1.Robinhood Stock Analysis

2. Robinhood Founder

3. Robinhood Financials & Valuation

1. ROBINHOOD STOCK ANALYSIS :

i. OVERVIEW. Robinhood is a Online stock broker platform which focuses on the retail investor & pioneered the concept of free trading founded in 2013.

robinhood stock analysis

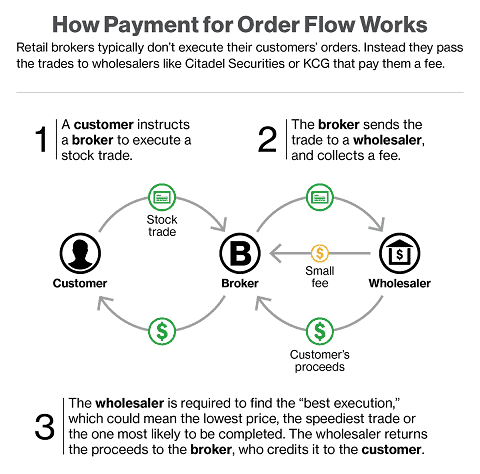

ii. BUSINESS MODEL: The Company Makes the Majority of Revenue from “PAYMENT FOR ORDER FLOW” , “buy/sell spread” from Retail & Institutional Investors.

How Payment for Order flow works Robinhood. Source: https://mingclee.medium.com/payment-for-order-flow-robinhood-589fabcfbaa7

2. Robinhood MANAGEMENT (FOUNDER)

Great Founder Traits: Long term vision, Tech Entrepreneur, Deep Knowledge of Industry

Robinhood Founder Source: Tech Crunch: https://edition.cnn.com/2021/02/04/investing/robinhood-ceo-vlad-tenev-finra/index.html

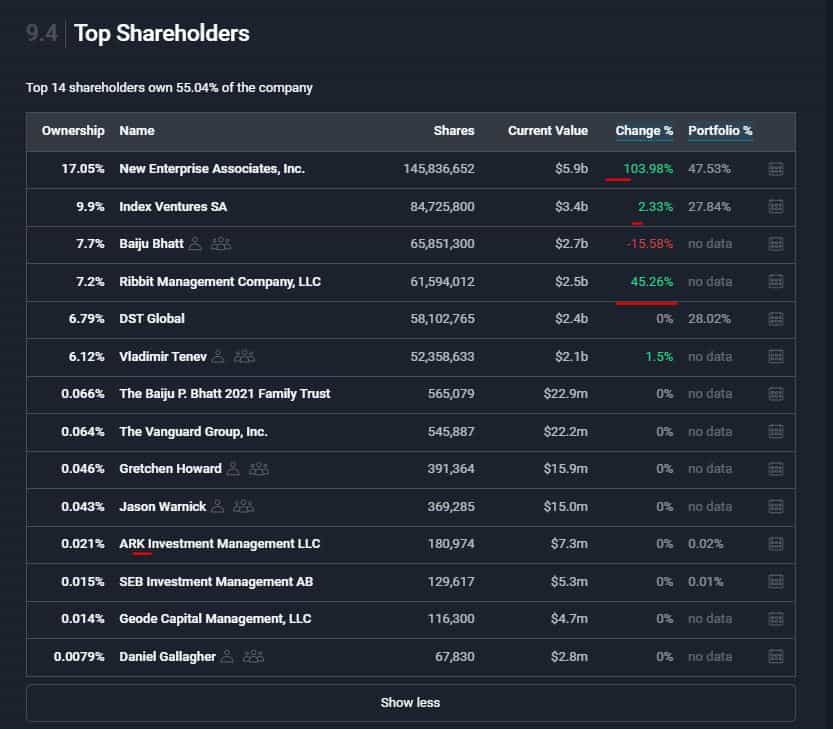

,FOUNDER LED :VLADMIR & Baiju Skin in the Game. (6% of company each) INSIDER TOTAL: 13.9%.

Robinhood Shareholders. Source. SimplyWallstreet.

INVESTORS: Ark invest 0.2% of company.

3. ROBINHOOD FINANCIALS & VALUATION:

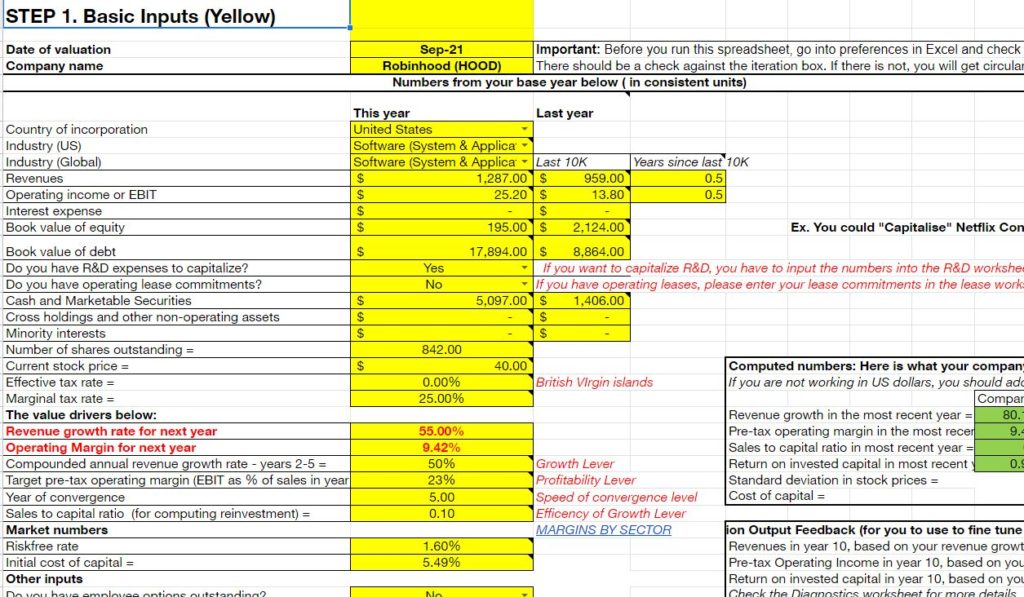

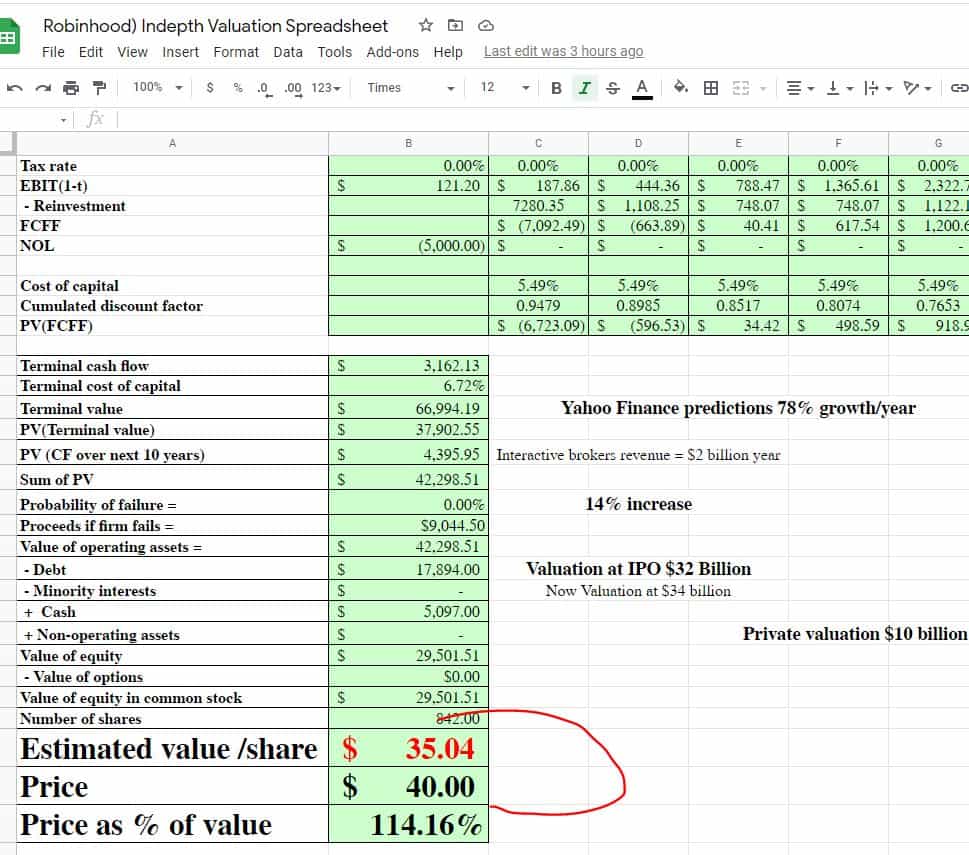

Robinhood Stock Analysis Valuation. Copyright Motivation2invest

Robinhood Stock Analysis Valuation. Copyright Motivation2invest (Original Template professor of Finance New York University)

Assuming a 50% revenue growth rate next 6 years, We have a Fair Value per share of $35. This is close to the original IPO price.

Stock only 14% overvalued right now.

This is NOT Financial Advice.

RISKS OF INVESTING:

, i. Commodity Broker/Competition (lots of brokerages for stocks many offer free trading now), Many Brokers already gained large market share in the international market, could, limit robin hood expansion.

ii. Robinhood controversy – Suspending orders in Meme stocks, damaged brand reputation shows platform limitations.

Robinhood Gamification criticism, gambling addictions SEC probe INSIDER BUYING: Ark Invest & Borad member (Jonathan ) small amount $2 million at $38.

Join Our Investing Course & VIP Community to Access all VALUATION MODELS for over 55 Stocks!

Click here to find out more https://www.motivation2invest.com/product/stock-investing-course/