Baillie Gifford is a UK based Investment firm which specialises in investing into founder led growth companies. The firm is an exceptional growth stock picker and were early shareholders in many stocks such as Amazon, Tesla and Alibaba.

Investment Strategy:

James Anderson’s investment strategy focuses heavily on companies growing their revenues very fast, even if profitability is hindered in the short term.

In addition the firm likes to invest into companies which are “Founder Led” where their founders have “skin in the game” a substantial number of shares in the company.

This ensures great investment decisions are made with the benefit of shareholders in mind. Examples of these exceptional founders include: Jeff Bezos (Amazon), Elon Musk (Tesla) , Jack Ma (Alibaba) and many more!

Baillie Gifford Fund James Anderson Investor. Credit: www.Motivation2invest.com/Baillie-Gifford

Investment Strategy: Growth stocks, Qualitative, Long term.

Baillie Gifford’s investment strategy focuses upon disruptive innovation very similar to Cathie Wood’s Ark Invest.

Exceptional Returns:

Baillie Gifford’s flagship fund the FTSE 100 listed Scottish mortgage investment trust (SMT) , (Very boring name) has previously achieved some outstanding & exciting results. In the past 20 years, the fund has delivered investors over 1,700% in returns!  Baillie Gifford Fund performance. Source: Baillie Gifford

Baillie Gifford Fund performance. Source: Baillie Gifford

James Anderson Retirement:

James Anderson was the prime investment manager at Baillie Gifford has recently retired in 2021. After some outstanding returns on stocks like Tesla stock which was the largest position in the fund making up approximately 10% of the portfolio for SMT.

Baillie Gifford Fund James Anderson Investor. Credit: www.Motivation2invest.com/Baillie-Gifford

Top 8 Investing Quotes

1. Invest Long Term

Baillie Gifford Fund James Anderson Investor. Credit: www.Motivation2invest.com/Baillie-Gifford

“In the Long Run, the value of stocks is the Long run free cash flows, but we have the barest clues what these will be” – James Anderson (Baillie Gifford).

Investing for the Long Term requires immense vision, faith and great projections. As the value of a company is the future cash flows discounted back to today. A bet on the future is a bet on uncertainty.

2. Embrace Uncertainty

Baillie Gifford Fund Performance Scottish Mortgage Investment Trust. Credit: www.motivation2invest.com/Baillie-Gifford

“We should respect & endure uncertainty to identify where extreme upside might occur & observe patiently” – James Anderson (Baillie Gifford).

Uncertainty is apart of the future, embrace the volatility both in terms of downside & upside opportunities. As the Great Investor Howard Marks states, “It’s hard to know where we are going, but we should know where we are”.

3. Test Your Beliefs

Baillie Gifford Fund James Anderson Investor. Credit: www.Motivation2invest.com/Baillie-Gifford

“It is critically important to test all our beliefs. This applies more strongly to our general contentions than our individual stock decisions.”

In life living by our beliefs is important, but we should also test them as they may be no longer valid. Thus when the facts change so should you opinion.

For example, Billionaire investor Howard Marks was previously sceptical on Cryptocurrency before seeing some Merit as a potential inflation hedge.

4. Listen to Experts

Baillie Gifford Fund James Anderson Investor. Credit: www.Motivation2invest.com/Baillie-Gifford

“Most investors don’t listen to experts, they listen to the media fearmongering” – James Anderson (Growth Investor).

Baillie Gifford has a strategy of looking at the facts & listening to real technical experts. This is may sound like common sense but is actually revolutionary in the Hedge Fund industry.

This doesn’t mean “experts” like the sound bites you see on CNBC, which generally promotes fear like most of the Media. This means research papers in technical areas.

5. Invest into the Future

Baillie Gifford Fund James Anderson Investor. Credit: www.Motivation2invest.com/Baillie-Gifford

Baillie Gifford bought Tesla stock at Just $6 Per share, it then surpassed $600 in 2020 (Split adjusted) and at the time of writing has surpassed $1000, giving Tesla a Market Cap of over $1 Trillion.

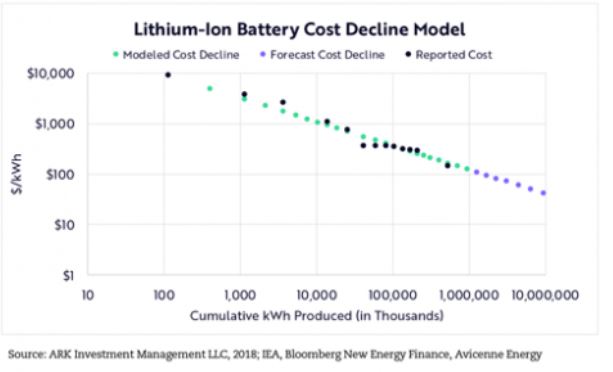

James Anderson & Baillie Gifford studied academic research papers which noted the decline in Battery prices & increases in performance.

These technology improvement traits are common in many Industries from Semiconductor chips in the late 90’s (Moore’s law) to Solar Panel cost declines etc. Ark Invest focuses on Wrights Law which predicts cost declines in many technologies as the quantity produced scales.

Battery cost decline wrights law. Credit: https://ark-invest.com/wrights-law/

6. Understand Change

Baillie Gifford Fund James Anderson Investor. Credit: www.Motivation2invest.com/Baillie-Gifford

“The Secret to Successful Investing is understanding change, how it happens, how much it happens & it’s implications” – James Anderson (Growth Investor).

Change equals opportunity, this could be a change in Consumer Habits, a Change in technology, costs etc. Many of these “Changes” occurred during 2020, which results in many exceptional investment opportunities. We covered plenty in our Stock Research Group.

7. Corporate Extinction

Baillie Gifford Fund James Anderson Investor. Credit: www.Motivation2invest.com/Baillie-Gifford

“A great corporate extinction is coming, 69 of the top 100 companies won’t survive because of revolutions in Energy, AI & Technology” – James Anderson (Growth Stock Investor).

Many new tech companies are disrupting legacy industries, Anderson says a “Great Corporate Extinction” is coming which is a bold claim.

- Amazon Disrupted the commerce Industry

- Uber Disrupted the Taxi Business

- Youtube Disrupted Television

- Square is Disrupting the payment industry

- Tesla is disrupting the Auto Industry

8. Be Eccentric

Baillie Gifford Fund James Anderson Investor. Credit: www.Motivation2invest.com/Baillie-Gifford

“We need to remain Eccentric & become more prepared to be radical” – James Anderson (Growth stock investor) Baillie Gifford has an Eccentric investing style of buying into innovative technology companies early.

James Anderson has urged the firm not to become complacent and still be more radical moving forward.