wood

Correction from the quote above, in more bullish estimates such as at the SALT Conference 2021, Cathie Believes “Bitcoin will to soar to $500,000 in five years time”.

This is an incredibly high price target and is effectively a 10x from it’s current price of around $50,000. Cathie Wood believes this is driven by conservative estimates of supply and demand, Wood stated:

“If we’re right and companies continue to diversify their cash into something like Bitcoin, and institutional investors start allocating 5% of their funds in Bitcoin […] we believe the price will be ten-fold what it is today. Instead of $45,000, over $500,000.”

10. “Only 4 Cryptocurrencies will survive the next crash”

Cathie Wood Quotes Ark Invest Motivation 2 invest (1) Credit:

This quote was from a conference a few years back when Cathie Wood stated only 4 cryptocurrencies will survive the next crash, Bitcoin, Ethereum etc. She also stated “most of the 2000+ crypto assets today will be worthless”

11. “The next FANG stocks are…”

Cathie Wood Quotes Ark Invest Motivation 2 invest (10)

For those of you who don’t know, the “FANG” or “FAANG” stocks are Wall Street nicknames for the best performing tech giants of our decade. These include: Facebook, Amazon, Apple, Netflix, Google.

However, Cathie Wood believes the next “FANG stocks are being birthed in the genomic revolution”. This is thanks to cost declines in gene sequencing mentioned previously driven by Wrights law.

12. “Flying Taxi’s are coming in 5 years”

Cathie Wood Quotes Ark Invest Motivation 2 invest (18)Credit: www.Motivation2invest.com/Cathie-Wood

“We wanted flying cars, instead we got 140 characters,” said Peter Thiel in 2013. However, according to a research report by Ark Invest, EVTOL (Electric Vertical Take-Off, Landing) vehicles could be with us soon. Many startups are working on this concept and have bullish projections to roll out vehicles by 2025. These include:

- Joby Aviation (JOBY) – Wen’t public as a SPAC backed by LinkedIn founder Reid Hoffman, now owns UBER Elevate.

- Archer (ACIC) – Already received a $1 Billion order from united airlines.

The excitement behind these companies is driven by Wrights Law again, Battery cost declines and the speed of travel.

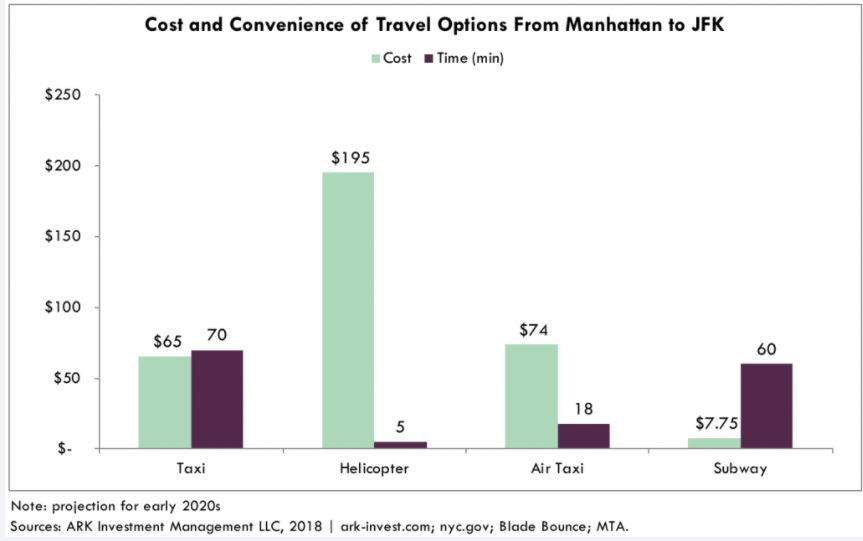

EVTOL Travel costs compared to alternatives. Source: https://ark-invest.com/articles/analyst-research/air-taxis/

From the above chart we can see a flying Taxi would be only slightly more expensive than a normal taxi but much faster (& cooler!)

13. Investing for Growth

Cathie Wood Quotes Ark Invest Motivation 2 invest (7)Credit: www.Motivation2invest.com/Cathie-Wood

“We want our companies to invest aggressively, we don’t want our profits now”. Companies which invest into innovation and take strategic bets long term tend to product greater returns for investors.

The most notable is Amazon which has a culture of “experimentation” and taking “lots of small bets”. Legendary investor Nick Sleep held onto this stock for many years & was rewarded with fantastic returns.

14. “The Strongest Bull Markets are built on walls of worry”

From the Financial Crisis in 2008 to the 2020 crash, “walls of worry” do often lead to the strongest bull markets.

15. Square Stock, fintech growth

Cathie Wood Quotes Ark Invest Motivation 2 invest (8)Credit: www.Motivation2invest.com/Cathie-Wood

Square is a fantastic company founded by the Legendary Jack Dorsey (who is also the co founder of Twitter).

Square started by selling innovative devices which allowed small businesses to accept payments through their phone. However, they have now expanded to other areas including Cryptocurrency and their popular cash app.

I previously analysed square stock & completed an advanced valuation model before the stock ran up huge. Full Disclosure I did invest after the video and so did many members of our VIP community, You download my advanced valuation models & access our group by clicking the link here