Jim Simons is a Billionaire Hedge Fund Manager & Legendary Mathematician. Simons is the greatest “Quant investor” in the world. He uses quantitative analysis & computer models with complex algorithms to spot inefficiencies in the stock market & trade daily.

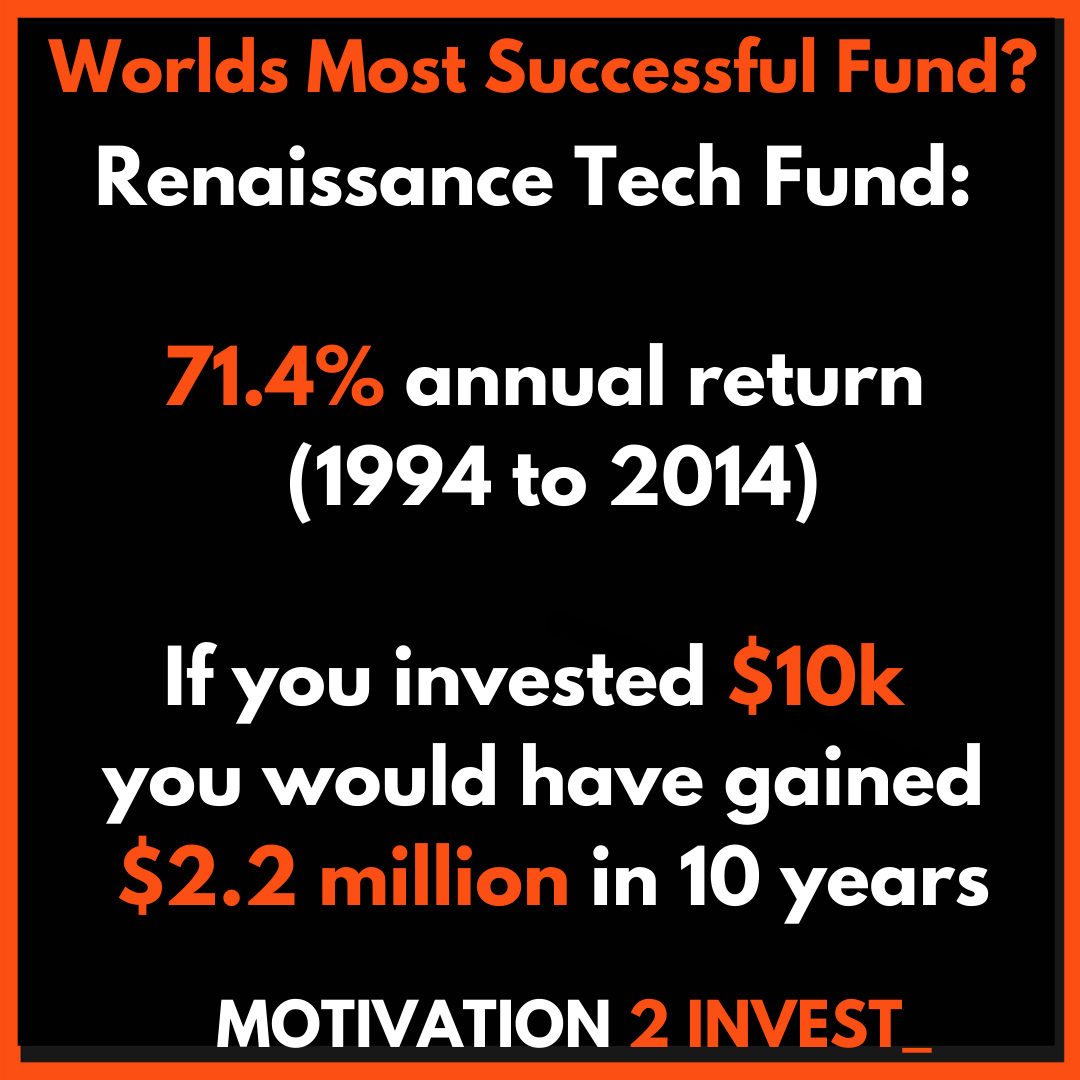

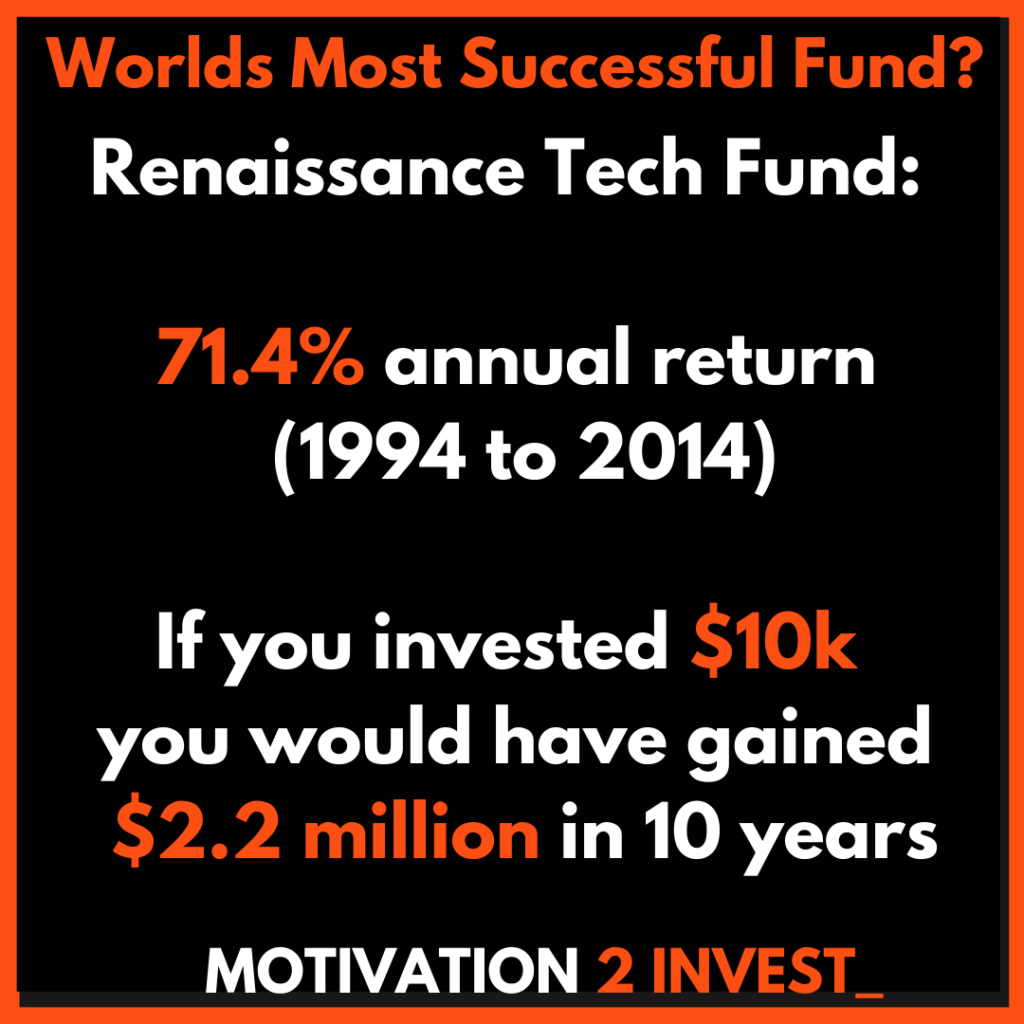

Jim Simons is the MOST SUCCESSFUL INVESTOR of all time, with an average annual return of 71.4% before fee’s. This is an incredible return.

Renaissance Technologies winning strategies have been notoriously secret which has led to the nickname “the worlds most secretive hedge fund”, this truly is the smartest money in the market.

Who is the Smartest Billionaire?

Jim Simons was nicknamed “The Worlds Smartest Billionaire” by Forbes. However, it wasn’t always obvious he would be. As a Teenager in Massachusetts he worked in the basement of a garden supply store and was terrible at the job. Simons Stated “I was terrible I couldn’t remember where anything went”.

The owners of the store asked him what he wanted to do in the future, he said “I want to study Math at MIT” of course they laughed at him and thought he was crazy.

At the age of 17 (1955) Simons joined MIT and finished a four-year program in just three years before heading for UC Berkeley for his Ph.D. in mathematics in 1962, at the age of just 23.

A couple of years later he was hired (and then fired) as a code breaker for the Pentagon’s secret Institute for Defense Analysis (IDA) at Princeton. Simons next became the chair of the Math Department at Stony Brook University where he and a colleague (Shiing-Shen Chern) published a paper which had a major influence on theoretical physics. Afterwhich Simons Started the worlds most successful and secretive hedge fund Renaissance technologies.

When did Jim Simons start Renaissance Technologies?

Simons started Renaissance technologies 1978, this was one the first quantitative funds, which used algorithms & model-based trading. Simons originally focused on trading in commodities and currencies. before expanding his criteria to anything which is “Publicly Traded, Liquid and Amenable to modelling”.

The Medallion Fund became the world’s most successful hedge fund producing a compounded annual return of 71.4% (1994 to 2014).

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

Who is the richest Mathematician?

Jim Simons is the richest Mathematician in the world with a net worth according to Forbes of $24.4 Billion (2022). Simons made his fortune as the founder of Renaissance technologies the worlds most successful and secretive hedge fund. This fund averaged a 71.4% compounded return annually between (1994 and 2014). If you invested $10k with Simons you would have made an incredible $2.2 million in 10 years.

What is Jim Simons Algorithm?

Jim Simons algorithm is a combination of historical, Real time, Fundamental, Technical and Economic Data. The algorithm is part of a quantitative model and although very secret it is thought to involve modelling of various assets, identifying trends and trading on market inefficiencies, which may only last a split second.

When asked for more details on the algorithmic model Simons stated:

“Of course we can’t show you our model, that would be like Buffett telling you what stocks he’s about to buy” – Jim Simons (Billionaire Trader).

Is Jim Simons Better Than Warren Buffett?

In terms of pure investment returns, Jim Simons is better than Warren Buffett. Jim Simons Medallion Fund averaged an incredible 71.4% compounded return annually between (1994 and 2014). Whereas Warren Buffett’s investment conglomerate earned “only” over 20% per year compounded. Both are incredible returns massively outperforming the S&P 500 index which averaged a 10.2% annual return.

However, it must be stated both Jim Simons & Warren Buffett have very different investing strategies, they are really complete opposites. Buffett focuses on the “Value Investing” strategy pioneered by Legendary investors like Benjamin Graham . In value investing a business is valued (a stock is a portion of a company), then the goal is to buy below that fair value (ideally with a margin of safety). Buffett has often stated he buys “stocks which wouldn’t bother him if the stock market closed for 10 years.”

Whereas, Jim Simons is the complete opposite, Simons uses advanced algorithms and computer models to detect market trends and mispricing’s then trades daily on these.

INVESTING LEGENDS GREATEST INVESTORS RETURNS STOCK MARKET JIM SIMONS OUTLIER. Jim Simons (renaissance technologies) Vs Warren Buffett (Berkshire Hathaway) Credit: www.motivation2invest.com/Jim-Simons-quotes

The graph above shows greatest investing Legends of all time, by what percentage they have outperformed the index (X axis) vs the Number of years (Y Axis).

We can see Jim Simons is a true outlier with over 60% compounded returns (above the S&P 500 Index) for over 20 years.

This was calculated till when the fund closed to outside capital. But the fund is still producing returns. Warren Buffett has show fantastic returns of approximately 13% (Above the S&P 500 Index) for nearly 60 years!

Can I invest into Renaissance Technologies?

Not exactly, Jim Simons secretive hedge fund is NOT ACCEPTING any new money and is mostly owned by employees such as leading Nobel prize winning scientists.

However, by being a Member of a platform like Invest with Legends you can view the past investments of Renaissance technologies, to access Simons full portfolio & quarterly trades.

9. Bring Smart People Together

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

When Jim Simons was asked the secret of the worlds most successful hedge Fund (71.4% Annual Returns), Simons stated: “Good Atmosphere and Smart People can accomplish alot” – Jim Simons (Renaissance Technologies)

8. Learn from History

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

“Past Performance is the best indicator of success” – Jim Simons (Renaissance Technologies) . Simons uses a vast amount of historical stock & economic data in order to help make predictions of the future. Now although History doesn’t always repeat it does rhyme. At Renaissance they are looking for trends & patterns which may only last a few seconds, to trade with their edge.

7. Which Stocks to Trade?

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

“We have three criteria, if it’s publicly traded, liquid and amenable to modelling, we trade it” – Jim Simons (Renaissance Technologies). Basically from Jim Simons criteria this is almost every publicly traded stock above a small market cap.

Thus they have over 2,900 stocks to choose from on the NYSE and 3,300 on the Nasdaq. If they invest internationally also the possibilities are even greater.

6. Predicting the Future

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

“One can predict the course of a comet easier than Citigroups stock, but you can make more money on the later” – Jim Simons (Billionaire Trader) . At Renaissance Technologies they are really trying to predict the future! But this is no easy task.

In fact although phrased as a joke, Simons is correct in saying it’s easier to the predict the course of a comet or even the movement of planets than a stock. Planets and Comets tend to follow orbits and are quite easily predictable from the gravitational fields. However, the stock market is “close” to random, I say “close” to random as there are small patterns which Renaissance exploits to make billions of dollars.

5. The Role of Luck

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

“Luck plays a meaningful role in everyone’s lives” – Jim Simons (Billionaire Trader) . Luck is apart of life and like it or not all great success to some extent. From the studies of success here on this website I have come to the conclusion, it is best to do everything you can control then let luck play out with the rest.

4. Luck & Investing Success

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

“In Business it’s easy to confuse luck with brains” – Jim Simons (Billionaire Trader) . There is a phenomenon called “Survivorship Bias” for example, if somebody does a risky illogical trade and makes millions (lets say investing into a crazy crypto token on whim).

They may “look” like a genius but really they were just immensely lucky. The trick is not to confuse the too as that can be very dangerous, if the person does believe they are a trading genius they may continue the risky strategy until they go to zero. Just like gambling in a Casino.

3. Good Things don’t last forever

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

“There is no such thing as the goose which lays the golden egg forever” – Jim Simons (Billionaire Trader).Good things (or even bad things) for that matter tend not to last forever, things tend to revert to the mean. This could be stock price, a successful business or even a relationship! The positive of this is continuous improvement can help to adapt and keep the golden goose strong.

2. Continuous Improvement (Kaizen)

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes.

“The System is always leaking & we keep adding water to stay ahead of the game” – Jim Simons (Billionaire Trader) . As mentioned previously the golden goose doesn’t lay egg’s forever, continuous improvement is the key to stay ahead of the game. There is a Japanese Manufacturing philosophy called “Kaizen” which pioneered the art of continuous improvement.

1. The Secret Trading Model

Jim Simons Trader Quotes (10). Credit: www.Motivation2invest.com/Jim-Simons-Quotes

“Of course we can’t show you our model, that would be like Buffett telling you what stocks he’s about to buy” – Jim Simons (Billionaire Trader).

The secret trading model used at renaissance technologies is thought to be a combination of Historical Data, Real Time data, complex algorithms and more. Of course, Simons will not reveal this model and the firm is kept notoriously secret. Partly to protect their golden goosem but also so the technology doesn’t fall into the wrong hands.

Luckily for you guys we track the trades on a quarterly basis by Renaissance Technologies and more! To stay up to date join our Investing VIP Group or Stock Research Platform.