Ray Dalio is the Billionaire founder of the worlds largest hedge fund, Bridgewater associates.

Dalio got his first taste of investing during the “nifty fifties” this was a major bull market and everyone was talking about stocks.

He overhead many conversations while caddying at a golf club & thus saved up his wages before investing.

He bought his first stock, North East Airlines which immediately increased in price. After which Dalio was hooked on investing & fell in love with the opportunities.

Investing Strategy of Ray Dalio

Ray Dalio’s investing Strategy has a big focus on Investing internationally and diversification across stocks, industries, asset classes etc.

Investing Strategy: Diversified, Value Investor, Emerging Markets, alternative assets, Long Term, International, Economics.

Ray Dalio Quotes MOTIVATION 2 INVEST (4) Credit: www.Motivation2invest.com/Ray-Dalio

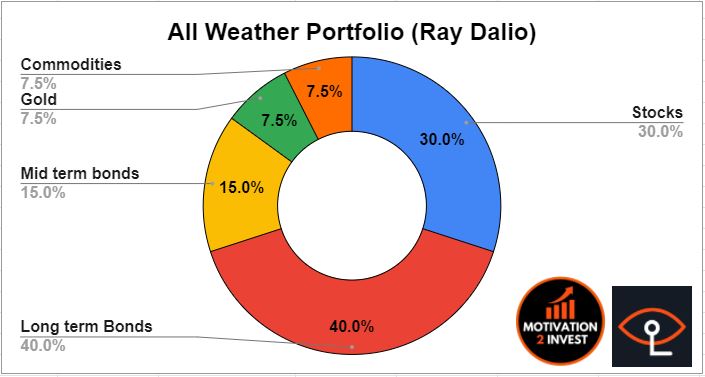

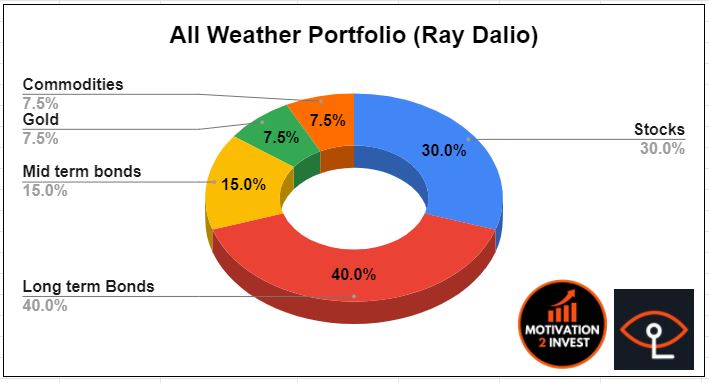

All Weather Portfolio:

Thus Dalio created such portfolios as the “All Weather Portfolio” an investment portfolio which should perform well under any conditions.

all weather portfolio ray dalio. Credit: www.motivation2invest.com/Ray-Dalio

The Stocks (equity) act as the growth driver of the portfolio. The Bonds act as a stabilizer or ballast reducing volatility (Beta) .

In addition, the bonds are a hedge against stock market crashes, as usually when stocks crash investors retreat to bonds for safety.

The gold acts as a hedge against inflation and the devaluing of US dollars as the currency.

Ray Dalio Quotes MOTIVATION 2 INVEST (17)Credit: www.Motivation2invest.com/Ray-Dalio

Dalio is a major bull on investing into Gold, he states “If you don’t own gold, you know neither history or economics”.

This is contrary to Warren Buffett who doesn’t invest into gold as it “doesn’t produce anything”, Buffett prefers farmland.

all weather portfolio ray dalio 3D. Credit: www.motivation2invest.com/Ray-Dalio

Holy Grail of Investing

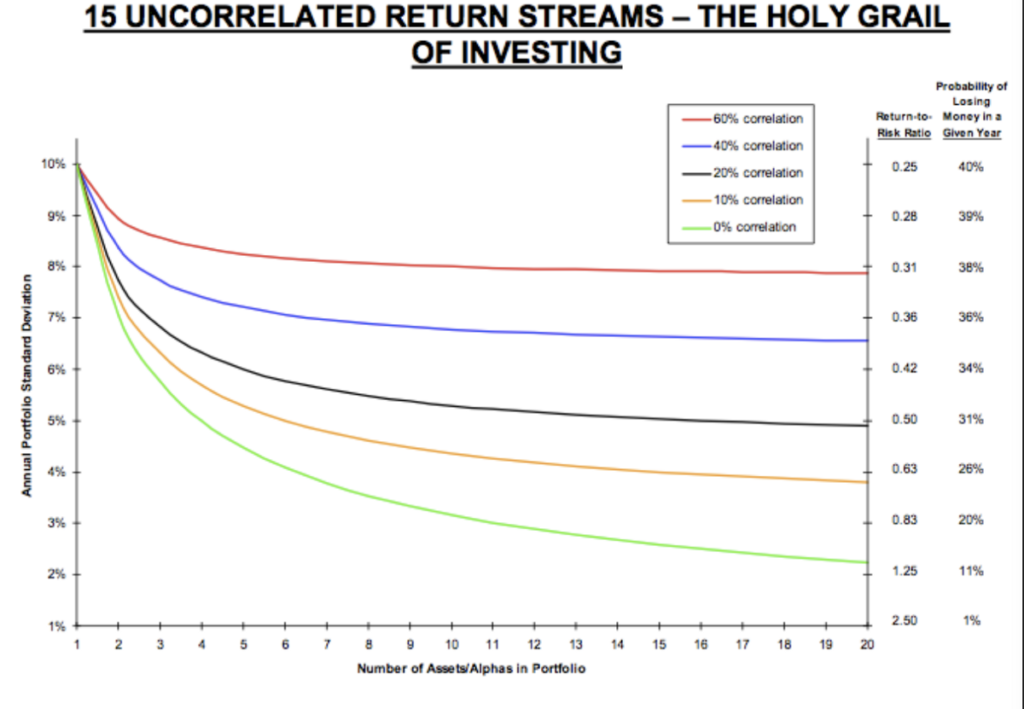

The “Holy Grail of Investing” is 12 to 15 uncorrelated bets which offer a low risk, high reward investment. This is known as an asymmetric risk/reward ratio.

Ray Dalio Quotes MOTIVATION 2 INVEST (1). Credit: www.Motivation2invest.com/Ray-Dalio-Quotes

12 to 15 Uncorrelated return streams – The Holy Grail of investing. This creates an investment portfolio with less volatility and risk but still with high returns.

Of course this is an ideal scenario and very difficult to achieve in practice as thanks to globalization many return streams are heavily correlated.

For example, according to a study by New York university, Crypto currency moves like a risky stock and real estate is not the hedge it once was.

Holy Grail of investing. Investopedia.com

We all know taking more risk can often lead to the chance of greater rewards but ideally we want a low risk, high reward situation.

Ray Dalio Quotes MOTIVATION 2 INVEST (3). Credit: www.Motivation2invest.com/Ray-Dalio-Quotes

Does Ray Dalio own Bitcoin?

In a recent interview with CNBC, Billionaire Ray Dalio stated he owned Bitcoin & gold as inflation hedges against the US Dollar. He stated Gold makes up a small portion of this part of his portfolio and Bitcoin makes up an even smaller position.

Dalio went onto to say “if it’s really successful, they’ll kill it” referring to government regulation. “We have China & India getting rid of it and El Salvador taking it on”. Bridgewater Associates put out a detailed paper with their thoughts on Bitcoin & Crypto Currency.

They stated “Although Bitcoin is limited supply, other cryptocurrencies can come along to take it’s place”

Ray Dalio Quotes MOTIVATION 2 INVEST (20) Credit: www.Motivation2invest.com/Ray-Dalio

View this post on Instagram

Bridgewater associates conclusion on Bitcoin is as follows, Quote:

“Overall, it’s clear that Bitcoin has features that could make it an attractive storehold of wealth; it also has proven resilient so far. However, we have to acknowledge that this financial vehicle is only a decade old.

In absolute terms and vis-a-vis established storeholds of wealth such as gold, how will this digital asset fare going forward?

Future challenges may still come from quantum computing, regulatory backlash, or issues we haven’t even determined yet.

Even if none of these materialize, Bitcoin, for now, feels more to us like an option on a potential storehold of wealth.”

Ray Dalio Quotes MOTIVATION 2 INVEST (20) Credit: www.Motivation2invest.com/Ray-Dalio

Investing into China

Ray Dalio is a major bull on Investing into China, as they have the 2nd largest economy in the world (soon to be first!) , a growing middle class and series of superstar technology companies such as Alibaba and Pinduoduo.

In a 2020 CNBC interview, Ray Dalio stated “almost all investors are underweight in China”.

“It’s a part of the world that one can’t neglect and not only because of the opportunities it provides, but you lose the excitement if you’re not there,”.

However, there are many risks for western investors in China. Including China’s crackdown on tech companies, Investing via American depository receipts (ADR’s), potential delisting of Chinese stocks and government control

Time stamps:👇👇 0:00 – Intro 1:50 – China stocks crash 3:50 – DIDI Stock crash 6:40 – Chinese stock investing tips 7:46 – Chinese ADR explained 8:40 – What happens if a stock is delisted?

Which Chinese Stocks does Ray Dalio own?

According to the latest portfolio update from the 13-F filing for Bridgewater associates, Q3, 2021. Ray Dalio has the following Chinese Stocks & Funds in his largest holdings:

- Alibaba Stock (0.021% of his portfolio ($321 Million)

- Pinduoduo Stock (0.9% of portfolio, $141 million)

- I Shares MSCI China ETF (0.9% of portfolio, $141 million)

- Loading stock data...

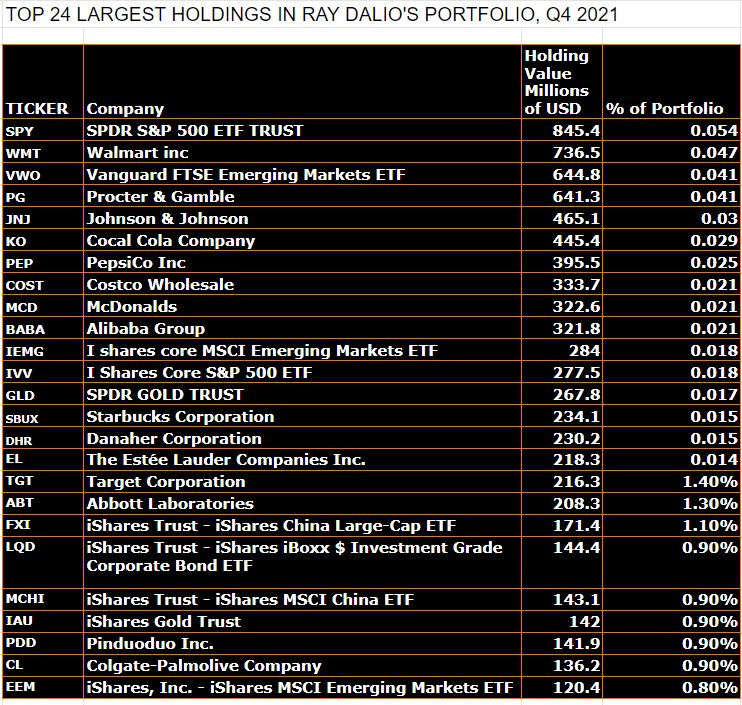

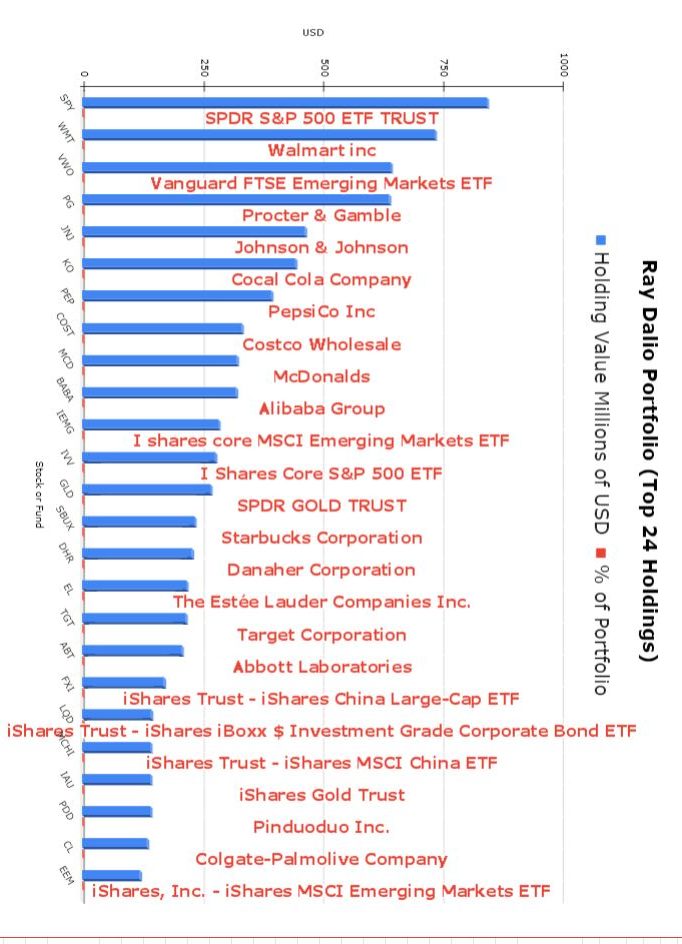

Ray Dalio’s Portfolio Update Q3 2021

Diving into the 13-F SEC filing for Bridgewater associates we can discover Ray Dalio’s top 24 largest stocks in his portfolio.

Largest Stocks in Ray Dalios portfolio Q4 2021

Ray Dalio Portfolio Q4 2021 Largest Stocks top. Credit: www.Motivation2invest.com/ray-dalio

Interactive Portfolio of Top 24 Holdings, Updated automatically:

Which Stocks has Ray Dalio been buying?

According to the 13-F filing (Q3,2021) for Bridgewater associates. Popular stocks Ray Dalio has been buying Q3 2021, include Lowe’s, The Home Depot and Lululemon.

- Loading stock data...

Ray Dalio also added to shares of these 10 stocks:

- WMT (+$230M)

- PG (+$207M)

- JNJ (+$183M)

- IAU (+$142M)

- KO (+$139M)

- PEP (+$131M)

- DHR (+$111M)

- COST (+$111M)

- MCD (+$105M)

- EEM (+$97M)

Ray Dalio Latest stock buys 2021 Credit: www.Motivation2invest.com/Ray-Dalio

Long Term debt Cycle Graph

In the words of Legendary Investor Howard Marks who wrote the book, Mastering the market cycle. “We don’t know where we are going, be we should know where we are”.

This is similar to the above quote by Ray Dalio, he often talks about cycles and knowing where we stand. Are we in a Bullish Market, Bearish, is their speculation in the air, fear?

Ray Dalio market cycles. Credit: www.Motivation2invest.com/Ray-Dalio

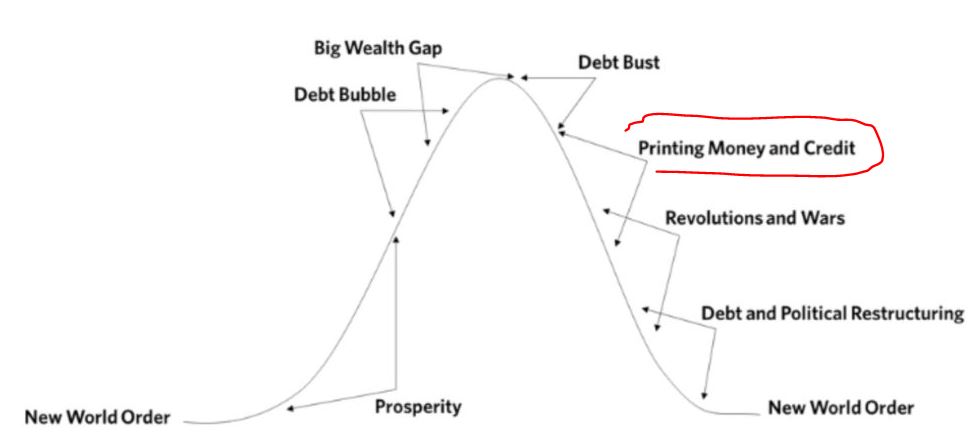

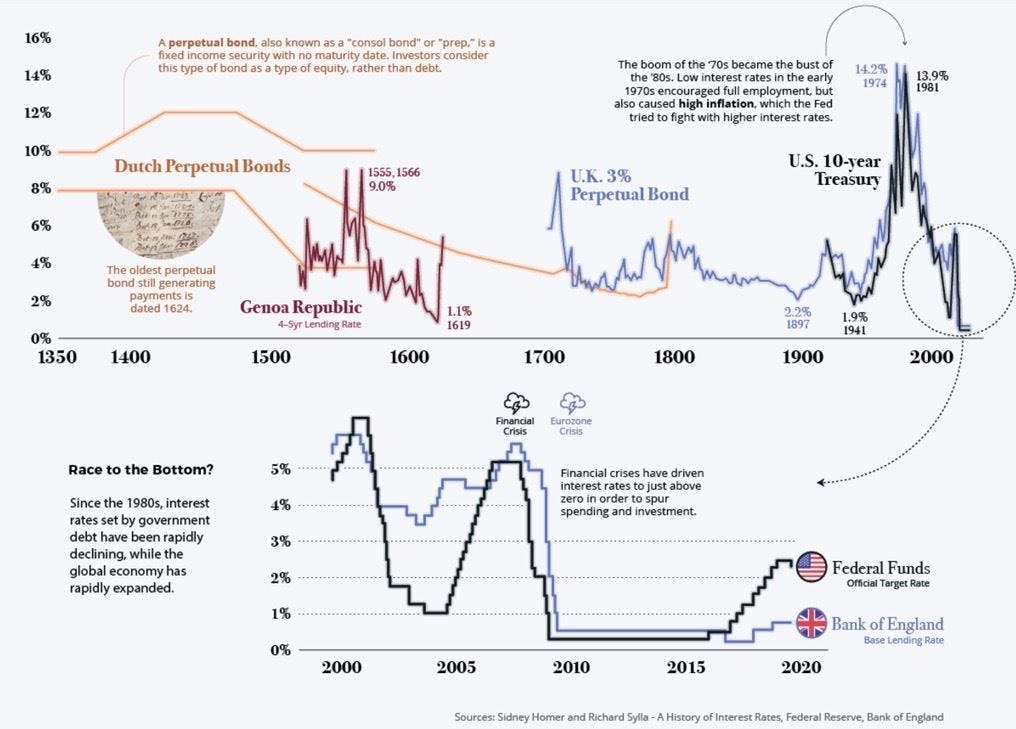

Dalio has spoken at length in the past about the Long term Debt cycle and states we are coming to the end of this.

Reviewing a Debt to GDP graph over the long term reveals alot about the long term debt cycle. I hate to be the bearer of bad news but we see to be at the point i’ve highlighted in red “printing Money and Credit”.

According to the Federal Reserve, 1 out of every 5 US dollars was printed in 2020. Mckinsey called it the “$10 Trillion dollar rescue” , the amount of money printed was triple the financial crisis in 2008.

Long term debt cycle graph 2021

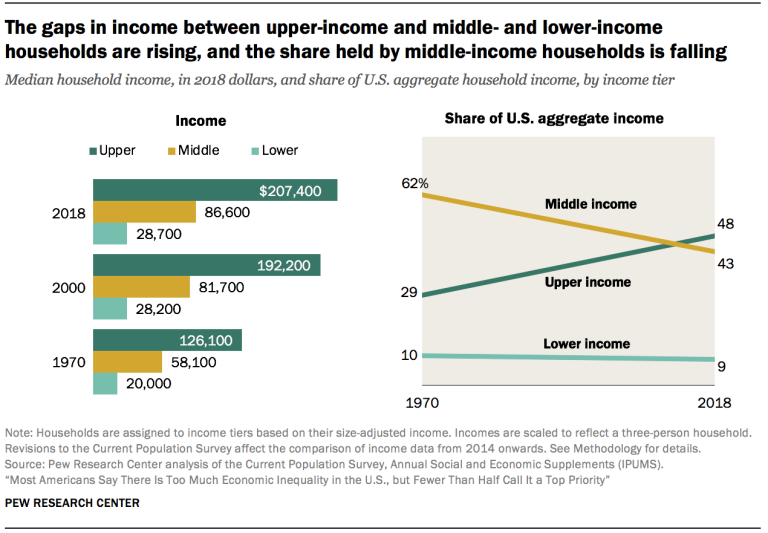

In terms of “Big Wealth Gap”, this is also true. According to a study by Pewresearch the gaps in income between upper and middle income households is rising.

Wealth Inequality Gap. Credit: https://www.pewresearch.org/social-trends/2020/01/09/trends-in-income-and-wealth-inequality/

The only think we haven’t had yet is a War, but there have been quite a few “revolutions” with many protests all over the world regarding various subjects.

What happens at the end of a debt cycle?

There are four ways to restructure debt at the end of the long term debt cycle.

1.) Austerity (Less government spending)

2.) Debt defaults (Bankruptcies if allowed could spiral into a depression)

3.) Raising taxes (Painful for people, but likely)

4.) Devaluation of currency (Already happening as we are seeing vast printing of money & rising inflation)

Long term debt cycle Ray Dalio