Charles “Chuck” Akre is the founder of Akre Capital Management which $17.5 Billion.

Akre Capital’s, Akre Focus Fund managed to outperform the S&P 500 Index by 3.5% between its inception in 2009 and 2020.

As per the latest 13F filing, Akre owned 28 stocks spread mainly across many Industries to Consumer Discretionary, Financials, and Technology sectors.

Investing Strategy: Qualitative, Value Investing.

1. Three Legged Strategies

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

Chuck Akre has an intriguing investment strategy which focuses on the three legs of stool concept.

- An extraordinary business model

- Exceptional people

- Abundant reinvestment opportunities

This highlighted his preference to not overlook the qualitative side of investing & shows investing is not just a game for number crunchers.

2. Every Day is a Learning Day

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“Every Day is a learning day” – Chuck Akre (Legendary Investor). Many great investors believe in being a continuous learning Machine.

3. Choose your Dance

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“We’re not smart enough to dance with all the dances” – Chuck Akre (Legendary Investor).

Choosing your investment strategy and sticking with it though various stock market cycles is the key to success. If you try to “Dance all the dances” then often you will end up dancing many dances badly.

For example, switching between momentum trading & value investing would be difficult.

4. Reading

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“I spend alot of time reading, that’s how idea’s bubble up in universe” – Chuck Akre (Legendary Investor). Many Legendary investors love to read regularly from Warren Buffett who reads over 6 hours per day to Charlie Munger.

5. Business is Volatile

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“Wall Street has created this business of transactions, they setup false expectation with their “beat by a penny missed by penny syndrome” – Chuck Akre (Legendary Investor).

Earnings releases causes expectations to be set by wall street & the company which don’t always materialise, this causes stocks to crash and analysts “vote with their feet” .

Companies which have had volatile earnings in the past such as Amazon and Tesla have been the great investment opportunities, Nick Sleep is an investor which held Amazon stock through much volatility.

6. Set Boundaries

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“Our Experience is once a guy sticks his hand in your pocket, he’s likely to do it again” – Chuck Akre

7. Every Basis point matters

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“Every basis point of returns has a staggering difference on outcomes in the long term” – Chuck Akre.

An eye on trading expenses and minor basis point changes can be the difference between huge and minor returns long term. This is the power of compound interest.

8. Wait for Opportunities

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“People say the market is overvalued, but you will always find times when most names are undervalued, that’s what we’re waiting for” – Chuck Akre (Legendary Investor).

Warren Buffett often talks about “waiting for the right pitch” . When stocks crash, they are cheaper and that can usually be a potential opportunity. In the mean time when the general market is “overvalued”, there is always individual stock investment opportunities to be found.

9. Keep Learning

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“Every day i’m lucky if I learn something new and i’m double lucky if it didn’t cost too much” – Chuck Akre . Being a continuous learning machine is a common success trait. There are plenty of ways to learn for free such as our Youtube Channel.

10. Think Long Term

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“If your selling because of a missed earnings report you’ve stopped looking at the rate of return a company can achieve over time” – Chuck Akre (Legendary Investor).

Bad Earnings reports can cause many investors to “vote with their feet” but for a long term investor these can be buying opportunities. All companies will go through tough times and there is not a straight path to success.

11. Understand Pricing Power

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

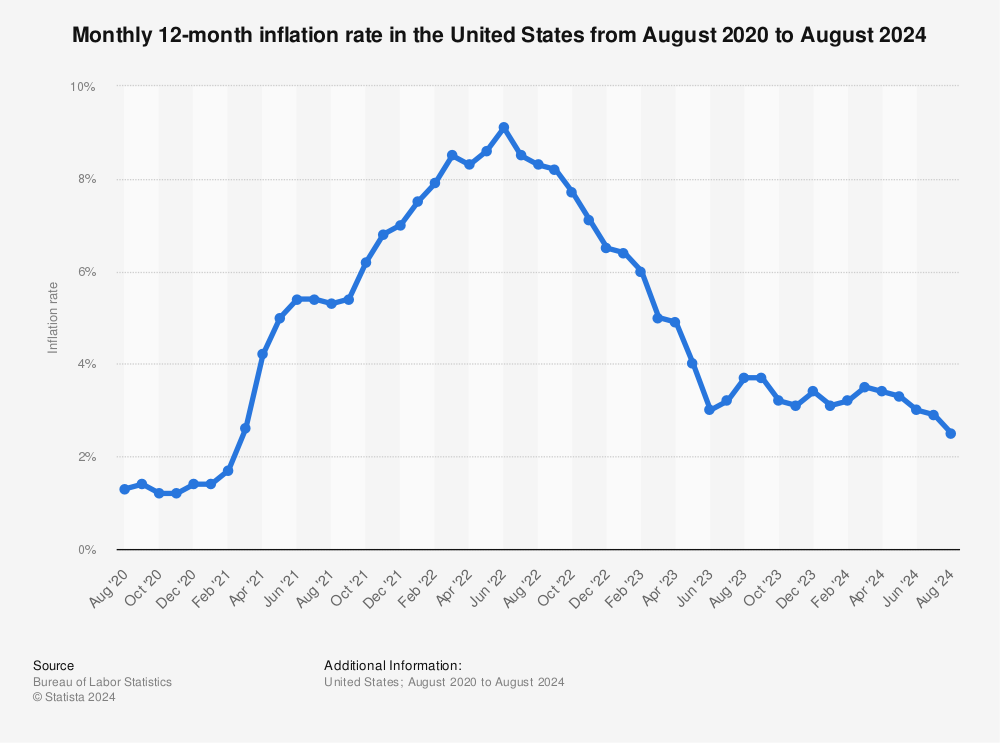

“Look to understand pricing power, that is key” – Chuck Akre (Legendary Investor). Recently many fears of rising inflation have been hitting the Economy. During these times you want to be invested into companies with “pricing power” this means the company can raise their prices as their costs increase. Examples include, Apple (brand pricing power) can charge more than competitors.

Bill Ackman is currently betting on rising inflation and has a trade setup in which he will profit huge from rising interest rates.

Source: Statista

12. Follow Your Passion

Chuck Akre Quotes m (9). Credit: www.motivation2invest.com/Chuck-Akre

“Follow Your Passion & Read like Crazy” – Chuck Akre .

Many Great Investors have a real passion for investing and continuing to learn more each day.

In our Investing VIP Group we have plenty of likeminded people with these similar traits and a desire to learn what it takes to be a great investor.

If you want to learn how to be a great investor, join our Investing Strategy Course or Stock Research Platform. We open the community to a limited number of people each month so click the links above to find out more.