Nick Sleep is a Legendary investor who ran Nomad Investment partnership, which was one of the worlds most successful investment firms!

Nomad Investment Partnership beat the market for over 13 years clocking up an astonishing compounded return of 20.8% per year vs 6.5% for the market index.

Adding up total returns the fund delivered 921% compared to just 117% for the MSCI World Index between 2001 & 2013.

Contents:

- Investing Returns with Nomad Investment Partnership

- Why did Nomad Investment Partnership close?

- Nick Sleep Holdings/Stocks?

- Nick Sleep Letters Summary | Top 10 Investment Principles

- Nick Sleep Quotes Gallery x 29

Nomad Partnership Investing Returns

Investing into Nomad Investment Partnership would have brought you some incredible returns.

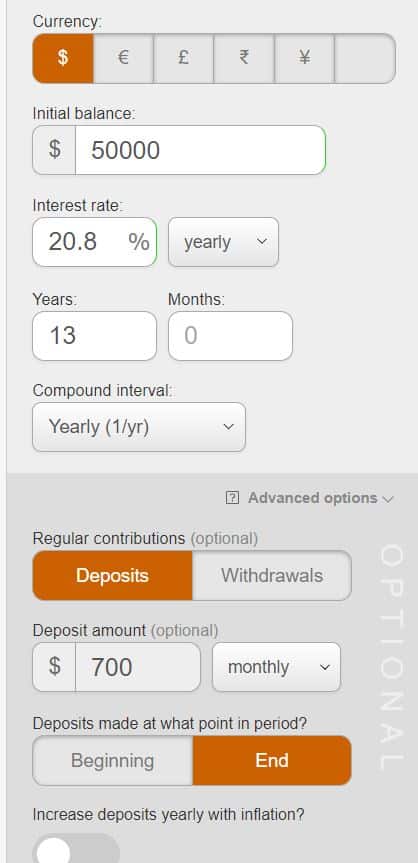

Using the compound interest calculator, starting with $50,000 and dollar cost averaging around $700 into your investment account every month for 13 years .

Investment Return Nomad Investment partnership compound interest calculator. Source: thecalculatorsite.com

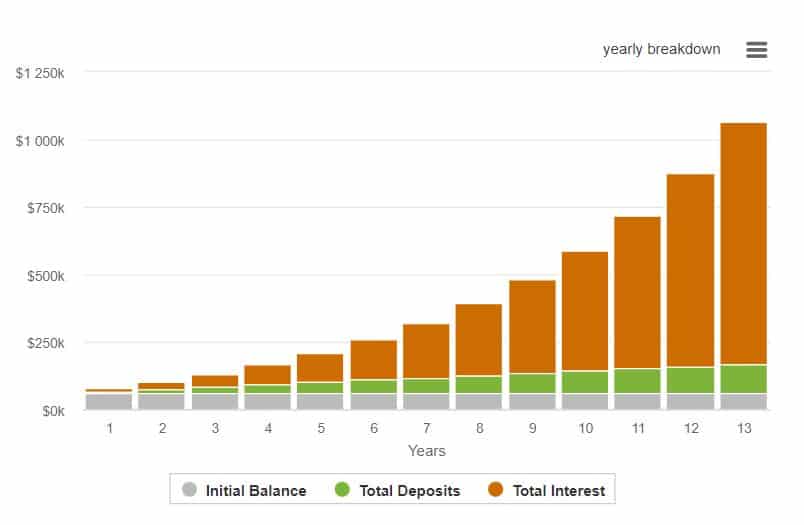

At the end of the calculation period you would have over $1 Million! Life changing money for many.

Nomad Investment Partnership Nick Sleep Returns. Source: thecalculatorsite.com

Nomad Investment Partnership Investment return. 20.8% Compounding annually Source: Calculatorsite.net

Nomad Investment Partnership Investment return, 20.8% compounding annually would turn $50k and $700 per month into over $1 Million in 13 years!

Can you still invest with Nick Sleep?

Unfortunately you cannot as Nomad was closed in 2014, due to many issues discussed in the next section.

Why did Nomad Partnership Close?

Nomad Investment Partnership closed for a variety of reasons, Nick Sleep stated he closed the fund in 2014 to seek “more caring pursuits” but there is more to the story than this.

Nick Sleep & Nomad were facing increasing pressure from the UK regulator due to the apparent “risk” of the fund which ran a focused portfolio compared to the traditional diversification

model. At one point the company had just three stocks! Although there were the no formal proceedings against the investment firm the stress of not being able to run the fund his way must have affected the decision.

Paraphrasing the words of Warren Buffett “It’s like marrying for money, not good…but crazy if your already rich!” Nick Sleep was very rich at the time.

In Nick Sleeps own words on why the fund closed he stated a mixture of forces “pushing & pulling.”

The direction of regulation was certainly irksome and the tools of regulation unnecessarily blunt but, also, we wanted to feel that we did not have to justify actions, and inactions, on an ongoing basis to a revolving door of interested parties.

We also felt we had wrung all that we could out of the investment process and to continue would have been to rinse and repeat, as it were.

After all, we had what we needed, just a few superb businesses and we were unlikely to sell any of those to fund the purchase of another cigar butt,”

He goes onto say…

The pull was the prospect of independence and a new adventure, this time working out how to recycle the funds for others to benefit.

We wound up at an age (mid 40s) when it forced us to build something new (you can’t sit on the beach forever) and, hopefully, we would live long enough to also see the consequences of our actions; we would have to eat our own cooking, as it were.

Nick Sleep Fun Fact:

Despite incredible returns Nick Sleep didn’t study Business or Finance but Geography. Sleep stated in his letters this is a “polymath” subject and focuses on many different areas. The subject also encourages the asking of questions, he believed this helped him to become a better investor.

Nick Sleep Nomad investment Partner Bio. Credit: Motivation2invest.com

Nick Sleep Holdings?

Nick Sleep & his business partner Qais Zakaria, ran a focused portfolio which had just 3 stocks at one point! These were Amazon Stock, Costco and Berkshire Hathaway.

According to legendary Value Investor Mohnish Pabrai in an Interview, “At one point Nick Sleep had 40% of the fund in Amazon Stock alone, the regulators did not like this“

After reading Nick Sleeps letters it was clear he made some witty comments which hinted about putting even more of the fund into Amazon Stock alone, “Our fund is not entirely in Amazon Stock…yet”

Nick Sleep Nomad Investment Partnership Amazon Stock. Credit: Motivation2invest.com

Which Stocks did Nick Sleep Buy?

Other stocks Sleep invested in at periods included Ocado, the British grocery delivery stock and Games Workshop stock a “dungeons and dragons” style figurine provider.

Fun Fact: Games Workshop had a cult following and when I was young I bought some of the figurines. The surprising point is this was very mainstream.

I wasn’t the typical kid who would be into these “dungeons and dragons” style figurines, most the people into the store were grown men at the time.

I also remembered the kits cost alot at the time, it could of been £40 ($55) for some little toys which you had to paint yourself! Back then I knew the margins were brilliant for the business.

Games workshop share price return Past 10 years

Nick Sleep & ASOS

Nick Sleep purchased ASOS stock after trimming his Amazon position.

Sleep has always admired the founder of ASOS and the fact he was more motivated by the mission than money.

According to the Nomad Investment Partnership Letters:

The best entrepreneurs we know don’t particularly care about the terms of their compensation packages,

….When we asked Nick Robertson, the founder of Asos, whose paper net worth has increased hugely since we have known him, whether, now he is a rich man, he has thoughts of leaving, his face lights up with the future possibilities of his firm and says he is having more fun now than ever before.

In this aspect of his life he has moved on from monetary rewards driving his behavior, and we are sure the business will be better for it.

Nick Sleep Nomad Investment Partnership. Credit: Motivation2invest.com

Nick Sleep Nomad Investment Partners Letters Quotes. Returns if invested into Tesla Stock or Amazon. Source: Motivation2invest.com

What is Nick Sleeps Net Worth?

Nick Sleeps net worth is currently unknown, but looking at the investment returns of his Fund, 20.8% for 13 years combined with the fee’s for running the fund.

Using the rule of 72. Number of years to double you investment = 72/Interest Rate

= 72/20.8 = 3.46 years . Thus Nick Sleep would have at least doubled his net worth every 3.46 years along with the fund, but he also would have been paid fee’s for management.

Thus it is estimated Nick Sleep would easily be a multi millionaire & possibly a Billionaire.

Nick Sleep Letters Summary:

Although we cannot invest with Nick Sleep & Nomad Investment Partnership, we can learn from his vast wisdom to help us to make better investment decisions. This is the closest you will get to a “Holy Grail of Investing”

Reading Nick Sleeps Investment letters from Nomad is a time consuming task as there is over 200 pages, which aren’t linked together like an easy to read book.

Thus after many requests, to help you guys out…I have done the hard work for you. I have deciphered the main themes and highlighted some quotes from the letters. For each of the Quotes I have provided a brief summary & expansion of the concept.

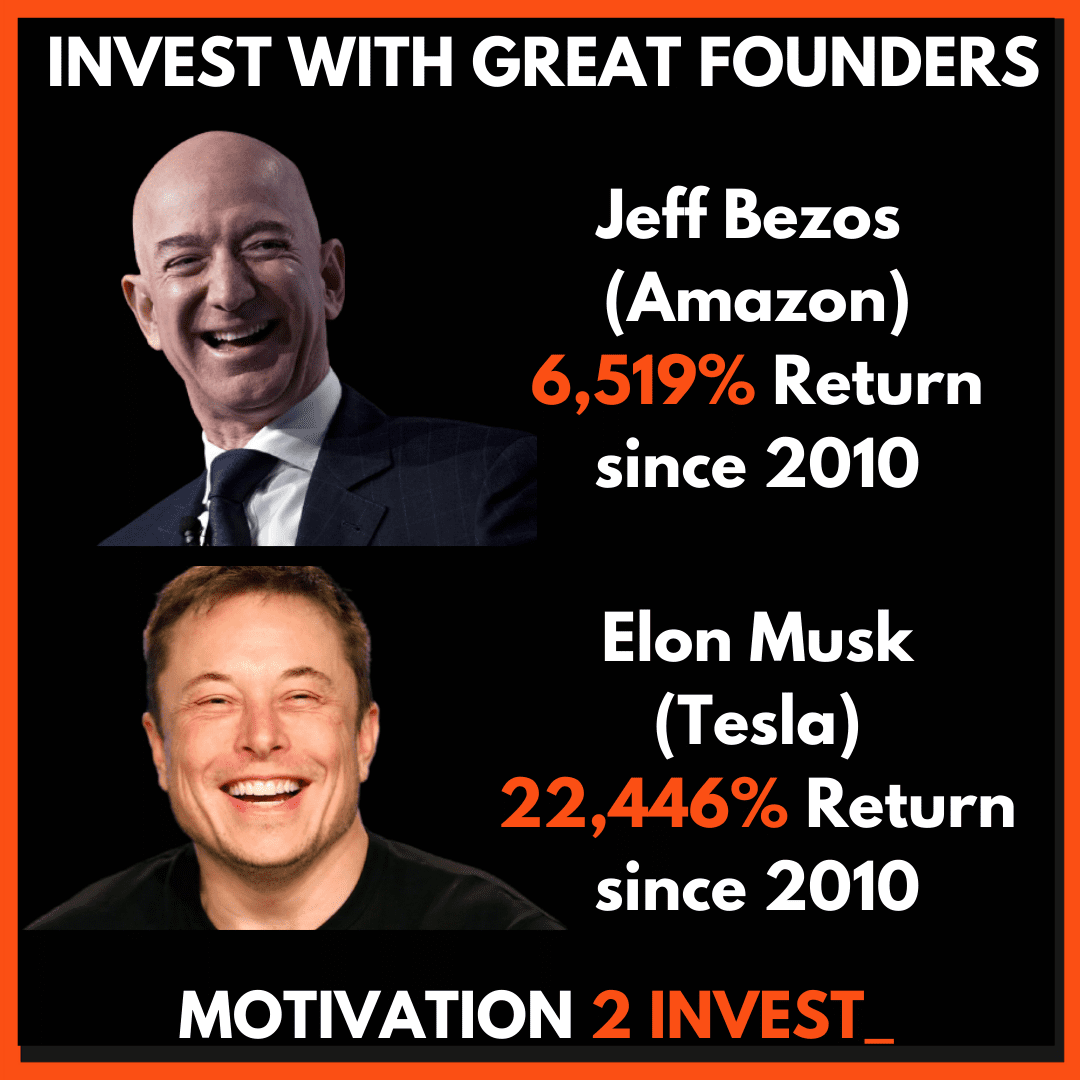

1. FOCUS ON THE DESTINATION

Nick Sleep Nomad Investment Partners Letters Quotes. Credit: Motivation2invest.com

Nick sleep talks alot in his letters about the “Destination” of the company, projecting forward to where the company is heading.

He calls this concept “Destination analysis” and is a great mental model to help analyse companies. It was clear from day one Jeff Bezos had a big vision for Amazon,

“We want to be the everything store” , they started with Books before expanding categories and moving further along towards their destination.

This same model could have also been used to spot companies like Tesla in the early days before the stock increased by over 700% in 2020 alone! Elon musk has stated from day one

“We want to create affordable EV’s which are cool” , “Starting with a high priced, low volume model, to low priced, high volume”

2. LONG TERM COMPOUNDERS

Nick Sleep Nomad Investment Partners Letters Quotes. Credit: Motivation2invest.com

Nick Sleep likes to identify “Long term compounders” then hold them for long periods of time. Companies which reinvest well and have high return on capital (>15%) are great compounders over time.

Jeff Bezos accomplished this at Amazon with a culture of experimentation, not every product was a success (Amazon Fire phone was a disaster!) but big bets like Amazon Web Services (AWS) more than made up for these.

3. SIGNAL FROM NOISE

Nick Sleep Nomad Investment Partners Letters Quotes. Credit: Motivation2invest.com

Any time you see headlines & fearmongering in the press ask yourself,

“Does this news make a meaningful difference to the relationship the business has with it’s customers?“

In other words, “Have the fundamentals changed?” if the answer is no then usually there is no need for alarm, if anything the lower stock price could be a buying opportunity.

Nick Sleep was a master of filtering the signal from the noise, back when Amazon nearly wen’t bankrupt and was facing daily pressure in the press for “not making any money” Nick Sleep held his shares and bought more during the dips and opportunities.

4. FOCUS OVER DIVERSIFICATION

Nick Sleep Nomad Investment Partners Letters Quotes. Credit: Motivation2invest.com

Rather than putting eggs in multiple baskets, Nick Sleep puts his egg in one basket he knows alot about.

This idea may seem counter intuitive to the diversification principle taught by Finance professors all over the world, it is actually not so revolutionary.

Most independent business people got rich by specialising in one company type & industry which gave them an edge, Nick Sleep in his Letters uses the example of Sam Walton (Wall Mart), Bill Gates (Microsoft) and more.

Nick Sleep Nomad Investment Partners Letters Quotes. Focus portfolio over diversification. Source: Motivation2invest.com

Even Legendary Value Investor Charlie Munger states “Three stocks is enough diversification” ,as it’s hard to know alot about everything.

Financial Warning: There is a caveat to this, you need to know an incredible amount about those three stocks,effectively more than anyone else to give you an edge. If you don’t have this in depth knowledge then diversification is best for most investors. This is not financial advice.

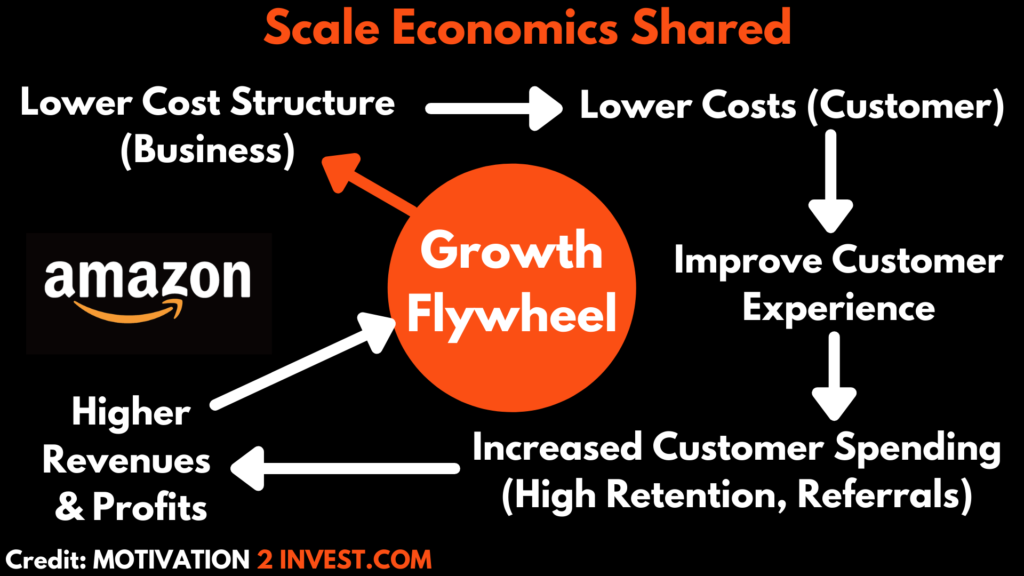

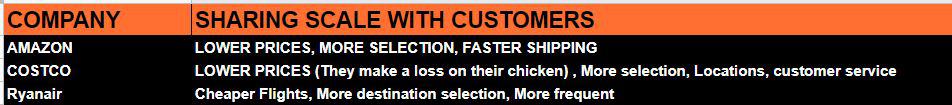

5. SCALE ECONOMICS SHARED

Nick Sleep Nomad Investment Partners Letters Quotes. Scaled Economics Shared Principle. Credit: Motivation2invest.com

This is one the key business model concepts Nick Sleep used to invest into companies like Amazon and Costco.

Most businesses save money as they scale thanks to the “economies of scale” , however very few companies reinvest this or pass on these saving to the customer. Those that do create a flywheel of success.

As the company passes savings onto customers, customers spend more and retention is increased, this increases revenues, profits and Market share.

Scale Economics Shared Nomad. Source: Motivation2invest.com

Scale Economics shared. Nick Sleep Source: Motivation2invest.com

Amazon utilised this business model to grow the market share substantially when the media stated amazon was “losing money” , they were growing market share and customer loyalty. Today over 72 Million IS Households are Amazon Prime Members

Approximately 80% of the US population.

Costco actually makes a loss on their Chicken it is so cheap. However, they place it at the back of the store to encourage the purchase of other products with higher margin on entry.

6. COMPETITIVE ADVANTAGE

Nick Sleep Nomad Investment Partners Letters Quotes. Credit: Motivation2invest.com

In the Nomad Letters Nick Sleep Talks alot of firms which are doing lots of little things better as a competitive advantage. He calls this an “Interlocking, self reinforcing network of small actions”

Sleep even goes onto say this could be more beneficial than doing “just one thing right. “

Traditional competitive advantages include, Patents, Network effects etc. Whereas Nomad Partners has identified these small advantages which compound.

7. INVEST INTO MISUNDERSTOOD BUSINESSES

Invest into Misunderstood businesses. Credit: Motivation2invest.com

The paradox of investing is that companies which everybody knows is great will be priced high and thus may not be a good investment. Thus the solution would be to invest into “Misunderstood companies”

these are companies which you have some insight on. If everybody hates a company and you know it’s not so bad, or even great then that could give you an “Information Edge“

8. Customer Focus over Competitors

Nick Sleep Nomad Investment Partners Letters Quotes

Jeff Bezos has always stated “The number one thing which has made us successful by far is the obsessive compulsive focus on the customer”. As companies grow and become more bureaucratic they can lose focus on what matters which is

the customer. Especially as management may be disconnected from actually speaking to customers.

Nick Sleep Nomad Investment Partners Letters Quotes

Nick Sleep also talks alot about “relationships” in his investing letters. He states the most crucial relationship is the what the company has with their customers.

Costco and Wall Mart examples of Customer Focus:

For example, Costco pays it’s staff 80% more than competitors they were criticised for this. However, it is clear that their staff are in direct contact with customers and thus this relationship is vital.

Sam Walton did something similar at Wall Mart, he trained every staff member to go up to a customer and always ask “how are they? and if they needed help” with a SMILE which is crucial.

This may seem simple, think to how many stores you go to and the staff look miserable and not inviting.

Wall Mart even has a customer chant.

Give Me a W! Give Me an A! Give Me an L! Give Me a Squiggly! (everybody does a funny twist)

Give Me an M! , Give Me an A! , Give Me an R! , Give Me a T!

What’s that spell?

Wal-Mart!

What’s that spell?

Wal-Mart!Who’s number one?

THE CUSTOMER!

9. DNA OF A FIRM

Nick Sleep Nomad Investment Partners Letters Quotes. Credit: Motivation2invest.com

This is one factor where Nick Sleep differentiates himself from a traditional “deep value investor” like Benjamin Graham. Rather than just buying very cheap companies, Nomad Partners focus more on companies with special DNA.

A company is just a group of people working towards a common mission, and the culture or DNA of the company is what bonds them together.

Google is a great example of this, they had a strong culture in the early days of hiring the most intelligent people then treating them well.

Amazon also has a very strong & unique culture, Bezos quotes lines such as “it’s always Day one” to encourage the company employees not to get complacent with their success.

We have seem many past success stories lose their crown over the years from IBM to GE.

10. LONG TERM FOCUS

Nick Sleep Nomad Investment Partners Letters Quotes

Nomad Investment Partners were true long term investors, Nick Sleep even stated “Few are” referring to the fact that most investors say they a long term, but when things go wrong they sell out fast.

Conclusion

Nick sleep is a Legendary Investor who will truly go down as one the greatest of all time. His style of running a focused 3 to 5 stock portfolio was unconventional and often seemed risky by many. But when you can pick the great “long term compounders” the results speak for themselves.

Do you want to learn how to invest like the greats?

We have compiled together a series of battle-tested investment strategies from the great hedge funds and legends of all time. Compiled together into an easy to decipher investment strategy, in addition to a private membership group

To find out more & start your journey click the link here: https://www.motivation2invest.com/product/stock-investing-course/

Memberships will be closing soon so be sure to check out availability for spaces now.

Nick Sleep Quotes Gallery x 29

Click the hidden slider arrow on the right of the image to scroll through the gallery of 29 quotes by Nick Sleep from the Nomad Investment Partnership letters.